After 6,106 wETH were stolen, they were successfully recovered. Is JPEG'd the hope for the NFT lending sector?

Author: 0xmonomi

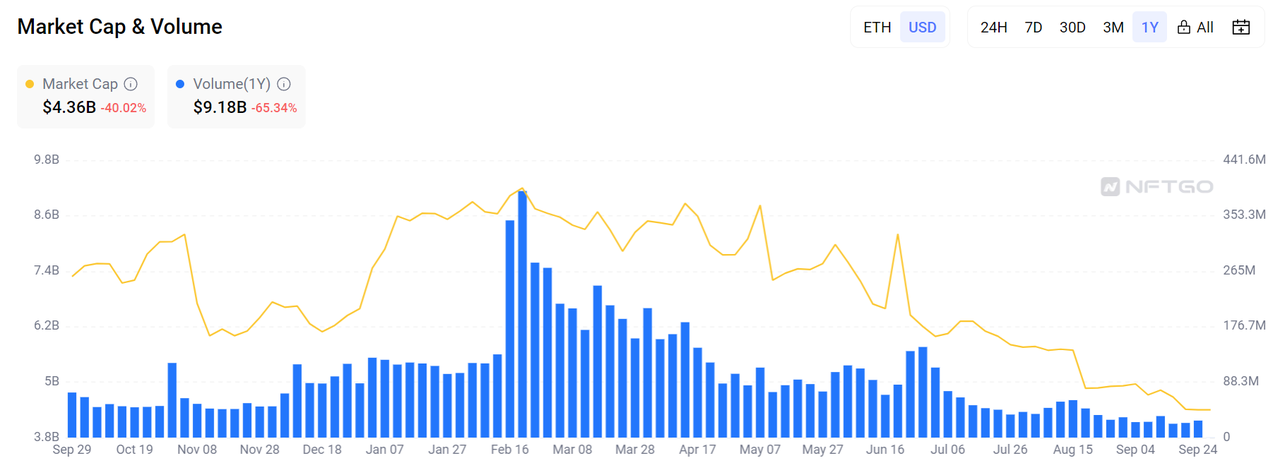

In the second half of this year, the NFT market and the entire cryptocurrency sector have experienced a profound downturn. The trading volume of NFTs has sharply declined, contrasting starkly with the booming scene at the beginning of the year. The market has fallen into a state of seeming "indifference," with the more segmented NFT lending market being particularly forgotten.

Recent NFT total trading volume trend chart

In this special macro environment, JPEG'd has garnered significant attention from industry insiders. Below is a brief introduction to this project.

After a Hacker Attack, JPEG'd Turns Crisis into Opportunity, Regaining User Trust with Sincerity and Strength

As an NFT lending project, JPEG'd was once highly anticipated. However, on July 31 of this year, JPEG'd's pETH-ETH Curve pool was hacked, resulting in a staggering loss of 6,106 wETH. This attack severely impacted the JPEG'd project, causing its pETH token price to drop by approximately 50%. This incident exacerbated the difficulties in the NFT lending market, raising doubts about its future.

Meanwhile, the NFT market faced severe challenges, with some projects choosing to pause or shut down in the face of adversity. However, JPEG'd opted for a proactive attitude, firmly confronting this difficult situation.

For any project, adversity is a strict test that assesses its resilience. The JPEG'd team demonstrated extraordinary effort and perseverance during this period. On August 5, JPEG'd successfully recovered the stolen funds, totaling 5,549 wETH. This action not only proved the professionalism of the JPEG'd team but also indicated their unwillingness to give up easily. They did not choose to passively accept setbacks but actively took steps for post-disaster reconstruction.

On August 22, the JPEG'd team took further measures by issuing a new pETH token to replace the original one and deploying two brand new pools on the Curve platform. This move marked the relaunch of the pETH lending system, paving the way for the project's revival.

Even more encouragingly, on September 14, the JPEG'd project officially restarted, launching a token incentive program and waiving fees. This series of actions revitalized the JPEG'd project, attracting more user participation and bringing new vitality to its future development.

The resilience and efforts of JPEG'd, along with their successful experience in overcoming adversity, provide an important case study for the NFT lending market. This experience demonstrates the proactive measures that projects can take in the face of significant market fluctuations and offers valuable insights for other projects. In the ever-evolving and changing NFT industry, JPEG'd has shown the spirit of an innovator, staying true to its original intention and continuously moving forward. This positive attitude and resilience will continue to drive the NFT lending market toward a more prosperous future.

From a data perspective, JPEG'd is undervalued, with its fully diluted market cap at $43.33 million, lower than the $61.24 million in assets held by its protocol treasury.

JPEG'd protocol treasury asset holding trend chart

Another encouraging sign is that JPEG'd's TVL (Total Value Locked) has seen significant growth. In the past month, JPEG'd's TVL has increased by 47.13%, placing it among the top three in the NFT lending market. This indicates that user confidence in JPEG'd is gradually recovering.

NFT lending market ranking chart, with JPEG'd in third place

Overall, JPEG'd has successfully emerged from the shadow of the hacker attack and regained its vitality. Despite facing severe setbacks, the project has effectively responded to adversity through determination and proactive actions. Its undervaluation and rapid growth in TVL have made its investment value apparent.

Looking at the Advantages and Disadvantages of JPEG'd's Mechanism and Model in the NFT Lending Protocol Environment

Like real estate in the physical world, NFTs also face relatively low liquidity issues. To reasonably release the liquidity of existing NFTs, NFT lending protocols have emerged, endowing NFTs with financial attributes, enhancing their liquidity, and broadening their application fields.

Through NFT lending protocols, users can collateralize NFTs to obtain stablecoins, thus achieving loans; users can also provide funds to the platform to earn corresponding returns while using NFTs as collateral. Based on this foundation, the NFT lending market has also derived various play styles such as leveraged lending, staking, and leasing, providing new financial services and applications for NFTs, further promoting the development of the NFT market.

Currently, there are three main types of NFT lending methods:

- Peer-to-peer lending: Users post loan requests on the platform and then transact directly with other users. Representative projects include NFTfi and X2Y;

- Peer-to-pool lending: Users collateralize NFTs and then borrow Ethereum from liquidity pools. Representative projects include Benddao;

- Peer-to-protocol lending: Users collateralize NFTs to the protocol and then borrow assets issued by the protocol. Representative projects include JPEG'd.

Both BendDAO and JPEG'd adopt an over-collateralized lending model, but there are some subtle differences between them:

BendDAO uses a peer-to-pool model, where borrowers interact directly with the platform's loan pool, using NFTs as collateral to obtain ETH. When the price of the collateralized NFT drops to a certain level, liquidation may be triggered. The ETH in the loan pool comes from deposits made by depositors, who can earn interest income as liquidity providers for the platform.

JPEG'd, on the other hand, employs a peer-to-protocol model, where users collateralize NFTs to obtain JPEG'd's native tokens pETH or pUSD, which can then be used on DeFi platforms like Curve and Convex to exchange for ETH, stablecoins, or engage in liquidity mining for higher returns.

It is worth noting that JPEG'd's business logic is similar to that of MakerDAO, while Benddao's business logic is more akin to AAVE.

JPEG'd has several notable advantages:

- It is currently the platform with the lowest collateralized lending rates in the NFT lending market;

- JPEG'd's native token pETH offers very high LP (liquidity provision) yield rates on platforms like Curve and Convex, which is one of the main drivers of the project's business growth;

- Compared to BendDAO, JPEG'd offers a higher maximum collateralization ratio, providing users with greater flexibility.

The NFT Lending Market is Full of Opportunities, and Innovative Projects in the Space Will Bring Incremental Value to the Industry

The NFT lending market, much like NFTs themselves, is undergoing rapid and dynamic development. Although this market has faced setbacks and adversity, it is still filled with tremendous potential. The emergence of NFT lending protocols has injected financial attributes into NFTs, enhancing their liquidity and providing more use cases, making them not just digital artworks but also financial instruments.

In this market, JPEG'd stands out as a highly regarded project that has experienced a hacker attack and subsequent restart, demonstrating resilience and adaptability. Its low interest rates, high LP yield rates, and greater collateralization ratios have earned it a significant market share and attracted many investors.

Despite the hopeful market outlook, we must also recognize that the NFT lending market is still in its early stages of development, with certain uncertainties and risks. The security, sustainability, and regulatory environment of projects are all factors that require close attention. Investors and users should fully understand each project, carefully assess risks, and make informed decisions.

In summary, the NFT lending market will continue to grow, providing more choices and opportunities for digital art and NFT holders. JPEG'd's experience is encouraging and symbolizes the resilience and innovative spirit of this market. In the future, we can expect more innovation and development, bringing more possibilities to the NFT lending market, while also hoping that this market can better meet user needs and contribute more to the prosperity of digital art and the blockchain ecosystem.