Will the rapidly growing Morpho be a potential competitor to Aave?

Author: Alex Xu

Introduction

After experiencing the bull and bear market cycle from 2020 to 2023, we find that in the Web3 business world, the application layer currently has only one truly established business model category: DeFi. The three pillars of DeFi remain DEX, lending, and stablecoins (the derivatives sector has also made significant progress in recent years), and even in a bear market, their business remains resilient.

Mint Ventures has previously written numerous research reports and analysis articles on DEX and stablecoins, covering many ve(3,3) projects such as Curve, Trader Joe, Syncswap, Izumi, and Velodrome for DEX, and projects like MakerDao, Frax, Terra, Liquity, Angle, and Celo for stablecoins. This issue of Clips will return to focus on the lending sector, with a particular emphasis on the emerging force Morpho, which has seen rapid growth in business data over the past year.

In this article, I will outline Morpho's existing business and the recently announced lending infrastructure service Morpho Blue, attempting to answer the following questions:

What is the current market landscape of the lending sector?

What businesses does Morpho encompass, and what problems does it attempt to solve? How is its business development currently?

What is the outlook for the newly launched Morpho Blue service? Will it impact the leading positions of Aave and Compound? What other potential effects might it have?

The following article reflects my views as of the time of publication, and may contain factual inaccuracies or biases, intended for discussion purposes only. I also welcome corrections from other research peers.

Landscape of the Decentralized Lending Market

Organic demand becomes mainstream, Ponzi characteristics fade

The capital capacity of decentralized lending has consistently ranked among the top, with the current TVL surpassing DEX, becoming the largest sector in terms of capital accommodation in DeFi.

Source: https://defillama.com/categories

Decentralized lending is also one of the few business categories in the Web3 space that has achieved "PMF" (Product-Market Fit). Although during the DeFi summer of 2020-2021, many projects offered substantial subsidies for lending activities through tokens, this phenomenon has significantly decreased in the bear market.

As shown in the figure below, the protocol revenue of the leading lending project Aave has exceeded its token incentive withdrawals since December 2022, and so far has far surpassed the token incentive withdrawals (in September, protocol revenue was $1.6 million, while Aave token incentive withdrawals were $230,000). Additionally, Aave's token incentives are primarily used to guide token holders to stake Aave to cover bad debts when the treasury's compensation is insufficient, rather than to incentivize users' lending and borrowing activities. Therefore, Aave's current lending and borrowing activities are entirely "organic," rather than supported by a Ponzi structure reliant on liquidity mining.

Monthly comparison of Aave's incentive withdrawals and protocol revenue

Moreover, the leading lending protocol Venus on BNBchain has also achieved a positive operation where protocol revenue surpassed incentive withdrawals after March 2023, and currently does not subsidize lending and borrowing activities.

Monthly comparison of Venus's incentive withdrawals and protocol revenue

However, many lending protocols still have substantial token subsidies behind their supply and demand, with the subsidy value for lending activities far exceeding the revenue generated.

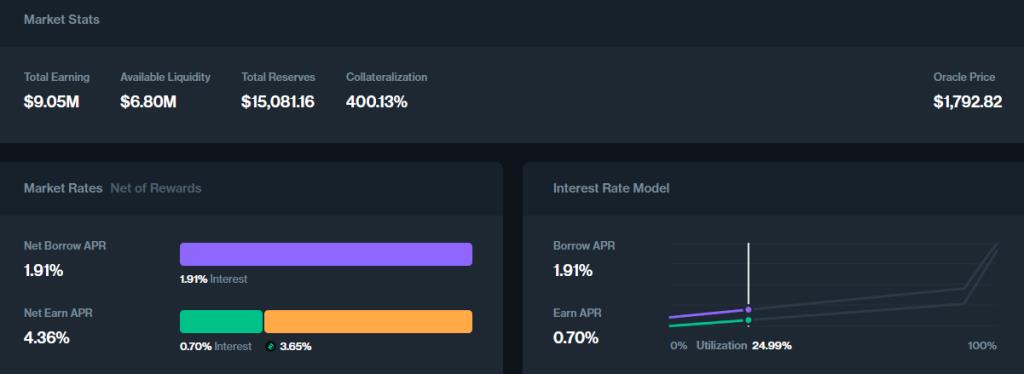

For example, Compound V3 still provides COMP token subsidies for deposit and borrowing activities.

The deposit rate for USDC on Compound V3's Ethereum mainnet is nearly half provided by token subsidies

The deposit rate for USDC on Compound V3's Base mainnet is 84% provided by token subsidies

If Compound maintains its market share through high token subsidies, another protocol, Radiant, is purely a Ponzi structure.

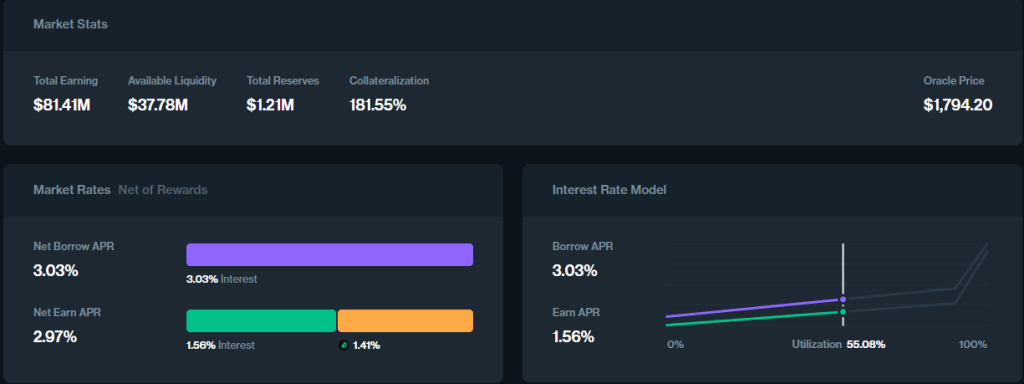

On Radiant's lending market page, we can observe two unusual phenomena:

First, its asset borrowing rates are significantly higher than market rates, with stablecoin borrowing rates in mainstream currency markets typically around 3-5%, while Radiant's rates reach 14-15%, and borrowing rates for other assets are 8-10 times that of mainstream currency markets;

Second, it prominently promotes "revolving loans" in its product interface, encouraging users to use the same asset as collateral repeatedly: deposit -- borrow operations, amplifying their "total deposit and borrowing amount" to maximize mining returns on the platform's token, RDNT. Essentially, the Radiant project is indirectly selling its project token RDNT to users by charging borrowing fees.

However, the problem is that Radiant's fee source—i.e., users' borrowing behavior—is not driven by genuine organic lending demand, but rather to obtain RDNT tokens, creating a "left foot stepping on the right foot" Ponzi economic structure. In this process, there are no real "financial consumers" on the lending platform. Revolving loans are not a healthy lending model, as both depositors and borrowers of the same asset are the users themselves, and the economic source of RDNT dividends also comes from the users themselves. The only risk-free profit maker is the platform project party that extracts profits from the fees (it takes 15% of the interest income). Although the project party has delayed the short-term death spiral pressure caused by the decline of RDNT tokens through the dLP staking mechanism, in the long run, unless Radiant can gradually shift its business from Ponzi to a normal business model, the death spiral will eventually come.

Overall, the decentralized lending market, represented by leading projects like Aave, is gradually shedding its reliance on high subsidies to maintain operating revenue, returning to a healthy business model.

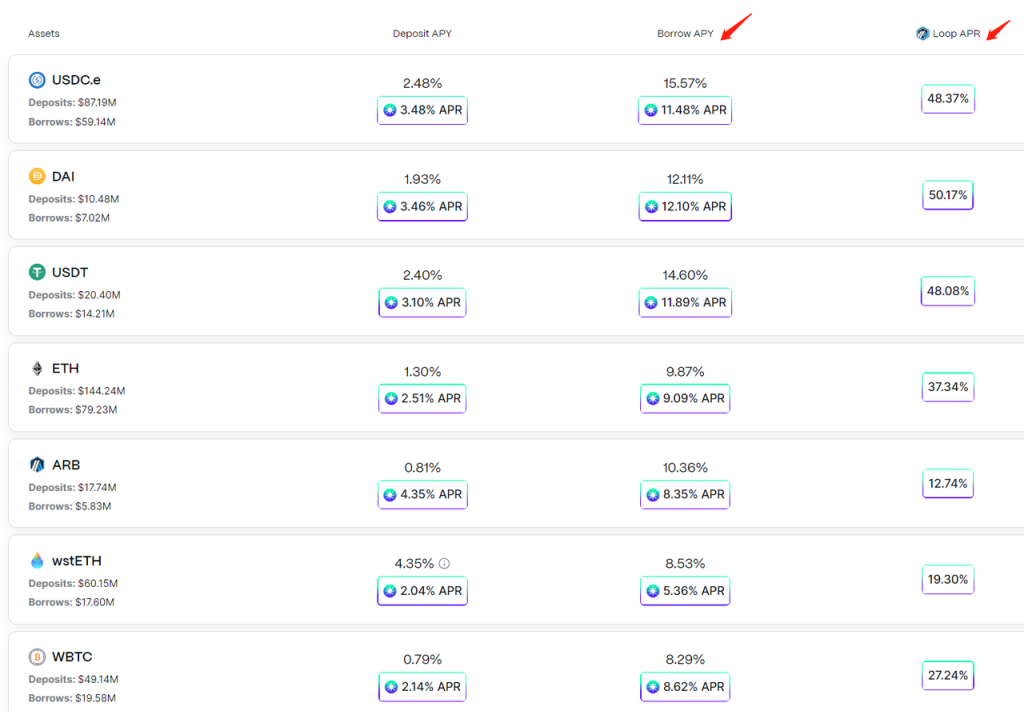

The following chart shows the changes in active loan volumes in the Web3 lending market from May 2019 to October 2023, from initial amounts of hundreds of thousands of dollars, peaking at $22.5 billion in November 2021, dropping to a low of $3.8 billion in November 2022, and now standing at $5 billion. The lending market's business volume is slowly bottoming out and recovering, demonstrating good commercial resilience even in a bear market.

Clear competitive advantages, high market concentration

As a part of DeFi infrastructure, the competitive moat of leading projects in the lending sector is stronger compared to the fierce competition in the DEX market, specifically reflected in:

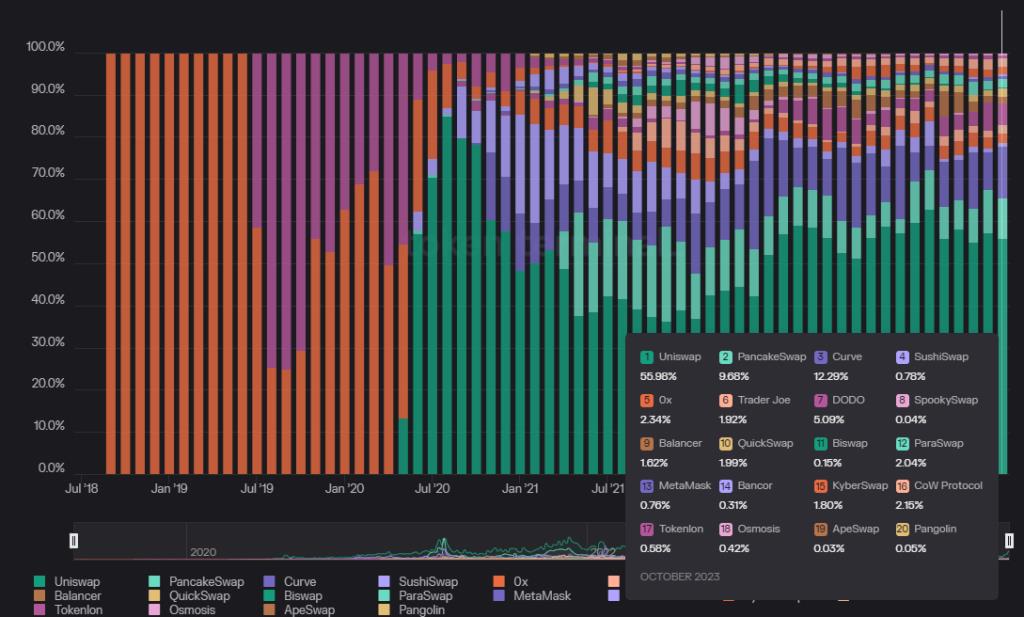

- More stable market share. The following chart shows the changes in the market share of active loan volumes for various projects from May 2019 to October 2023. Since Aave's push in mid-2021, its market share has remained stable in the 50-60% range, while the second-place Compound, although its share has been squeezed, still maintains a relatively stable ranking.

In contrast, the market share changes in the DEX sector are much more volatile. The leading project Uniswap quickly captured nearly 90% of the trading volume market share after its launch, but due to the rapid growth of Sushiswap, Curve, and Pancakeswap, its market share once dropped to 37%, and has now returned to around 55%. Additionally, the total number of projects in the DEX sector is far greater than that in the lending sector.

- Stronger profitability of lending sector projects. As mentioned in the previous section, projects like Aave can achieve positive cash flow without subsidizing lending activities, generating monthly interest margin revenues of around $1.5-2 million. In contrast, most DEX projects either, like Uniswap, have not yet initiated fees at the protocol level (only frontend fees), or the value of token emissions used for liquidity incentives far exceeds the protocol's fee income, resulting in an actual loss-making operational state.

The competitive moat of leading lending protocols can be broadly summarized as brand strength in terms of security, which can be further broken down into the following two points:

- A long history of secure operations: Since the DeFi Summer of 2020, numerous Aave or Compound fork projects have been established across various chains, but most have encountered theft or significant bad debt losses shortly after their establishment. Aave and Compound have yet to experience serious theft or unmanageable bad debt incidents, and this long-term operational history in a real network environment serves as the most important security endorsement for deposit users. New lending protocols may have more attractive concepts and higher short-term APYs, but without years of experience, it is difficult to gain the trust of users, especially whale users.

- More ample security budgets: Leading lending protocols have higher commercial revenues and abundant treasury funds, allowing for sufficient budgets for security audits and asset risk control. This is crucial for the development of new features and the introduction of new assets.

Overall, lending is a market that has validated organic demand, healthy business models, and relatively concentrated market share.

Morpho's Business Content and Operational Status

Business Content: Interest Rate Optimization

Morpho's currently launched business is a peer-to-peer lending protocol (or interest rate optimizer) built on Aave and Compound, aimed at improving the inefficiencies in capital allocation caused by mismatched deposits and loans in lending protocols like Aave.

Its value proposition is simple and clear: to provide better interest rates for both lenders and borrowers, meaning higher deposit yields and lower borrowing rates.

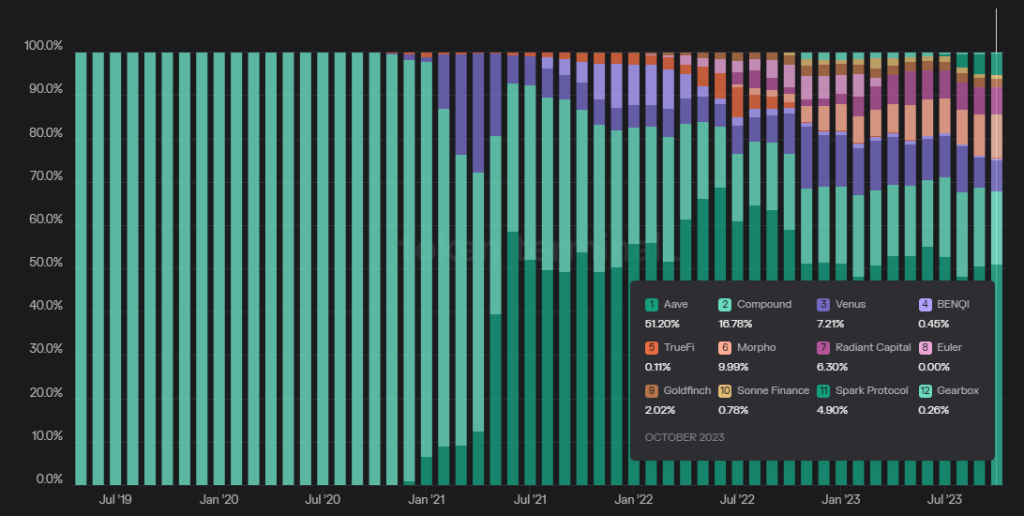

The inefficiency in capital allocation in Aave and Compound's peer-to-pool model arises because the total scale of deposited funds (the pool) is always greater than the total scale of borrowed funds (the points). In most cases, the USDT money market has a total deposit of $1 billion, but only $600 million is borrowed.

For depositors, the idle $400 million must also be allocated to the $600 million in loans, reducing the interest each person can receive; for borrowers, although they only borrow a portion of the pool, they must pay interest on the entire pool, increasing their interest burden. This is the problem caused by mismatched deposits and loans.

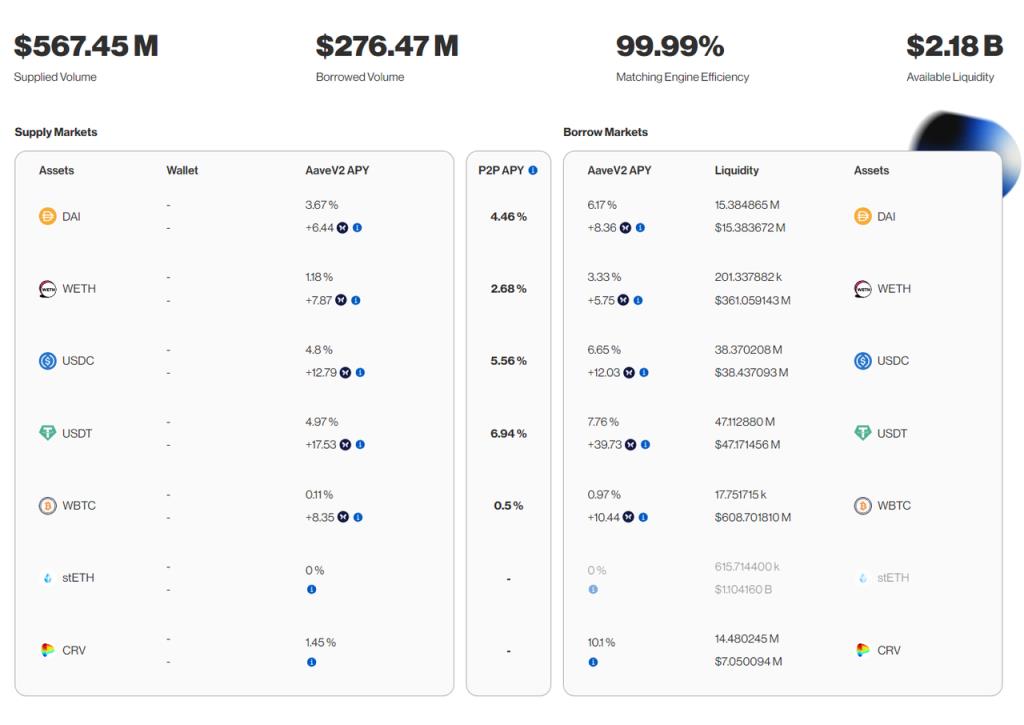

Taking the interest rate optimizer module on Aave V2, which currently has the largest deposit volume for Morpho, as an example, let's see how Morpho's interest rate optimization service addresses this issue.

Deposit: Depositor BOB deposits 10,000 Dai into Morpho, which will first deposit the funds into Aave V2's money market, with a deposit rate of Aave's market rate of 3.67%.

Collateral for Borrowing: Borrower ALICE first deposits 20 ETH as collateral into Morpho and requests to borrow 10,000 Dai. Morpho will deposit the collateral into Aave V2's money market.

Matching Deposits and Loans: Morpho then retrieves the 10,000 Dai previously deposited by BOB in Aave and directly matches it to lend to ALICE. Note that at this point, BOB's deposit and ALICE's borrowing are perfectly matched, with BOB's deposit fully utilized; ALICE only pays interest on the 10,000 Dai she borrowed, rather than the entire pool. Thus, in this matched scenario, BOB receives a deposit rate of 4.46%, which is higher than Aave's peer-to-pool model of 3.67%; ALICE incurs a borrowing interest rate of 4.46%, which is lower than Aave's peer-to-pool model of 6.17%, optimizing the rates for both parties.

*Note: The 4.46% P2P rate in the example is closer to the lower limit (deposit APY) or upper limit (borrowing APY) of the underlying protocol, determined by Morpho's parameters, which are governed.

- Resolving Mismatches: If BOB wants to retrieve the Dai he previously lent while ALICE has not yet repaid, and there are no other lenders on Morpho, Morpho will borrow 10,000+ Dai principal and interest from Aave using ALICE's 20 ETH as collateral to provide to BOB for redemption.

- Matching Order: Considering gas costs, the P2P matching of deposits and loans prioritizes "matching large funds" first; the larger the deposit and loan amounts, the higher the priority for matching. This reduces the gas consumption ratio per unit of funds. If the gas consumption value for executing the match becomes too high relative to the matched fund amount, the match will not be executed to avoid excessive wear.

Through the above explanation, we find that Morpho's business essentially uses Aave and Compound as capital buffer pools to provide interest rate optimization services for depositors and borrowers through matching.

The cleverness of this design lies in the composability of the DeFi world, allowing Morpho to attract user funds without any initial capital. For users, the appeal lies in:

They can obtain financial rates equivalent to Aave and Compound at the very least, and when matching occurs, their returns/costs will be significantly optimized.

Morpho's products are primarily built on Aave and Compound, with risk parameters fully replicated, and its funds are allocated within Aave and Compound, thus inheriting the brand reputation of the two established protocols to a large extent.

This clever design and clear value proposition have allowed Morpho to achieve nearly $1 billion in deposit scale just over a year after its launch, making it the second largest by data after Aave and Compound.

Business Data and Token Situation

Business Data

The following chart shows the total deposits (blue line), total loans (light brown line), and matched amounts (dark brown line) for Morpho's business trends.

Overall, Morpho's various business scales continue to grow, with a deposit matching rate of 33.4% and a loan matching rate of 63.9%, which is quite impressive.

Token Situation

Source: Official Documentation

The total supply of Morpho tokens is 1 billion, with 51% allocated to the community, 19% sold to investors, and 24% held by the founders and the development company Morpho Labs and the operational entity Morpho Association, with the remainder allocated to advisors and contributors.

It is worth mentioning that although Morpho tokens have been issued and are already being used in voting decisions and project incentives, they are in a non-transferable state. Therefore, there is no secondary market price; users and investors who receive tokens can participate in governance voting but cannot sell them.

Unlike projects like Curve, which hard-code future token outputs and incentives, Morpho's token incentives are distributed in batches, determined quarterly or monthly, allowing the governance team to flexibly adjust the intensity and specific strategies of incentives based on market changes.

I believe this is a more pragmatic approach and may become the mainstream model for token incentive distribution in Web3 business in the future.

In terms of the targets of incentives, Morpho incentivizes both lending and borrowing activities. However, currently, the allocation of Morpho tokens in incentives is not substantial, with only 30.8 million tokens distributed in the past year, accounting for 3.08% of the total supply. Moreover, from the incentive periods and corresponding token allocation amounts shown in the chart below, the official token expenditure on incentives is rapidly decreasing, and this reduction in expenditure has not slowed down the growth rate of Morpho's business.

This is a positive signal, indicating that Morpho's PMF is quite sufficient, and user demand is becoming increasingly organic. The community token share of 51% currently remains nearly 48%, providing ample budget space for future business incentives in new segments.

However, Morpho has not yet charged for its services.

Team and Financing

The core team of Morpho is based in France, primarily in Paris, with most members having their real names disclosed. The three founders come from the telecommunications and computer industries, with backgrounds in blockchain entrepreneurship and development work.

Morpho has undergone two rounds of financing: a $1.3 million seed round in October 2021 and an $18 million Series A round led by A16z, Nascent, and Variant in July 2022.

Source: Official Website

If the above financing amounts correspond to the 19% investor share disclosed by the official sources, the project's comprehensive valuation is approximately $100 million.

What is Morpho Blue and Its Potential Impact

What is Morpho Blue?

In simple terms, Morpho Blue is a permissionless lending infrastructure. Compared to Aave and Compound, Morpho Blue opens up most lending dimensions, allowing anyone to build lending markets based on Morpho Blue. The dimensions that builders can choose from include:

What to use as collateral;

What to use as borrowed assets;

Which oracle to use;

What the loan-to-value (LTV) and liquidation ratio (LLTV) are;

What the interest rate model (IRM) looks like;

What value will this bring?

In the official article, the characteristics of Morpho Blue are summarized as follows:

Trustless, because:

Morpho Blue is immutable; no one can change it, adhering to the principle of minimal governance.

It consists of only 650 lines of Solidity code, making it simple and secure.

Efficient, because:

Users can choose higher LTVs and more reasonable interest rates.

The platform does not need to pay third-party audit and risk management service fees.

Based on simple code, it uses a singleton smart contract (meaning the protocol uses one contract to execute rather than a combination of multiple contracts, similar to Uniswap V4), which significantly reduces gas costs by 70%.

Flexible, because:

Market building and risk management (oracles, lending parameters) are permissionless, no longer following a unified model, meaning the entire platform does not adhere to a set of standards established by a DAO (like Aave and Compound).

Developer-friendly: It introduces various modern smart contract patterns, account management allows for gasless interactions and account abstraction, and free flash loans enable anyone to access all market assets through a single call, as long as they repay within the same transaction.

Morpho Blue adopts a product approach similar to Uni V4, focusing solely on a type of major financial service as its infrastructure, while opening up all modules above the infrastructure, allowing different people to come in and provide services.

The difference from Aave is that while Aave's lending is permissionless, the assets that can be deposited and borrowed on Aave, the risk control rules, which oracle to use, and how to set interest and liquidation parameters are all determined and managed by Aave DAO and various service providers behind the DAO, such as Gaunlet and Chaos, which monitor and manage over 600 risk parameters daily.

Morpho Blue, on the other hand, is like an open lending operating system, where anyone can build their own optimal lending combination on top of Morpho Blue, and professional risk management institutions like Gaunlet and Chaos can seek partners in the market to sell their risk management services for corresponding fees.

In my view, the core value proposition of Morpho Blue is not merely trustlessness, efficiency, and flexibility, but rather the provision of a free lending market, facilitating collaboration among participants in various aspects of the lending market, offering richer market choices for customers in each segment.

Will Morpho Blue pose a threat to Aave?

It might.

Morpho differs from many previous challengers to Aave in that it has accumulated some advantages over the past year:

$1 billion in capital management, which brings it to the same order of magnitude as Aave's $7 billion in capital management. Although these funds are currently tied up in Morpho's interest rate optimizer function, there are many pathways to channel them into new features;

As the fastest-growing lending protocol in the past year, coupled with its tokens not being in formal circulation, there is significant room for imagination, and the launch of its heavyweight new features is likely to attract user participation;

Morpho has a sufficient and flexible token budget, capable of attracting users through subsidies in the early stages;

Morpho's stable operational history and capital volume have already built some brand credibility in terms of security;

Of course, this does not mean that Aave will necessarily be at a disadvantage in future confrontations, as most users may lack the ability and willingness to choose services from numerous lending options. Currently, the lending products output under Aave DAO's unified management model may still be the most favored.

Secondly, Morpho's interest rate optimizer largely inherits the security credibility of Aave and Compound, making more funds gradually feel secure in using it. However, Morpho Blue is a brand new product with separate code, and whales will inevitably have a hesitation period before feeling secure to invest. After all, incidents like the theft of Euler, a previous generation of permissionless lending markets, are still fresh in memory.

Furthermore, Aave has the capability to build a set of features similar to Morpho's interest rate optimizer on its existing solutions to meet users' needs for improving capital matching efficiency, potentially pushing Morpho out of the P2P lending market. Although this possibility seems low at present, as Aave granted funding to a P2P lending product similar to Morpho, NillaConnect, in July this year instead of developing it themselves.

Lastly, the lending business model adopted by Morpho Blue is fundamentally not different from Aave's existing solutions, and Aave is capable of observing and imitating effective lending models from Morpho Blue.

Nevertheless, the launch of Morpho Blue will provide a more open lending testing ground, offering possibilities for participation and combinations across all aspects of lending. Will new lending groups formed in this way emerge with solutions capable of challenging Aave?

We shall see.