Coral Finance: Building a New Narrative Blueprint Based on the Premium Mechanism

Author: 0xdabai

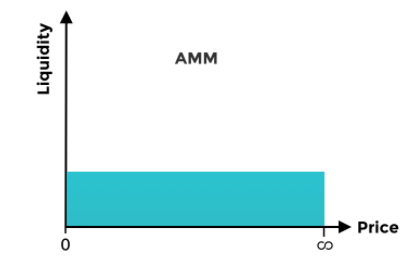

In the on-chain world, liquidity is the prerequisite for facilitating all transactions. Good liquidity allows for smoother transactions, and the associated costs around trading are lower. Liquidity mining based on AMM was the catalyst for DeFi Summer, enabling participating users to spontaneously become liquidity contributors through token rewards, fee incentives, and other means.

We see that in the AMM model represented by Uniswap v2, there is usually a large amount of trading around the market price, which means that the AMM token trading model is only effective with liquidity near the market price. Although it can provide trading liquidity of (0, ∞), low capital utilization has always been a bottleneck for the DEX sector. On the other hand, its liquidity sources overly rely on incentives such as tokens and fees for participating users, making it easy for projects lacking strong community consensus to fall into a death spiral.

Uniswap v3 introduced CLMM (Concentrated Liquidity) to improve capital efficiency and set up a three-tier fee model. Participating users can decide to inject the provided assets into selected price ranges and earn different fees based on the price fluctuation risks of the tokens they provide (the higher the risk, the higher the return: 0.05%, 0.30%, 1.00%). However, participating users need to closely monitor the prices of their provided assets and take timely actions, such as withdrawing liquidity and reallocating funds to new price ranges, to mitigate the impact of impermanent loss. In fact, in Uniswap v3, nearly half of liquidity providers experience negative returns due to impermanent loss, leading to an imbalance in liquidity acquisition and capital utilization.

Compared to Uniswap v3, the solution offered by Maverick Protocol seems more mature. By introducing the "Directional LPing" mechanism and the Boosted Position tool, it can achieve concentrated liquidity that automatically moves according to trading prices and even formulate liquidity strategies to earn higher returns. Maverick Protocol appears to be more suitable for professional traders and liquidity providers, and it is still based on AMM. We see that after the value of its incentive token $MAV continuously declined, it significantly impacted the trading volume and TVL data of Maverick Protocol.

In the exploration of liquidity in the DeFi market, we observe that liquidity, capital utilization efficiency, and LP returns seem to form an "impossible triangle" that cannot be achieved simultaneously.

However, the emerging on-chain derivatives protocol Coral Finance seems to be a relatively special case, attempting to balance the aforementioned "impossible triangle" by introducing a premium trading mechanism. Shortly after entering the market, Coral Finance successfully attracted significant interest from many DeFi users, who are eager to participate.

This article will further explore Coral Finance's premium trading mechanism and the long-term narrative direction of the project to enhance users' understanding of the Coral Finance ecosystem.

Coral Finance and the Premium Trading Mechanism

Coral Finance is a derivatives trading platform that provides reliable, non-inflationary liquidity solutions for ecosystem projects through innovative premium trading. It aims to improve users' capital utilization efficiency and provide asset appreciation and hedging means. It also functions like an options protocol that can provide value for liquidity and token economics.

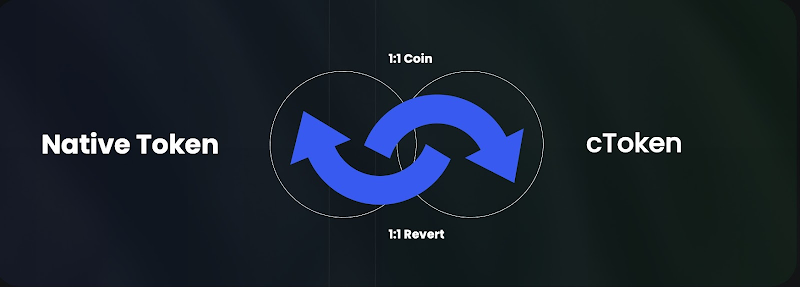

This derivatives system is built on the "Premium Incentive Mechanism" (PIM). This mechanism introduces a new type of cToken, a derivative token that holders can obtain by staking the original token 1:1 into the premium pool. After staking, the value of the obtained cToken will be significantly higher than that of the original token, but the cToken is locked and cannot circulate. Users need to continuously engage in liquidity-enhancing behaviors, including providing liquidity and completing trades, to unlock the locked cToken and earn profits from the premium.

Taking BTC as an example, when we stake 1 BTC token into the corresponding premium pool, we will receive 1 cBTC token, but cBTC is locked. We need to provide liquidity for cBTC (cBTC needs to be purchased additionally) to change the cBTC token from a locked state to an unlocked state (tradable) to earn profits.

The value of the cToken itself is a non-limited multiple of the original token's value. This premium mainly arises from the fluctuations in the intrinsic value of the asset over time, trading strategies, and market behaviors. Therefore, when cTokens are unlocked and traded, traders engage in a game with multiple parties and can benefit significantly from it.

The unlocking process of cTokens is continuous. Users need to provide liquidity for cTokens to unlock them, and the number of tokens unlocked is closely related to the price of cTokens, the amount of USDT in the premium, and their liquidity proportion.

Coral Finance's premium pool recalculates earnings weekly based on changes within the pool, so the number of individual cTokens earned will also change dynamically each week. Participants can remove their liquidity from the pool at any time. On the other hand, users can also redeem unlocked or locked cTokens on a 1:1 basis at any time, which serves as a risk-hedging mechanism, unlike the potential liquidation risks present in derivatives markets like GMX.

Another advantage of Coral Finance's premium pool is the absence of impermanent loss, while also maintaining good capital efficiency.

Coral Finance's LP mechanism primarily involves single-coin liquidity, meaning that when users provide liquidity to a premium pool (cToken-USDT/USDC), they can choose to stake assets in a single-coin form on one side or both sides, rather than using the AMM LP method. The returns from adding liquidity to the cToken side are the premium earnings after unlocking, while the returns from providing liquidity to the USDT/USDC side are liquidity mining rewards.

The potential risk of traditional AMM-based liquidity mining lies in impermanent loss, especially when token prices fluctuate; impermanent loss can even exceed earnings. Coral Finance's single-coin liquidity approach eliminates impermanent loss, alleviating investors' concerns about it.

In terms of capital efficiency, Coral Finance employs a balancing mechanism to ensure liquidity balance on both sides. Each cycle will rebalance the APR of the two pools to ensure sufficient liquidity on both sides. For instance, when the left pool (cToken) lacks liquidity, the APR returns of the right pool (USDT/USDC) will be reduced to attract liquidity to the left pool. This rebalancing is similar to Maverick's precise liquidity mechanism, enabling concentrated liquidity to automatically move based on trading pair prices, significantly enhancing the capital efficiency of the pool.

Thus, based on Coral Finance's premium incentive mechanism, when users want to earn from the premium pool, if they do not hold the original token, they need to purchase the original token to participate in the premium and earn profits, which provides good liquidity to the secondary market. If users hold the original token, their participation in the premium pool will further restrict the secondary market liquidity of the original token, which is more beneficial for the asset's market value management. While participating in premium trading, users need to continuously contribute to the liquidity of the premium pool to earn premium returns (with low or even no impermanent loss), which will bring continuous liquidity to cTokens.

Unfazed by Bull and Bear Markets: The Value "Engine" of the Crypto Market

In a bear market, the decline in token prices leads to a lack of incentives, making liquidity systems centered around AMM ineffective, and liquidity has become one of the scarce resources in the on-chain world. Since the last bull market, over 70% of projects have declared death due to liquidity exhaustion. The significant decline in incentives and returns has further led to a massive outflow of funds and users from the on-chain world, leaving the DeFi market lacking development momentum.

The earnings generated by Coral Finance's premium incentive mechanism are unrelated to the tokens themselves, meaning that regardless of how the external market changes, traders can always expect potential and considerable returns from the premium incentive mechanism and can use Coral Finance as a tool to hedge against potential market risks. In this process, it can inject continuous liquidity into the market.

For project parties, i.e., liquidity demanders, there is no need to pay a high price to capture liquidity. They can significantly reduce the market circulation of project tokens based on Coral Finance and hedge against the impact of external market selling pressure, making it an indispensable tool for managing tokens. Therefore, whether in a bull or bear market, Coral Finance can become the "engine" of value in the crypto market and has the opportunity to bring new growth to DeFi, sparking a new wave of on-chain application enthusiasm.

Recently, Coral Finance announced that it will soon launch its full-chain Swap. This feature is a crucial part of the entire premium pool functionality, allowing participants to engage in the premium pool in a one-stop manner and quickly and conveniently obtain the original assets of specific premium pools, creating a seamless user experience.

Additionally, the rapid development of the LSD track is providing a reference for Coral Finance's further design of cTokens. We see that LST assets have already demonstrated their composability and programmability in external LSDFi protocols, and Coral Finance is also expected to endow cTokens with the ability to capture value externally, such as further circulating in potential scenarios like lending, staking, contract trading, and bonds. This will promote a more diversified development of the Coral Finance ecosystem, better empowering the development of the DeFi market.

In the long term, Coral Finance aims to empower the long-term development of cTokens and the ecosystem through RWA (Real World Asset tokens). The new combination of the premium system and RWA is expected to build a new value system for Coral Finance.

Coral Finance's RWA Narrative

Since the crypto industry entered a development trough in 2022, how to capture value externally to stimulate the next bull market has become a long-term exploration question. RWA is one of the narrative directions worth paying attention to, as it is expected to become a bridge linking traditional assets worth trillions of dollars with the on-chain world and is considered a cornerstone for driving the next bull market.

According to a previous research report by Binance on the RWA track, it was predicted that by 2030, the RWA market size could exceed $16 trillion, accounting for more than 10% of global GDP.

Currently, in the RWA track, there are already several refined sectors, including centralized stablecoins, private credit, public bond markets, stock tokens, private equity, real estate, carbon credit certificates, artworks and collectibles, and precious metals, each of which is a potential area worth deep exploration. As on-chain infrastructure continues to improve, RWA is expected to achieve rapid growth in the short term, based on mature traditional financial markets.

In fact, compared to traditional financial assets like stocks and bonds, RWA typically has poorer liquidity, and investors may need a long time to sell assets. This is often due to the inadequacy of the secondary market for RWA assets and the lack of targeted liquidity measures.

Coral Finance's advantage lies in its premium trading mechanism, which is expected to alleviate the liquidity challenges faced by RWA assets in their early development.

The introduction of RWA also represents a long-term gain for the long-term development of the Coral Finance ecosystem. We see that the value of cryptocurrencies usually stems from market consensus, and favorable or unfavorable market news can lead to significant fluctuations in cryptocurrencies. For example, a false ETF news item can cause Bitcoin to spike temporarily, which essentially reflects the lack of actual value support for cryptocurrencies.

In contrast to traditional financial assets, which are usually deeply linked to physical assets and have solid value support, this plays a crucial role in building a value foundation for the Coral Finance ecosystem.

On the other hand, tokenizing RWA assets into cTokens is expected to promote the circulation of RWA assets in a new form to external markets, fully leveraging their composability and programmability, and helping Coral Finance better capture funds and users from external markets.

Currently, Coral Finance has also made some progress in its RWA layout, as it is strategically cooperating with Donghao Group for the HKEX experiment. Donghao Group is an institution that can provide diversified services, covering brokerage and financing, fixed income product trading, underwriting and placement, securities research, fund management, portfolio investment, IPO fundraising, mergers and acquisitions, and capital restructuring.

This provides assistance for Coral Finance's deep expansion in the RWA field. In addition to being able to map stocks to tokens in a compliant manner, it will also be the first to establish a stock premium pool and a treasury supported by equity assets. Meanwhile, the HKEX experiment will collaborate with more traditional financial institutions in the future to incorporate more traditional assets, including bonds, funds, and commodities, into the Coral Finance ecosystem in the form of RWA, which is expected to become one of the important infrastructure for the trillion-dollar potential RWA market.

Coral Finance Treasury

In theory, all assets listed on CEX and DEX can establish premium pools within the Coral Finance protocol. Therefore, in Coral Finance, the premium pool will consist of three parts:

(1) Mainstream assets, including BTC, ETH, etc.;

(2) Sub-mainstream assets (top 100 by market cap), such as OP, ARB, SOL, UNI, etc.;

(3) Other altcoin assets;

Coral Finance will levy a "tax" on the unlocked cTokens participating in the premium pool, and the "tax" will enter the Coral Finance treasury. A portion of the funds in the treasury will be used for incentives for ecosystem users and will also serve as a reserve fund for the ecosystem. As the number of mainstream asset premium pools in Coral Finance increases, it will attract a large number of traders looking to hedge risks and profit, leading to significant growth in trading volume, user numbers, and TVL, which also means that Coral Finance will have long-term revenue capabilities.

In contrast, the vast majority of DeFi protocols rely solely on transaction fees from specific trading pools to sustain themselves, and in a bear market, the lack of trading motivation among users leads to a continuous decline, making it difficult to achieve long-term revenue growth. Coral Finance's revenue-generating ability and self-sustaining capacity will become increasingly prominent.

Furthermore, as Coral Finance expands into the RWA field, the treasury's income will further consist of stocks that genuinely represent equity, and Coral Finance's DAO treasury is expected to become one of the most valuable crypto fund repositories.

Overall, Coral Finance is an emerging innovative derivatives protocol in the current crypto market. Based on its unique liquidity premium mechanism, it is expected to play an important role in revitalizing liquidity in the crypto market and promoting the healthy development of the emerging crypto market. With its ongoing expansion in the RWA field, it is building an organic link between the traditional financial world and the crypto world, driving the development of the RWA track and exploring more possibilities. Coral Finance is constructing a new narrative blueprint.