In the next cycle, how Vimverse explores the new narrative of DeFi 2.0

Author: 0xdabai

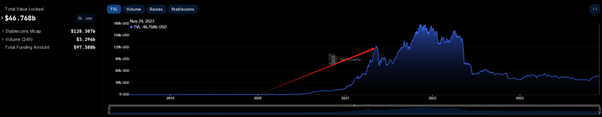

The emergence of AMM and liquidity mining has empowered DeFi facilities to capture liquidity in a decentralized manner through incentive mechanisms. This not only allows DeFi applications to be self-sustaining and sustainable but also drives the DeFi Summer craze. More composable and programmable DeFi provides investors with a viable alternative to CeFi facilities, attracting a large influx of funds and users through higher interest rates and more investment opportunities, ultimately propelling the last bull market.

After establishing a brief prosperity during DeFi Summer, it gradually fell into developmental difficulties.

Liquidity mining is built on incentives, but this liquidity, which can be withdrawn at any time, is overly reliant on the level of incentives. This led to a massive withdrawal of funds by LPs after the DeFi Summer craze faded and incentives declined. Most on-chain protocols fell into liquidity crises due to their inability to provide substantial incentives. On the other hand, leading DeFi protocols such as Uniswap, Curve, Aave, MakerDAO, and Compound were the pioneers of DeFi Summer and among the biggest beneficiaries. Now, a few top protocols control more than half of the trading volume in the DeFi market and have become monopolists of DeFi liquidity.

In the imbalanced liquidity quarters of the DeFi market, there is also a problem of low capital efficiency. The AMM model represented by Uniswap v2 typically prepares liquidity for all prices, meaning the price range for the trading liquidity it can provide is (0, ∞). However, in reality, there are usually a large number of trades occurring around the market price, which means that only the liquidity near the market price is effective, leaving most of the assets deposited in the liquidity pool unused.

Moreover, roles such as LPs and traders are losing patience, not only due to extremely low farming yields but also because of high slippage and impermanent loss caused by low liquidity, which makes these roles suffer. In search of more stable returns, they have no choice but to turn to leading DeFi protocols or CEXs, further exacerbating the monopolistic effect.

New Explorations of DeFi 2.0

Although DeFi Summer has shown excellent development potential, some changes are still needed to promote its long-term development.

Starting in 2021, the concept of DeFi 2.0 gradually emerged, building on the progress of DeFi 1.0, such as yield farming and lending. It aims to improve liquidity, capital efficiency, scalability, governance, user experience, and security, providing more complex incentives for on-chain users to promote more sustainable development in the on-chain world.

DeFi 2.0 no longer advocates simply "renting" liquidity through straightforward incentives; it aims to overcome the liquidity constraints faced by many on-chain protocols with native tokens and thoroughly address common issues related to liquidity supply and incentives. It provides alternatives and supplements to the yield farming model, offering projects a way to maintain a long-term source of liquidity and elevating liquidity and capital efficiency to a new level. Through the DeFi 2.0 system, protocols and users, and even users and users, can bind in more complex ways from multiple directions, allowing LPs to derive greater long-term value from the protocol rather than hastily withdrawing liquidity after short-term profits.

For example, Olympus DAO is an early example of DeFi 2.0.

Olympus DAO attempts to solve problems through a new bonding mechanism, focusing on "protocol-controlled liquidity," often referred to as POL. Olympus DAO does not acquire liquidity through liquidity mining but instead uses bonds, allowing third-party LP tokens to be exchanged at a discount for Olympus DAO's native token OHM as a reward. Of course, the discounted bonds purchased must be held for at least 5-7 days (linear release) to prevent excessive arbitrage from causing too much selling pressure.

Thus, the Olympus DAO protocol acquires liquidity by issuing bonds rather than renting third-party liquidity, eliminating the risk of liquidity withdrawal and establishing a lasting liquidity pool while generating income for the protocol.

Olympus DAO also sets a cap on the dynamic price of bonds, allowing the protocol to control two key factors: the speed of token redemption and the total amount redeemed. For instance, when bond sales are excessive, the discount will decrease or even turn negative, while it also controls the liquidity supply by setting a cap, stopping bond issuance beyond this limit, and better managing token supply through precise parameters to maintain economic health.

The incentive mechanism between Olympus DAO's third-party liquidity providers and on-chain protocols has been re-coordinated, allowing it to more effectively reduce impermanent loss compared to liquidity mining. This bond-based additional incentive mechanism can lock in liquidity, reduce trading slippage for users when trading native tokens, and lower the entry threshold for users into the ecosystem. It is reported that Olympus DAO once controlled over 99.7% of OHM-DAI and OHM-FRAX liquidity and earned millions in trading fees daily on DEX.

In addition to Olympus DAO, Tokemak, Alchemix, and others are also early representatives of development in the DeFi 2.0 field.

With the emergence of more technologically advanced Layer 1s, the completion of the ETH 2.0 upgrade, and the explosion of Layer 2, on-chain protocols have gained more scalability. Leading protocols, including UniSwap, Curve, and Aave, are also playing a role as composable and foundational protocols, allowing them to share their technological innovations and various resources, including liquidity. The narrative direction of DeFi 2.0 is thus becoming richer.

After Olympus DAO, Tokemak, and other established LaaS protocols laid the initial outline of DeFi 2.0, Vimverse is taking up the narrative baton of DeFi 2.0 and pushing it to a whole new height.

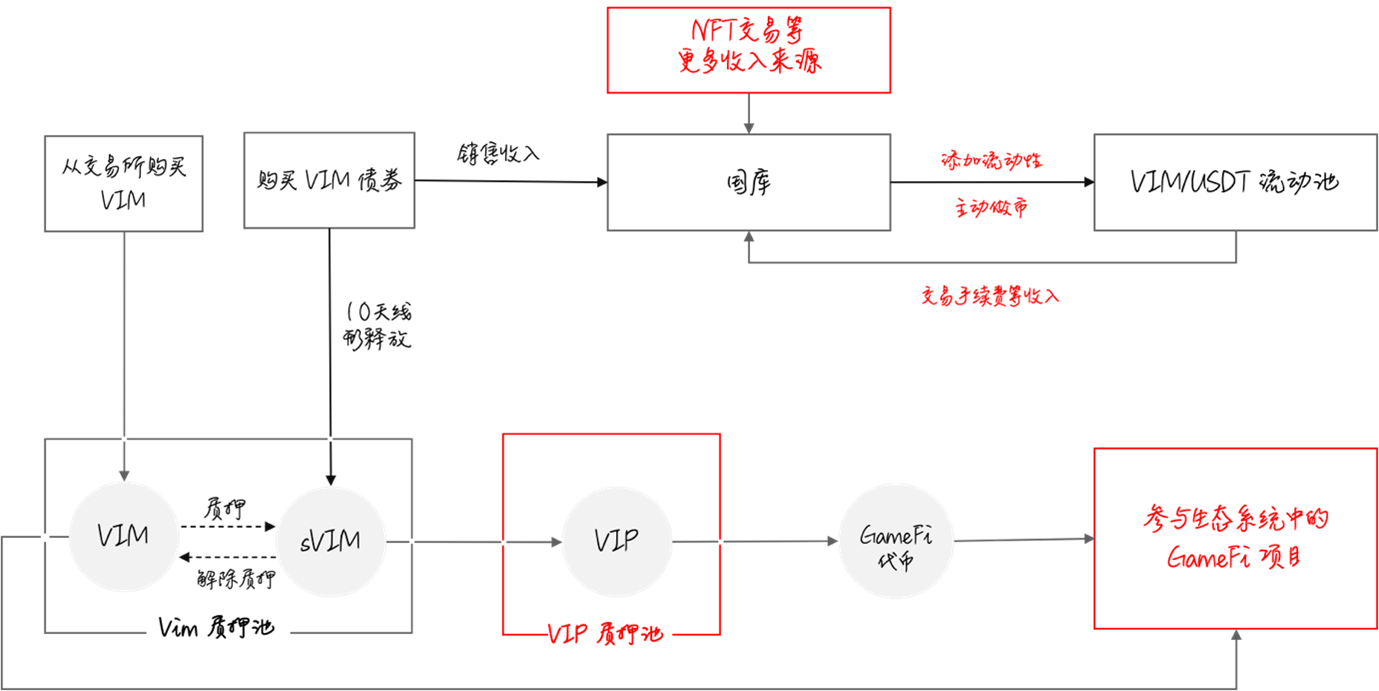

Vimverse adopts the Protocol Owned Liquidity (POL) mechanism from Olympus DAO, capturing liquidity through discounted bonds, but on this basis, Vimverse combines with Uniswap v3, using the latter as the underlying layer to achieve active fund management and elevate fund utilization to a new level. Clearly, this aligns more closely with the purpose of DeFi 2.0 (relatively speaking, early DeFi 2.0 protocols did not perform well in capital efficiency). The DeFi 2.0 economic system of the Vimverse ecosystem is built around $VIM, and Vimverse further establishes new application scenarios for its token, actively capturing value to solidify the ecological value foundation.

New Narrative of Vimverse's DeFi 2.0

Vimverse has established a brand new DeFi 2.0 system around the VIM token, allowing users to purchase discounted bonds (sVIM) using stablecoins and other value tokens as incentives. After purchasing the debt asset sVIM, users will lock it in the pool and linearly release it over 10 days. Holding sVIM as a type of equity bond will allow users to earn coin-based interest, and sVIM can be exchanged for VIM tokens at any time.

Similar to Olympus DAO, in Vimverse, each VIM is backed by at least 1 USDT. If the price falls below 1 USDT, the protocol will buy back and burn VIM to maintain its value. If the price exceeds 1 USDT, more VIM will be minted and sold to stabilize the price. The increase in treasury funds will introduce more buyback mechanisms, further stabilizing token value.

Whether purchasing or selling VIM assets, the Vimverse protocol is always able to profit. Based on this rebase effect, Olympus DAO's OHM once reached as high as 1300 USDT each, while the more innovative Vimverse (discussed later) is expected to drive the value of VIM assets to new heights through new value empowerment.

We see that Olympus DAO focuses on how to better establish liquidity rather than on capital efficiency, as LPs themselves represent liquidity (usually sourced from AMM DEXs like Uniswap v2), but it is difficult for LPs to further manage capital efficiency. On the other hand, LP assets themselves carry the risk of impermanent loss, which poses a potential risk for both investors and the protocol itself.

Vimverse does not support purchasing bonds through LPs; it further combines with Uniswap v3 to actively manage liquidity. In fact, Uniswap v3's CLMM mechanism balances capital efficiency, allowing LPs to provide liquidity within specific price ranges. Based on this, after selling bonds to obtain funds, Vimverse actively market-makes through its proprietary protocol active market-making (PMMM) mechanism, implementing refined liquidity management strategies by combining with Uniswap V3's customized liquidity features. While controlling liquidity, a professional market-making team will actively and efficiently manage liquidity through strategies, returning profits to bond purchasers after fully profiting.

Uniswap v3 has excellent capital efficiency compared to Uniswap v2 and CEXs, achieving better liquidity effects with less capital. Additionally, it exhibits higher market depth across all price ranges, a fact that has been proven by Paradigm in the paper "The Dominance of Uniswap v3 Liquidity." Furthermore, Uniswap v3 has shown significant effectiveness in reducing trading slippage, particularly within narrower price ranges.

The further combination with Uniswap v3 will endow the PMMM mechanism with the aforementioned advantages. Therefore, the advantages of Vimverse compared to Olympus DAO become even more apparent. We can intuitively see that the new liquidity management scheme can achieve price stability within range intervals, reduce severe price fluctuations, and is expected to improve capital utilization efficiency, significantly increasing trading fee income. By establishing sufficient liquidity through Vimverse and managing it reasonably, trading slippage will be further reduced, ultimately enhancing the user trading experience.

For liquidity seekers (project parties), using Vimverse as an entry point based on the PMMM mechanism will allow them to achieve higher liquidity efficiency with less capital and allocate more funds for ecosystem and technology development.

Moreover, according to specific model yield calculations by Vimverse, the annualized trading fee yield (APR) brought by the combination of the Olympus DAO + Uniswap v3 model exceeds 115%, which is quite competitive for most DeFi models. From the perspective of active liquidity management alone, Vimverse possesses strong self-sustaining capabilities.

It is worth mentioning that Vimverse is also expanding in a new direction; it is not just a DeFi protocol but also a launchpad and incubation platform for GameFi and other innovative projects. Through close cooperation with these projects, Vimverse is driving the ecosystem towards a more diversified direction.

Based on this, VIM assets play an important role not only in its debt system but also in participating in GameFi projects within the ecosystem, acquiring game assets, and enjoying more opportunities for returns and gaming experiences. VIM can also be used to purchase bonds from cooperative projects within the ecosystem to obtain tokens at discounted prices. Through the GameFi system, VIM has more consumption scenarios, further increasing the necessity of VIM assets.

To deepen users' long-term engagement and community consensus while enhancing interconnectivity among projects within the ecosystem, Vimverse has introduced an innovative strategy. Users can lock sVIM (i.e., staked VIM) to earn VIP (Vimverse points). These VIP points can be redeemed for tokens from GameFi projects within its ecosystem and allow users to enjoy a series of exclusive benefits such as NFT airdrops and minting discounts.

Thus, the revenue of Vimverse is highly diversified, originating not only from bond sales and profits generated by active market-making but also from GameFi NFT sales/trading, token trading fees, etc. These revenues are used to increase liquidity and maintain the stable price of VIM tokens. With a significant improvement in capital efficiency, income from VIM trading fees will increase substantially, continuously forming a positive value flywheel.

Of course, Vimverse is not only a representative of the new wave of DeFi 2.0 projects but also provides a reference for how DeFi protocols can achieve innovation through new paths.

Innovative Paths of DeFi

Since the development of DeFi Summer, the DeFi track has gradually become more complete, with leading protocols capturing the vast majority of industry resources through brand effects and continuously attempting technological iterations. For example, after Uniswap v3, various technically distinctive versions like Uniswap v4 and Uniswap X have been launched.

Composability is opening new avenues for DeFi innovation, with clever developers building new links by combining DeFi facilities with different functions in a Lego-like manner, constructing more creative products through this vertical innovation. DeFi 2.0 follows this idea, addressing a series of issues arising from on-chain trading in a composable manner.

However, after several major innovations in the DeFi world, achieving disruptive innovation in this field is becoming increasingly difficult. Vertical innovations specific to the DeFi field are facing bottlenecks, and the evolution speed of DeFi applications is slowing down.

Vimverse is providing a new reference for the innovative path of the DeFi world, not only constructing a new LaaS system through vertical improvements in liquidity management but also better addressing the triangular dilemma of liquidity, capital efficiency, and yield faced by the DeFi field. Additionally, by horizontally integrating GameFi, it further empowers its ecosystem and establishes a higher value moat. Through the combination of horizontal and vertical innovation, the ecosystem built by Vimverse is more three-dimensional and multi-faceted, endowing the ecosystem with the ability to capture value externally.

Further combining DeFi to achieve breakthroughs in innovation has opened a new DeFi 2.0 era, and further horizontal expansion on this basis may be the beginning of the DeFi 3.0 era.

In the future, new combinations like Vimverse that leverage both horizontal and vertical innovations may become the mainstream approach to innovation in the DeFi track.