2024 Crypto Investment Guide: Which Narratives Are Worth Following?

Author: Kyle

Compiled by: Deep Tide TechFlow

As we approach 2024, my core investment portfolio is now fully allocated. This article is about my perspective on the developments in 2024. I will do my best to express my views on investing in this article. But this is not financial advice; it is merely an insight into how I see the development of cryptocurrency in 2024.

If you don't plan ahead, your investments will fail

In the past few months, we have seen Bitcoin finally break out of a nearly 500-day consolidation between 15k and 32k, and now everyone is anticipating a bull market.

But as my favorite Twitter blogger 0x_Kun said:

Make an investment plan and stick to it. Because when the market turns sour, you will know what to do.

Therefore, the core of this article is to delve into my plans for 2024. This article is divided into two main parts:

How I view the developments in 2024

Which narratives I believe will perform well

Part One: The Bull Market Case for 2024

I always prefer a top-down approach when investing: macro first, then micro. Therefore, here are the key narratives that I believe will drive the bull market:

Bitcoin ETF

Interest rate cuts

Bitcoin halving

There are many other smaller factors—such as the presidential election year, China's stimulus policies, etc. But I believe the three factors mentioned above are the most important and have the greatest impact on my portfolio. If you worry about every little factor, you will never make a trade.

Next, I like to list a series of possible events and predict the probability of each event occurring. I believe the wisest investment is to determine how cycles will develop on a longer-term basis.

Scenario Analysis

Before we dive into the scenarios, let me explain some basic assumptions I have regarding the key narratives I listed.

BTC Halving is Certain

In all these scenarios, I believe that the Bitcoin halving does not necessarily mean an immediate price increase.

As can be seen from the chart above, Bitcoin halvings always occur before bull markets, but halvings have never been a direct catalyst for bull markets. There is always a delay between the halving and the price increase.

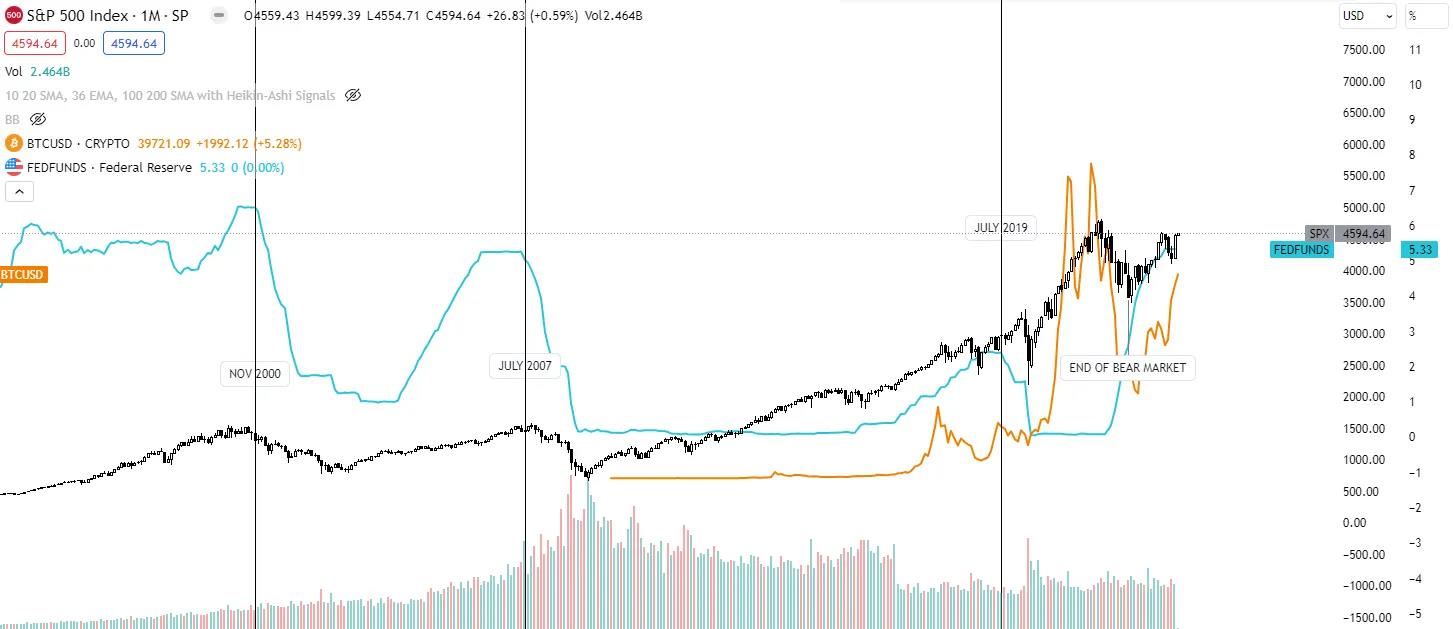

Interest Rate Cuts are Bearish

Lowering interest rates will drive Bitcoin prices down.

Secondly, I believe that interest rate cuts are bearish. Like halvings, they are events that happen before bull markets, but when rate cuts occur, they are negative for the market.

Having said that, we can analyze the five scenarios that I believe could unfold.

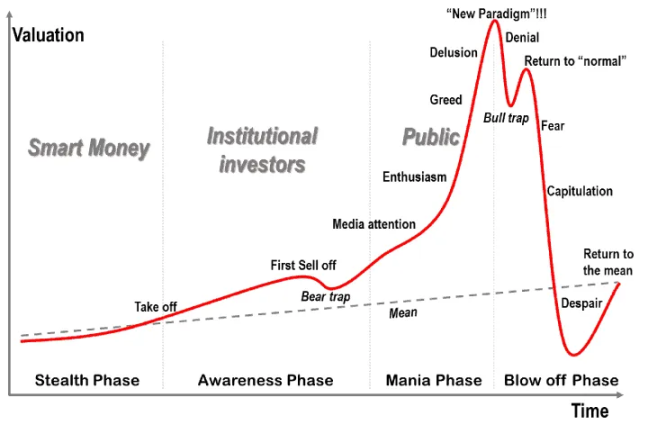

Could this bull market be different from the past?

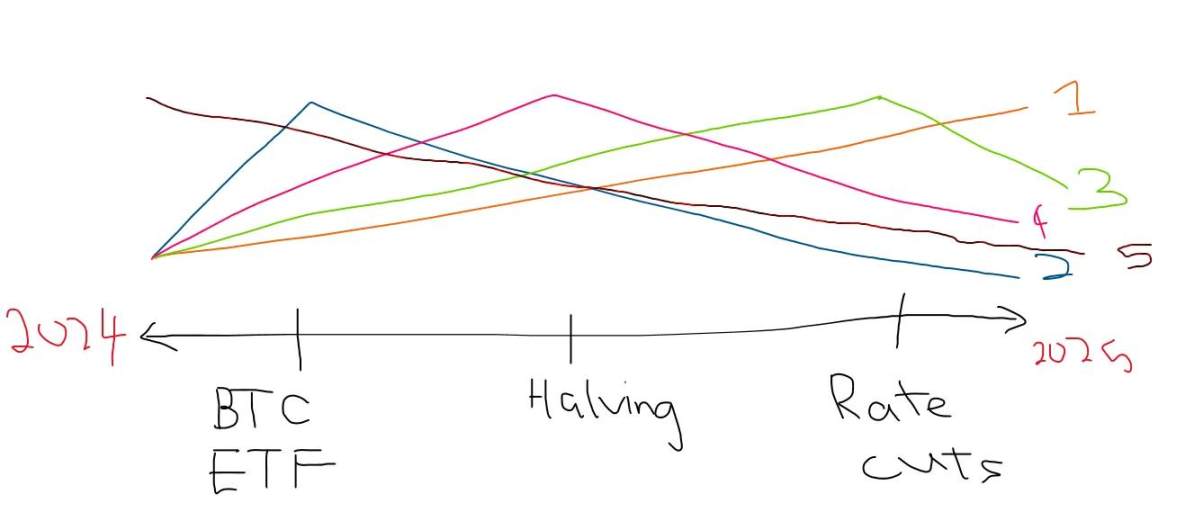

The market could take on five different trends. Each trend will perform differently as events unfold.

Scenario 1 - Best Case, but Least Likely

Scenario 1 is a bull market from 2024 to 2025, with prices continuously rising. There isn't much explanation needed for this scenario.

Scenario 2 - Price Drops After Bitcoin ETF Approval, Also Unlikely

The Bitcoin ETF creates a local top, then drops until a certain point before rising again. Now, if you have been following me, you would know that I have talked about how ETF approval could lead to a price drop because BTC rises in anticipation of that event. At that time, no one thought that the Bitcoin ETF approval would lead to a drop; everyone was just trying to buy before the ETF was officially approved.

My stance has changed, and now everyone is talking about how ETFs will lead to a drop, and I believe this will result in significant price volatility from the Bitcoin ETF.

Scenario 3 - Interest Rate Cuts are Bearish, Most Likely

Compared to traditional financial markets, cryptocurrency hasn't really existed for that long. When we look at how Bitcoin performed under high interest rates, we only have one point in time to reference—2019.

2019 is remarkably similar to the situation we face now. I believe this is the most likely event: at some point in 2024, we will see a local top due to interest rate cuts, followed by a few months of decline, and then enter the largest bull market we have ever seen.

ETFs, halvings, and interest rate cuts mainly set the stage for a larger bull market. 2024 will not simply be about rising prices.

Scenario 4 - Halving is Bearish, Unlikely

I don't need to elaborate further—this is similar to Scenario 2, except the halving occurs before a top.

Scenario 5 - Prices Just Decline; Also Unlikely

If prices keep declining, it could catch the entire market off guard, but I don't believe this will happen.

Scenario 6 - Local Top, but Then a Rebound

I didn't describe this in the chart above because it would be too complex, but Scenario 6 is essentially any of the previous five scenarios occurring, but we do not reach the price peak I expect, and instead, there is a rapid decline afterward. This means shorts and sidelined capital will be caught off guard as people wait for "better entry opportunities."

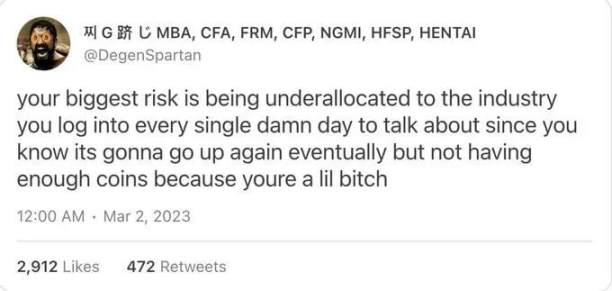

So the conclusion is: I believe we will see a situation similar to 2019, where people expect new all-time highs, and at some point, we will see a drop. This tweet almost summarizes what I think will happen:

So what will I do?

The biggest risk I learned in 2023 is that when I know there will be a price increase at some point in the future, my position is too low.

As a retail investor, I am not bound by LPs (limited partners) and do not have to constantly adjust to optimize returns. I can manage my assets as I see fit.

Therefore, my strategy will be heavily tilted towards left-side investing. Before the interest rate cuts, I will reduce my portfolio risk by a certain percentage and then buy back at lower prices while keeping the rest of my positions unchanged.

This is a simple strategy, and I prefer to optimize for simplicity in investing rather than returns. I believe that more complex investment methods equate to greater chances of mistakes/errors. This strategy will not yield the highest returns, but it is very easy to manage.

Additionally, I think I will hedge by shorting major cryptocurrencies or reducing my long positions. Other ways might include diversifying into more defensive assets or buying out-of-the-money options.

As I said, retail investors should keep their investment strategies simple.

To summarize, I foresee a price drop after interest rate cuts, followed by an increase.

Part Two: Narratives to Watch

Which narratives will be most prominent in 2024?

Again, we need to take a top-down approach. One question to address is: Who is buying?

I believe 2024 will be primarily driven by institutions, as evidenced by the launch of Bitcoin ETFs and the increasing attention on cryptocurrencies. The narrative is essentially just hype, with everyone trying to get on board and exit before others.

Therefore, the narratives that perform best will be those with the most buyers, and I believe these buyers will primarily be institutions. I think the narratives that perform best will meet certain criteria, namely:

Regulated

Products that have demonstrated product-market fit

This does not mean that all narratives must meet these criteria. In the past month, we have seen many narratives in crypto, such as RWA, DeSci, etc. These will clearly continue to emerge in a bull market, but for simplicity's sake, I prefer to focus on narratives that I believe will consistently perform well.

1. ETF Beneficiaries

ETF inflows into Bitcoin mean that its returns could see excellent performance in the short term. We have already seen this happen with investments like STX, ORDI, TRAC, etc.

After the Bitcoin ETF is approved, there may be a significant amount of traditional financial institutions continuously buying in.

Best Investment Choices: COIN (stock) / BTC / ETH

Considering that Coinbase has been selected by 9 out of 12 ETF issuers, I believe Coinbase will be a huge beneficiary of the ETF narrative. Just because people pursue performance, the price will rise, and Coinbase is the recipient of liquidity directly entering the crypto ecosystem.

Imagine this: large institutions like BlackRock and Franklin Templeton come to you and say they want to use your platform to custody their products. It would naturally drive up the stock price.

We may also see Ethereum ETFs, so you can expect ETH to rise when this happens.

Derivative Narratives: BRC-20 / LSTs

Correspondingly, as derivative assets of BTC and ETH, BRC-20 and LST will also rise.

2. Lindy Effect

In the crypto space, anti-fragility is very important. We have seen VanEck's paper on Solana, where traditional finance wants higher excess returns but does not want vaporware, which is a perfect niche market.

Best Choice: SOL

I wrote a full report explaining why I believe SOL will soar around $20; you can read it. I believe that once the FTX estate fully liquidates their remaining uncollateralized SOL, the foundation will start accumulating it as a high-quality asset. Solana could become the next Ethereum.

Derivative Narratives: TIA / Aptos / L2

TIA is definitely not a representative of the Lindy effect; when investors ask, "What is SOL beta?" TIA is the first ecosystem that comes to mind.

Aptos has great growth potential because they are doing some impressive things. While MATIC may be considered to have the best BD team, Aptos's partnerships with companies like Windows and Alibaba this year are impressive.

Finally, L2 is a decent product with good use cases, but with 10 different second layers emerging in the past month, from Blast to… an L2 for board games? I am a bit bearish on this because it feels more like "random experimentation" rather than technological innovation.

Community is very important in building strong tokens, and Solana has a very resilient community; those communities that rely more on breadth rather than depth tend to perform worse.

3. Regulation and Product-Market Fit

I believe 2024 will also be a year of regulation. I think that when DeFi regulation is still unclear, no fund will be willing to invest in DeFi. Instead, I believe people will gravitate towards those products that have passed the tests and have shown clear product-market fit.

There is really only one vertical that fits both categories: exchanges.

Best Investment Choices: MMX / dYdX

Exchanges are one of the few products in crypto that solve core problems. I believe Perp DEXes will see a revival, especially considering that the SEC is now regulating all centralized exchanges: first Binance, now ByBit.

I think MMX and dYdX are two choices that will benefit. In the past, any negative news about a CEX almost always meant a rise for dYdX (CEX vs DEX narrative). dYdX has shown continuous technological innovation: now that v4 has arrived, investment funds may see it as a more "revenue-generating" play.

MMX is also a bet on Saudi funds; recently, the Phoenix Group IPO (a BTC mining company) was subscribed 33 times, which makes me think they are eager to invest in crypto.

You might wonder—why isn't DeFi on my list? Well, as I said, DeFi is currently in an unclear space. I tend to think there may soon be some regulation targeting DeFi.

Derivative Narratives: Other Perp DEXes

GMX, Hyperliquid, Level Finance, Synthetix, etc.

4. Decentralized AI

Here, I wrote a long article explaining why you should be optimistic about DecAI. This could be my main narrative for 2024, as you have a product that is revolutionizing the 21st century, and ordinary investors are actually agreeing to decentralization.

Sam Altman's legend has left a bitter taste as people realize the dangers of centralization, leading more and more people to say we need "open-source" AI.

Preferred: TAO / OLAS

Edge Narratives: TAO subnet tokens / RNDR / AKASH / Other AI tokens

I believe RNDR's performance will not be that great, as this coin has a large number of holders from past cycles who may control the market and sell off significantly after taking profits.

5. GameFi

In the last cycle, we were very interested in GameFi, and in this cycle, we will see the release of these games. Many crypto OGs hate GameFi—play-to-earn, play-and-earn… but who cares? They are all high FDV tokens that should be thrown in the trash.

Many funds are hesitant to invest in GameFi with high FDV, which is why I think GameFi will be disliked. But in this cycle, those Web3 games that have truly built amazing things will perform the best.

Best Investment Choices: Overworld / Treeverse / Prime / L3 E 7

Derivative Narratives: NFTs → BLUR

The bottom for NFTs may have already been reached, and I believe we will see renewed attention on gaming NFTs.

6. Other Potential Narratives

In addition to the five narratives above, I will also list narratives that I believe have shown good potential over the past few months:

dePIN / RWAs

deSci

Memes (BONK / DOGE / PEPE / HPOS 10 INU)

RUNE / CACAO

GambleFi

Airdrops (LayerZero / Starknet / ZKSync)

Conclusion

Congratulations if you have read this far! This article summarizes my views on the cryptocurrency market in 2024.

One thing I haven't discussed is how I think this cycle will end. Recently, I have been thinking more about GCR's perspective: "The top of a bull market is when funds join, and the next bull market top is when nations start buying."

At that time, it sounded absurd, but after learning that high-inflation countries are considering incorporating Bitcoin into their portfolios (e.g., Argentina), I think it is becoming increasingly likely.

But that is the content for another article. Wishing everyone a Happy New Year in advance!