Nearly a thousand financings, over ten billion dollars: An overview of the 2023 Web3 primary market barometer

Written by: Carl, Techub News

2023 was a year of transition from a bear market to a "bull market." During the first nine months of the bear market, financing in the Web3 industry continued to decline, but after October, it entered a "mini bull market," and financing began to show signs of recovery. According to incomplete statistics, the Web3 industry completed 954 financing rounds in 2023, with a total financing amount of 11.1 billion USD.

On December 20, Web3 tax startup Tres Finance completed a Series A financing of 11 million USD; on December 21, Web3 fan platform Medallion announced the completion of a Series A financing of 13.7 million USD; on December 22, Australian Bitcoin miner Arkon Energy completed a financing of 110 million USD…

At the end of 2023, amid calls for a "bear to bull" transition, the global Web3 industry welcomed a new peak in financing.

From a monthly perspective, financing peaked in March and April 2023, then continued to decline, reaching a low point in September and October.

Since entering October, the cryptocurrency industry has welcomed a mini bull market, with Bitcoin rising from 26,500 USD to 44,000 USD in three months, an increase of over 60%. Meanwhile, the number and amount of financing in November and December saw significant increases.

According to Techub News statistics, there were 954 financing events in the Web3 industry in 2023, with a total financing amount of 11.1 billion USD. Although this represents a significant decline compared to 29 billion and 33.2 billion USD in 2021 and 2022, respectively, it is still far higher than any previous year.

In terms of financing rounds, early-stage projects were more popular, with Pre-seed and Seed rounds accounting for 78% of the number of financing events and 37% of the financing amount.

Among early financing rounds, there were 9 instances where the financing amount exceeded 20 million USD, all of which were Seed rounds, including 4 in the infrastructure sector, and 2 each in AI and NFT/GameFi.

| Infrastructure Takes the Largest Share

From a specific sub-sector perspective, infrastructure was the most popular investment area, with 358 financing events, accounting for about 38% of the total, and nearly 3 billion USD in financing, accounting for 30% of the total financing amount for the year.

Among them, there were 80 projects with financing exceeding 10 million USD, 39 projects with financing exceeding 20 million USD, and 7 projects with financing exceeding 100 million USD. The following are the top 10 projects ranked by financing amount:

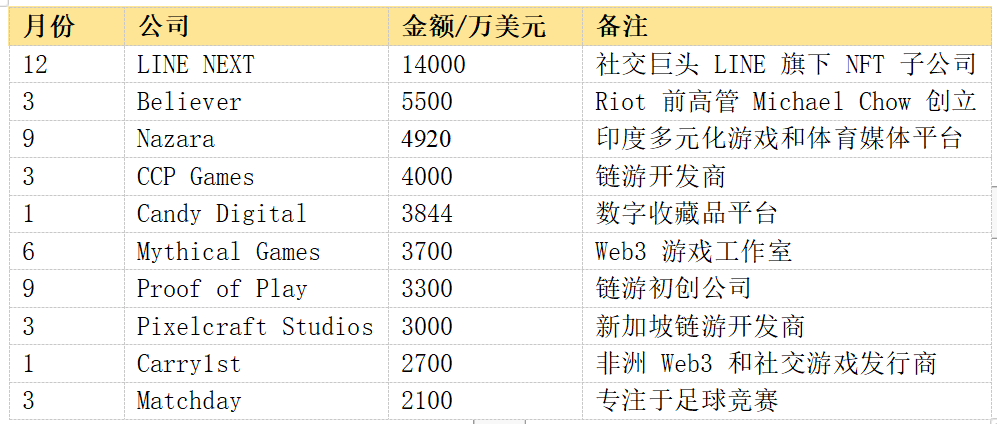

Next is the NFT/GameFi sector, which accounted for 16% and 11% of the number and amount of financing, respectively. Among them, there were 29 projects with financing exceeding 10 million USD. The following are the top 10 projects ranked by financing amount:

| AI Financing Surges

Since the release of the ChatGPT chatbot model by OpenAI at the end of 2022, AI has been a focal point for investment institutions, with almost all Web3 VCs discussing the transformative potential brought by AI, which is also clearly reflected in the financing.

In 2023, the number of financing events in the AI sector was relatively low, with only 26 events, but the financing amount exceeded 2 billion USD, accounting for 21% of the total financing amount for the year.

Among the top 10 projects by total financing amount for the year, 5 were in the AI sector, namely Anthropic (financed twice, with amounts of 100 million and 450 million USD), Mistral AI (financed twice, with amounts of 113 million and 415 million USD), OpenAI (300 million USD), Beyond Light Years (230 million USD), and AI21 Labs (208 million USD).

In 2023, financing in the DeFi and CeFi sectors was relatively low, with a total of 170 financing events, accounting for 14% of the total financing events for the year, and a total financing amount of 1.4 billion USD, accounting for 17% of the total financing amount. The following are the top 10 projects by financing amount:

| a16z Invested in 37 Events

The institution with the most investments in the Web3 industry in 2023 was a16z (Andreessen Horowitz), which participated in 37 investment events, leading 23 of them. This was followed by Coinbase Ventures (35 events), Shima Capital (33 events), and Animoca Brands (32 events).

The above 8 institutions participated in 190 projects in 2023, among which 72 were in the infrastructure sector and 38 in the NFT/GameFi sector. The following are the projects with larger financing amounts invested by each institution: