A list of new projects worth paying attention to that have airdrops

Original Author: Meteor, ChainCatcher

Original Editor: Marco, ChainCatcher

After the excitement of the Bitcoin spot ETF approval, besides the good gains of various meme coins on major chains, it seems to be airdrop season again. Projects like Zetachain, AltLayer, and Dmail have started releasing information related to airdrops, and it's time to shift our focus to some new projects.

Here are some recent new projects worth paying attention to, compiled by ChainCatcher:

Asteroid Protocol

Keywords: Cosmos inscription market, Delphi Labs, Astroport Foundation, first Cosmos inscription ROIDS

Asteroid is a protocol framework for inscriptions and token meta on Cosmos and other Cosmos SDK blockchains. Through Asteroid, users can connect their Keplr wallet to record data, images, and text and/or mint CFT-20 tokens (including the recently popular first CFT-20 ROIDS), directly publishing content to the Cosmos Hub. It has also launched an inscription market where users can trade Cosmos inscriptions.

The framework is developed in collaboration between Delphi Labs and the Astroport Foundation, bringing inscriptions and fungible tokens (FT) to the Cosmos blockchain, which itself does not support tokens or smart contracts. The open-source Asteroid framework includes the Asteroid indexer, browser, API, Cosmos Fungible Token (CFT-20) specification, token deployer and minting tools, as well as front-end/back-end software.

savmSwap

Keywords: SatoshiVM, first DEX

SatoshiVM is also a recent hot topic in Bitcoin L2. (Related reading: SatoshiVM and IDO platform clash, 300x myth collapses due to uneven interests) savmSwap is the first DEX on SatoshiVM, currently featuring a simple interface with Swap and Pool functionalities.

The core of traditional AMM systems is to replace typical buy/sell orders with liquidity pools composed of two assets, where the value of each asset is equivalent to the other. Swapping one asset for another changes their relative value and recalibrates the interest rates between them. Savmswap's AMM model is known as a constant function market maker, providing instant feedback on rates and slippage.

Inspired by the core values of SatoshiVM, the Savmswap protocol is built on the principles of permissionless and immutable. The permissionless framework ensures that the protocol's services are universally accessible, with no restrictions on who can use these services. This open accessibility allows anyone to participate in swaps, provide liquidity, or create new markets.

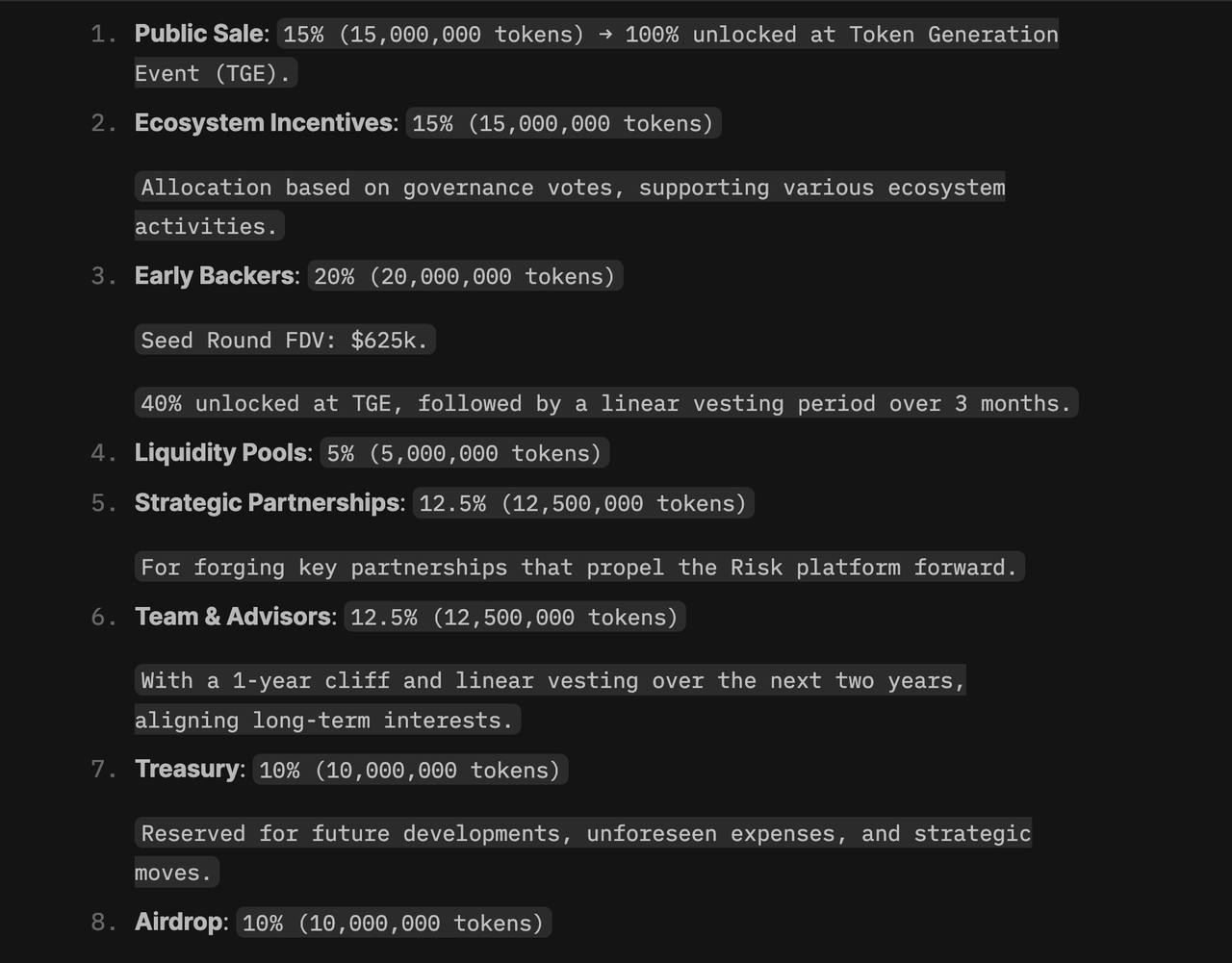

Risk

Keywords: Airdrop, Blast Network

Risk is an on-chain betting and gambling platform built on Blast, aiming to become an automated liquidity pool solution specifically for on-chain gambling. This pool enables any game developer based on BLAST to provide near-instant payments, alleviating financial burdens. Additionally, Risk has established a DAO to decide which games to include in the risk pool through anonymous voting.

Risk has also announced the launch of its token economy, aimed at balancing the needs of early supporters, the team, and the broader ecosystem. The total supply cap of the RISK token is 100 million, with 10% allocated for user airdrops. Details of the public sale for the RISK token will be announced soon. Currently, its Dev website is under development, and users can wait for the Dapp launch to interact and participate in the airdrop.

Blastway

Keywords: Borrow/lend incentives, non-custodial

Blastway is an innovative money market protocol built on Blast, providing high yields for lending on the platform, allowing users to have complete control over their assets. Compared to other L2 platforms, Blast offers a 4% interest rate for ETH and a 5% interest rate for stablecoins. Blastway leverages this advantage of Blast, aiming to enhance TVL and user experience through Blast's native yield features.

Blast Futures

Keywords: Airdrop, zero Gas, Rabbit X

Blast Futures is a DEX built on Blast, offering advanced order types, chart trading, and order book trading functionalities, built on Blast with deposit-native yield features that can automatically compound assets on Blast Futures. Blast Futures adopts zero Gas trading fees, making it user-friendly. Blast Futures is also one of the partners of the Blast Big Bang event, promising fair token airdrops for early users, with each user depositing on Blast Futures receiving corresponding airdrop rewards. Additionally, Blast Futures recently announced a collaboration with Perp DEX Rabbit X.

Bloom

Keywords: Blast Big Bang participants, 50x leverage, zero gas

Bloom is a Perp DEX built on Blast, featuring zero Gas trading, social login, enhanced yields, and up to 50x leverage. Bloom is also one of the partners of the Blast Big Bang competition.

The Blast Big Bang is a Dapp incentive event held by Blast after launching the testnet, where Dapps that perform well in this event will receive ecological token airdrops after the launch of the Blast mainnet.

beanbag

Keywords: Platform experience speed, team personnel, Blast Network

beanbag is a fast trading AMM DEX built on Blast, with limited information disclosed so far, and the Dapp is set to launch in February 2024.

The project introduction indicates that beanbag has significant advantages over protocols like Uniswap and Curve in terms of yield, fees, and platform speed. Notably, its AMM model's combination incentive approach is more innovative compared to platforms like Uni. beanbag is developed by engineers and product designers from world-renowned institutions such as MIT and Citadel.

oooo

Keywords: BTC L2, cross-chain protocol

oooo is a modular infrastructure cross-chain protocol supporting Bitcoin L2. Currently, Bitcoin L2 is showing a flourishing trend similar to Ethereum L2 (Related reading: Bitcoin Layer2 welcomes a financing boom, overview of 20 early projects), attracting a large number of developers and users, and its cross-chain protocol supporting Bitcoin L2 is also worth paying attention to.

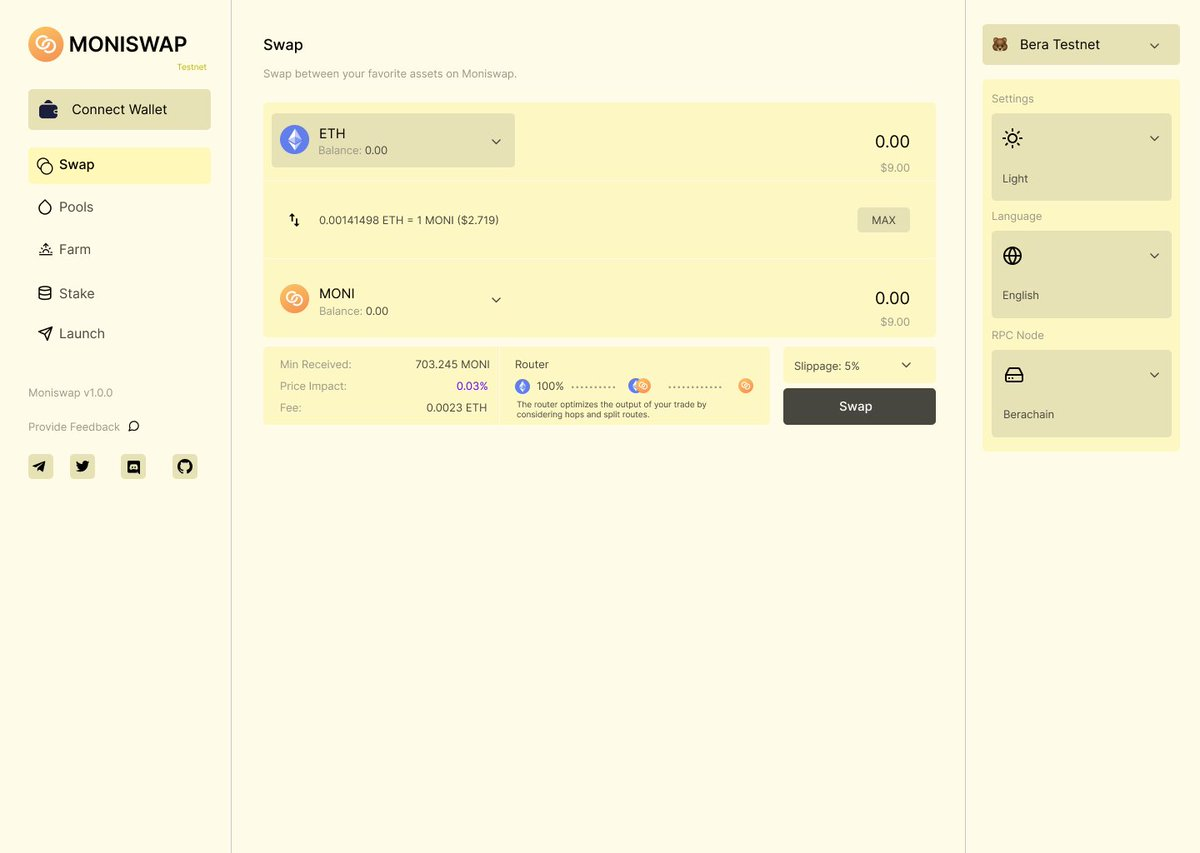

Moniswap

Keywords: Berachain testnet, Launchpad, interaction

Moniswap is an AMM and Launchpad platform on Berachain, dedicated to establishing deep and efficient liquidity for Berachain. Its project design combines models from Curve, Convex, and Uniswap, and its token MONI has been confirmed. Users can interact with the Berachain testnet through this platform while also engaging with Moniswap, achieving dual benefits.

Lobster

Keywords: Token rewards, algorithm optimization

Lobster is an algorithmically optimized automated DeFi investment protocol that offers autonomous strategies. The Lobster protocol algorithm will remotely manage user assets according to the selected strategy, including providing liquidity on Uniswap and lending through AAVE. The algorithm continuously monitors and adjusts strategies based on market conditions (such as token prices, pool TVL, trading volume, and other users' positions) to optimize user returns and minimize risks, avoiding the complexities of manual operations and impermanent loss. Additionally, the algorithm has no authority to execute operations beyond the contract's definition and cannot withdraw user funds.

Lobster also plans to launch a testnet based on Arbitrum in Q1 2024, and a future Lobster token is under consideration, which will reward the platform's early adopters, with greater participation leading to more token rewards.

Haiko

Keywords: Custom AMM strategies, automatic position updates

Haiko is an AMM protocol on the Starknet network, designed to provide efficient trading for users. Haiko offers automated strategies and native limit orders, and has also launched custom modular strategies that allow users to manage token market liquidity autonomously, updating positions and orders as market conditions change. In conventional AMMs, liquidity positions are set within static price ranges; in Haiko, positions are replaced by strategies that dynamically update based on on-chain data feeds and custom logic.

Haiko is currently in the testnet phase and supports Starknet wallet logins.

Tren.Finance

Keywords: Long-tail assets, over-collateralization, token rewards

Tren.Finance is a crypto CDP (Collateralized Debt Position) protocol focused on releasing liquidity for long-tail cryptocurrencies. The platform provides an independent lending market backed by trenUSD (the stablecoin launched by Tren), allowing users to use over 100 different assets as collateral to obtain loans. Meme coins, LP tokens, option vaults, LSTs, etc., are all managed by TREN holders.

The Tren.Finance team recently launched the Trencentives program, aimed at recognizing and rewarding key contributors within our ecosystem, allocating 35% of the total TREN supply as incentives for users contributing to Tren.Finance.

Additionally, the governance token for the project is TREN, with an initial total supply of 1 billion tokens, which will gradually decrease over time. TREN serves as the core of Tren.Finance, coordinating incentives for users and the platform, promoting the development of a sustainable DAO governance protocol.