SOL returns to $150, Upexi transforms into "Solana version of MicroStrategy," is unlimited growth about to begin?

Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

As Trump announced a reduction in tariffs on China, global market sentiment quickly rebounded. Bitcoin surged past $94,000, and Solana also broke through $150. Beyond the macroeconomic benefits, another disruptive growth engine for Solana seems to be quietly starting.

On April 21, Upexi, a publicly traded company in the U.S., announced it had secured $100 million in funding led by the well-known crypto market maker GSR, with approximately 95% of the funds earmarked for establishing and operating a Solana treasury reserve.

After Bitcoin, SOL is becoming the "next pivot" in corporate crypto strategies. Will Upexi's aggressive entry spark a new wave of value for Solana?

Upexi's Bold Move into Crypto

Since its establishment in 2018, Upexi has focused on the development, manufacturing, and distribution of consumer products, owning several innovative brands, such as the medicinal mushroom product brand Cure Mushrooms, the pet care brand LuckyTail, and the energy gummy line Prax.

In 2024, to focus on high-growth sectors, Upexi undertook a major business restructuring: selling E-core / Neti, Tytan Tiles, and a warehouse in Clearwater, Florida, closing two operational sites in Las Vegas, and streamlining about 30% of its workforce.

To enter the crypto asset market, Upexi established two wholly-owned subsidiaries, ChainBitMiner and QuantumHash, specifically responsible for crypto investment management. Currently, the company's digital asset strategy primarily revolves around Bitcoin mining and allocating to high-growth potential altcoins. ChainBitMiner will create a diversified cryptocurrency investment portfolio, with 50-70% of assets held in Bitcoin, replacing traditional cash reserves. Meanwhile, QuantumHash aims to expand its digital asset portfolio through self-mining, targeting low-risk, leveraged treasury growth.

In Upexi's strategic roadmap for 2025, in addition to crypto mining and investment, Upexi plans to explore blockchain projects related to staking, decentralized lending, and yield generation models. This series of initiatives demonstrates that Upexi is gearing up to "make a big splash" in the crypto market.

Is Upexi's "All In" the New Engine for Solana?

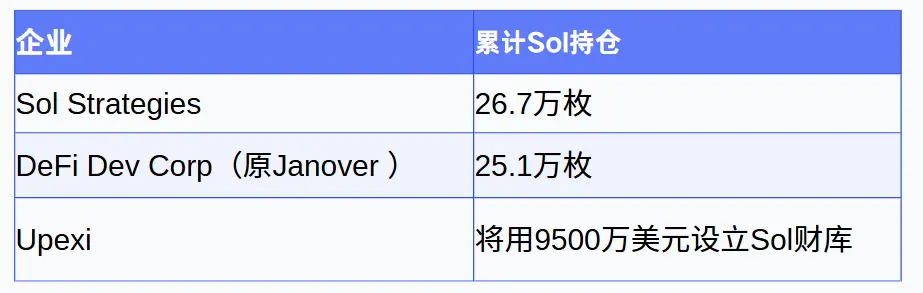

Upexi is not alone in this endeavor; even before it, projects like SOL Strategies and DeFi Dev Corp had already made deep inroads into the Solana ecosystem. Here are their SOL holdings statistics:

SOL Strategies has chosen a slow but steady path. Its growth model can be understood as "first inorganic, then organic": initially relying on external acquisitions to expand its business, and later gradually shifting to natural growth driven by its own team and infrastructure.

In contrast, Upexi's approach is different, directly "going all in on Sol," resembling a micro-strategy for Solana. Upexi has signed securities purchase agreements with some investors to issue and sell 43,859,649 shares of common stock or pre-subscription warrants at a price of $2.28 per share, with expected fundraising of up to $100 million. It plans to allocate approximately $5.3 million of this for working capital and debt repayment, while the remaining funds will be used to establish the company's Solana treasury system and increase its Solana assets.

A.G.P./Alliance Global Partners is serving as the exclusive sales agent for this private placement. The transaction is expected to be completed around April 24, 2025, provided that customary closing conditions are met.

If this model of "public companies continuously financing to buy crypto assets" can replicate success with Solana, could SOL be on the verge of a new explosion?

Upexi's Strategy: What Are the Odds of Success?

On the day Upexi announced its purchase of SOL tokens, the company's stock price skyrocketed from $2 to a peak of $22, an increase of 1000%. Although it later fell back to $9, this surge has already demonstrated that the move garnered widespread market attention.

Arif Kazi, the business head of Sonic SVM, stated on the X platform that this action marks a "shift in traditional capital markets' understanding of on-chain yields." He emphasized that Upexi's allocation of SOL is not for hedging purposes but is viewed as an "infrastructure investment." This operation could very well be the largest Solana-native treasury allocation among U.S. public companies, priced above market value, with no token incentives, no lock-up period, and no convertible bond structure.

"When treasury strategies combine with DeFi primitives, it's not just 'alignment'; it's 'acceleration,'" Arif wrote. "Solana now has an operational manual that capital allocators can directly replicate."

However, the market is not without its criticisms, which quickly emerged.

Some pointed out that Bitcoin, due to its scarcity and the presence of long-term believers, can support strategies that leverage debt instruments to hold BTC; whereas SOL has no supply cap and is more volatile, making it difficult for traditional institutions to accept a "high-risk, high-volatility, continuously inflationary" asset as a core treasury.

The on-chain chip distribution of SOL differs from that of BTC. Bitcoin's "faith chain" can continuously convert into holding motivation, but SOL lacks this user structure. Community user @DL_W59 pointed out that "how to stimulate holders' willingness to hold long-term or even increase their positions will be the key to Upexi's strategy's success or failure."

Whether from the Solana community, traditional markets, or crypto VCs and regulators, all are watching Upexi's gamble. As traditional capital increasingly delves into the on-chain world, similar stories will continue to unfold. In this era where the old and new financial orders intersect, every "all in" is a gamble and a rehearsal for the future financial landscape. This time, Upexi has placed its bet on Solana.

And this spring is writing the answer.