The current status of Bitcoin scalability

Original: 《The Current Landscape of Bitcoin Scaling》

Author: Botanix Labs

In the process of developing Botanix, we constantly ask ourselves a question: can systems built on Bitcoin truly be called sidechains or Layer 2 (L2)? This is a complex question because, from a technical perspective, Bitcoin cannot serve as a true L1 to support L2 like other ecosystems can, given its current capabilities. Typically, L2 relies on smart contracts deployed on the base layer to validate proofs. For example, in the Ethereum ecosystem, L2 validation is performed by deterministic functions in smart contracts, executed by all Ethereum nodes when processing transactions.

The situation with Bitcoin is both simpler and more complex. Discussions about L2 on Bitcoin are often confusing. Unlike Ethereum, which natively supports Turing completeness and expressiveness, Bitcoin's current capabilities are extremely limited, and the nuances of what is technically feasible versus what is not are abundant. Because of this, systems built on Bitcoin do not strictly possess L2 or sidechain functionality. So why do we prefer to call them "Bitcoin Chains" rather than extensions or L2? The reason is that these chains built on Bitcoin typically have independent operational logic and build their own ecosystems around it.

Bitcoin does not support smart contracts like Ethereum. Any complex logic must be implemented through structures built on top of it. Therefore, Bitcoin itself cannot directly verify proofs or maintain the state of smart contracts. Most types of proofs are too large to be included on-chain—Bitcoin transactions only allow for 80 bytes of arbitrary data. Solutions like Starkware's m31 are highly specialized and closed. Even if you manage to publish some proof or state update to Bitcoin, the process resembles optimistic rollups. However, waiting an entire week to resolve fraud proofs is neither practical nor acceptable; relying on third-party bridges introduces delays and trust assumptions, both of which are not ideal in the Bitcoin native environment.

Interactions with Bitcoin are limited to unspent transaction outputs (UTXO) with ScriptPubKey and BTC transfer transactions. The OPRETURN instruction can only carry 80 bytes of data, making it impossible to support interactions with complex data structures. Because of these limitations, it is difficult to give Bitcoin full L1 support for L2 functionality unless there are significant changes to the protocol (e.g., a hard fork). Such modifications not only require a high level of community consensus but may also undermine Bitcoin's uniqueness and value proposition as an asset. For example, proposals to introduce new instructions like OPCAT (such as CatVM) have yet to achieve widespread consensus. Even with consensus, a BIP (Bitcoin Improvement Proposal) often takes years from proposal to activation.

For this reason, Botanix's goal is to build based on "current Bitcoin" rather than trying to forcibly transform it into L1 or push for radical protocol changes. This path is possible because we have adopted Spiderchain technology and a network of coordinators. So, to what extent has the ecosystem currently being built on Bitcoin developed?

Background: The Emerging Landscape of Bitcoin Chains (L2)

Despite the objective existence of the above limitations, most projects still prefer to call themselves "L2," treating this term as a generic label. One of the earliest projects to claim itself as Bitcoin L2 is Stacks. Although Stacks anchors data on Bitcoin and interacts with BTC, it is essentially an independent blockchain with its own consensus mechanism. Another example is BounceBit, which is classified as Bitcoin L2 because it uses BTC in its consensus mechanism (along with its native token). However, this is not entirely accurate. Architecturally, it is closer to a restaking model, operating on its own chain, with Bitcoin's role limited to indirect participation.

However, the vision of making Bitcoin "come alive"—transforming it from merely a value storage tool into an asset that can "do more"—has long attracted the attention of many developers. With the new supercycle that began in 2022, this vision has become increasingly important. While Ethereum has seen a roughly 4x increase from bottom to top during this cycle, Bitcoin, despite its slower and more "clunky" movements, has risen by 6x. This dynamic is quite interesting, isn't it? It further reinforces Bitcoin's position as the dominant asset in the Web3 world.

Source: Https://App.Artemis.Xyz/

From value utilization metrics like TVL (Total Value Locked)—which indirectly reflects the degree of utilization of the underlying asset in the ecosystem—the comparison between Bitcoin and other networks becomes even more pronounced. TVL represents the value carrying capacity of an ecosystem, encompassing both the applications built on top and the utilization of the underlying asset in L2 running on that base chain.

Currently, Bitcoin's TVL in decentralized applications is only $5.5 billion, while its FDV (Fully Diluted Valuation) is an astonishing $1.74 trillion. This means that only a tiny fraction of Bitcoin's value is truly realized on-chain. In contrast, Ethereum's TVL in DeFi applications and staking infrastructure (such as Lido, EigenLayer, Rocket Pool, etc.) has reached $48.9 billion, representing a significant proportion of its $228 billion FDV actively participating in the ecosystem.

The gap is clear in comparison. Solana's TVL relative to its FDV is also at a high level—$8.25 billion compared to $76 billion. You can see the difference! Solana is $8.25 billion vs. $76 billion, while Bitcoin is $5.5 billion vs. a staggering $1.73 trillion valuation! This reflects the enormous growth potential in the value utilization of the Bitcoin ecosystem.

Source: DefiLlama, Coinmarketcap

It is indeed a very stark contrast, isn't it? This highlights the enormous upside potential in the Bitcoin ecosystem—this potential is precisely what attracts protocol developers like Botanix to build projects on Bitcoin.

At the same time, there are factors that, while promoting technological innovations like Botanix, may conversely slow down the overall development of the Bitcoin ecosystem. This "paradox" is reflected in the typical mindset of BTC holders: they are accustomed to storing their assets in cold wallets for the long term, rather than frequently interacting with protocols like Ethereum's DeFi users. Compared to Ethereum users who actively participate in staking, lending, liquidity mining, and other activities, BTC holders place a higher emphasis on asset security, self-management, and strongly adhere to Bitcoin's fundamental values.

This is also one of the reasons why many "synthetic BTC" or "cross-chain BTC" versions based on non-Bitcoin native chains have struggled to gain mainstream adoption. Bitcoin users generally lack trust in ecosystems on non-native chains, believing that those are not truly "anchoring" the Bitcoin network.

The intrinsic value of BTC is primarily reflected in its "long-term value storage" function. Data shows that approximately 60% to 70% of Bitcoin has not seen any on-chain transfers in the past year, and this proportion continues to rise, reflecting the solid presence of long-term holders (HODLers). In November 2024, this proportion reached a new high of 70.54%, although it slightly declined during the subsequent rise in BTC prices.

Source: Https://Studio.Glassnode.Com/Charts/Supply.ActiveMore1YPercent?A=BTC\&Amp;Category=\&Amp;Zoom=All

Moreover, the global trend charts of Long-Term Holder Supply and Spent Output Profit Ratio (SOPR) also show a continuous growth trend. This indicates that Bitcoin is attracting more and more long-term holders, further solidifying BTC's value as a "long-term wealth storage tool." The root of this trend lies in the fact that the Bitcoin blockchain is currently the most decentralized, robust, trustless, and censorship-resistant network, and it is these characteristics that ensure BTC becomes one of the safest assets globally.

Source: Https://Charts.Bitbo.Io/Long-Term-Holder-Supply/

Source: Https://Charts.Bitbo.Io/Long-Term-Holder-Supply/

From another perspective—these dynamic changes also suggest that new Bitcoin holders may begin to view BTC as a "liquid asset" rather than purely a store of value. But the question arises: are these users willing to deal with packaged assets (like WBTC), or do they still prefer to use "native Bitcoin" more directly? To answer this question, we need to look at the current development trends of the Bitcoin Chains (Bitcoin Chains/L2) ecosystem in the context mentioned above.

The Bitcoin Chains (L2) Ecosystem is Taking Off

Initially, the ecosystem on Bitcoin developed far earlier than Ethereum's history of scaling through Layer 2. The Lightning Network appeared 3 years before Plasma and 5 years before the earliest Rollup, making progress in decentralized payment scalability. However, it inherited many design limitations, such as interactivity (users must be online to receive payments), payment routing complexity in multi-party scenarios, and complex liquidity requirements for deposits and withdrawals.

Some issues have been alleviated by another Layer 2 protocol called ARK. ARK introduces ASP (Ark Service Provider) to settle payments privately between users while still allowing for trustless redemption of Bitcoin on the main chain. However, without the introduction of a Covenant mechanism, ARK still faces interactivity limitations, and its high demand for capital also makes the protocol inefficient.

Previously, these Bitcoin-based chains had their place in payment scenarios but still faced scalability bottlenecks and made almost no attempts to add additional functionalities to Bitcoin. Subsequently, more complex and functional designs emerged. Meanwhile, some complex solutions have been developed in parallel: Rootstock was launched in 2015, and Stacks can be traced back to 2013. However, their development paths have been long.

Until two years ago, Bitcoin's presence in decentralized applications was still weak. At the beginning of 2023, only a few hundred million dollars of BTC were deployed in DeFi—compared to Bitcoin's massive market cap, this was just a drop in the ocean. But by 2024, everything changed. The earliest projects attempting to introduce programmability to Bitcoin included Rootstock and Stacks. According to DefiLlama data, in the first half of 2024, Rootstock hosted approximately $294 million in BTC, while Stacks hosted about $289 million, totaling $570 million. In 2024, with the entry of new players, the landscape of the Bitcoin ecosystem underwent significant adjustments. In February 2024, Rootstock and Stacks accounted for over 94% of the total locked value (TVL), but by March 2025, this landscape had diversified significantly.

Source: DefiLlama Data, En.Coin-Turk.Com

Against this backdrop, by the end of 2024, Bitcoin's total on-chain locked value (TVL) surged over 20 times—from $307 million in January 2024 to $6.5 billion in December, skyrocketing over 2000% within a year. This is not just growth; it marks the true explosion of Bitcoin in the on-chain finance sector. TVL began to rise in October 2024 and peaked at $7.39 billion in December. Why did all this happen?

Source: DefiLlama

In 2024 alone, the growth of the Bitcoin ecosystem reached 600%, with the total locked BTC exceeding 30,000 coins, equivalent to nearly $3 billion in assets actively used in various scaling solutions. The message is clear—Bitcoin is evolving. It is no longer just a means of value storage but is gradually becoming an indispensable part of the on-chain economy.

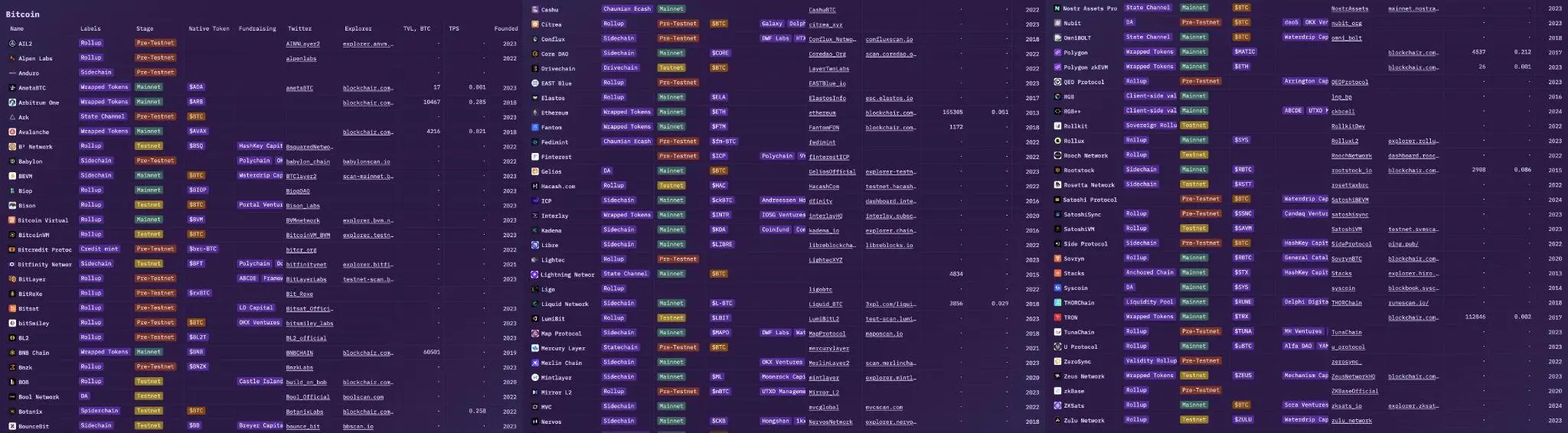

At the same time, the market positions of Rootstock and Stacks began to decline, gradually being replaced by more advanced and functional protocols. Bitcoin's programmable layer solutions rapidly exploded, pushing Bitcoin DeFi into a new era. According to L2Watch data, there are now over 75 Bitcoin-based projects in development, covering EVM-compatible chains, Rollup solutions, and newly designed sidechains. The common goal of these projects is to unlock Bitcoin's vast liquidity and integrate it into a broader DeFi ecosystem.

Source: L2.WatchData

With the diversification of protocols, the capacity of the Bitcoin ecosystem has also increased. This field has come a long way—from the initial network overlay layers used for payments (like Lightning) to the complex chain ecosystem that now offers multiple capabilities. However, the key challenge is not just to build chains that provide new possibilities for Bitcoin users, but also to retain Bitcoin's native characteristics and security in the process. This is far more complex than simply establishing cross-chain bridges or synthetic assets through minting and burning mechanisms. Botanix addresses this issue through Spiderchain technology and a network of coordinators, maintaining direct connection and continuity with the Bitcoin mainnet.

The evolution of these technologies is driving Bitcoin from "holding (HODL)" to "yield": entering DeFi and real-world asset (RWA) scenarios. Botanix's goal is to achieve this "intelligent use of Bitcoin" without departing from the Bitcoin main chain itself. Bitcoin chain solutions equipped with smart contracts now support on-chain lending, trading, and yield generation, gradually replicating Ethereum's DeFi system. This allows BTC holders to earn yields or use BTC as collateral without relying on centralized custodians. As VanEck points out, these chains and abstract technologies will transform Bitcoin from a passive store of value into an active participant in decentralized ecosystems, further unlocking liquidity and driving cross-chain innovation.

Conclusion

Thus, Bitcoin is no longer just "digital gold" stored in cold wallets. With the emergence of innovations like Botanix Spiderchain and Botanix EVM, Bitcoin is becoming more usable, more vibrant, and deeply integrated into the on-chain economic system. The past two years have demonstrated the possibilities of this—Bitcoin's on-chain finance has rapidly expanded from nearly zero to billions of dollars in scale. Looking ahead, as technology continues to mature and users keep growing, the locked value of Bitcoin will continually transform into released opportunities, truly bridging the past and the future, paving the way for a Bitcoin DeFi era empowered by Botanix.

We stand at the starting point of a new era for Bitcoin. An era where Bitcoin's liquidity, security, and trustlessness collectively reshape the landscape of decentralized finance.

And the most exciting part is—this is just the beginning.