A Comprehensive Understanding of Global Cryptocurrency Market Regulatory Policies and Evolution Trends

This article is an original piece by Chain Catcher, authored by Richard Lee and Bran.

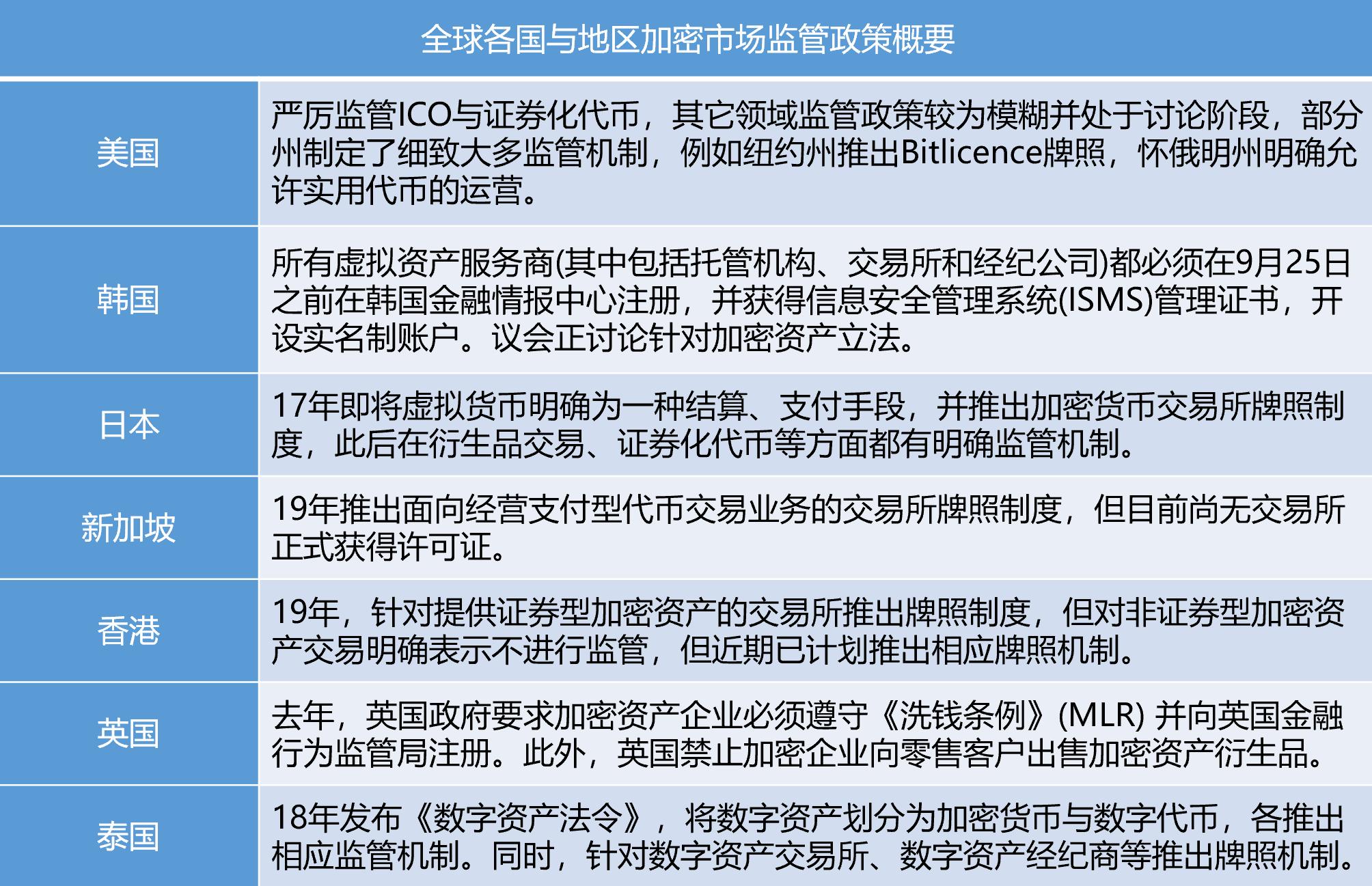

Recently, regulation of the cryptocurrency market has become one of the most discussed topics both inside and outside the crypto industry. Countries, led by the United States, have intensified their regulatory efforts on the crypto market. Currently, it appears that regulation will play an increasingly important role in the cryptocurrency industry.

Therefore, Chain Catcher has compiled information on several countries with clear regulatory policies for the crypto market, analyzing aspects such as the nature of cryptocurrencies, corresponding regulatory policies, exchange regulatory systems, and tax policies, hoping to enhance policy awareness for practitioners and stakeholders in the crypto market.

1. United States

As the most developed financial market in the world, the United States has very detailed regulatory rules for the crypto market. Multiple administrative agencies have established specific regulatory rules based on the nature of cryptocurrencies. For example, the U.S. Securities and Exchange Commission (SEC) considers certain tokens as "securities," the Commodity Futures Trading Commission (CFTC) refers to them as "commodities," and the Internal Revenue Service (IRS) views them as "property."

ICOs are typically subject to regulation by the SEC. According to the Securities Act of 1933, if a crypto asset is determined to be a security, the issuer must register the security with the SEC or provide an exemption from registration requirements. The SEC has left some room regarding whether a token is classified as a security, stating that it "depends on the characteristics and use of that specific asset." However, overall, the SEC tends to view cryptocurrencies as securities, applying securities laws comprehensively to digital wallets, which also affects exchanges and investors.

In December 2017, the then-chairman of the SEC issued a statement regarding cryptocurrencies and ICOs, stating that potential buyers are sold on the potential appreciation of tokens, which can be locked in by reselling tokens on the secondary market or profiting based on the efforts of others. These are key indicators of securities and securities issuance. Therefore, the chairman stated that, overall, the initial coin offering structures he observed involved the issuance and sale of securities, and the SEC would take enforcement actions against ICO activities that violate the Securities Act.

Regarding cryptocurrency exchanges, they are primarily regulated by the Financial Crimes Enforcement Network (FinCEN), focusing on fund transfers and anti-money laundering (AML). Under the Bank Secrecy Act, FinCEN regulates money services businesses (MSBs). In March 2013, FinCEN issued guidance identifying cryptocurrency exchange service providers as MSBs. Under this framework, cryptocurrency trading platforms must obtain FINCEN licenses and implement comprehensive anti-money laundering risk assessments and reporting mechanisms.

In December last year, FinCEN proposed new data collection requirements such as KYC for cryptocurrency trading providers. According to the proposed rule, banks and money service businesses will be required to submit reports, maintain records, and verify customer identities, including private digital wallets held by non-financial institutions. This proposal has sparked significant controversy, and FinCEN announced in January this year that it would extend the comment period, with no updates currently available.

In terms of cryptocurrency derivatives, the CFTC views cryptocurrencies as commodities. Under the Commodity Exchange Act, trading of cryptocurrency futures, options, and other derivative contracts must be conducted on exchanges regulated by the CFTC. Currently, the Chicago Board Options Exchange and the Chicago Mercantile Exchange offer futures trading linked to Bitcoin prices.

Regarding cryptocurrency investment taxation, the IRS treats cryptocurrencies as property for tax purposes. For individual citizens, if they hold cryptocurrencies as capital assets for more than a year and realize gains, they must pay capital gains tax; if held for less than a year and gains are realized, they pay ordinary income tax.

In addition to the decentralized regulation at the federal level in the U.S., state governments can establish specific rules and regulations within their jurisdictions.

New York was the first state to propose a comprehensive regulatory framework for the crypto market, known as BitLicense, in August 2015, which is also the most influential license in the crypto industry. BitLicense includes key consumer protection, anti-money laundering compliance, and cybersecurity guidelines, regulating any company or individual residing in New York that uses cryptocurrencies, requiring companies involved in virtual currency businesses to apply for a license. Currently, more than 20 companies, including Circle and Ripple, have obtained BitLicense.

Additionally, New York has introduced a trust charter for cryptocurrency custodians, with nearly ten companies, including Paxos, Gemini, NYDIG, Coinbase, Bakkt, and Fidelity Digital Asset, having obtained this charter.

Wyoming is one of the more crypto-friendly regions in the U.S., having enacted over a dozen related bills. The most influential is the HB70 "Open Blockchain Token Exemption" bill passed in March 2018, which proposed an asset category similar to "utility tokens." According to this bill, if the issued tokens are not used as investments but solely for consumption purposes, such as exchange or receiving goods and services, they can be exempt from the constraints of the Securities Act.

Subsequently, well-known crypto companies such as Ripple and Cardano's developer IOHK migrated to Wyoming. Since September 2020, three companies, including Kraken and Avanti, have also received approval from Wyoming regulators to establish crypto banks under the SPDI law, providing commercial banking and custody services for tokenized assets and digital currencies.

In May of this year, the SEC stated it had urged Congress to legislate to grant the SEC more regulatory authority over digital assets. At the same time, the SEC is working to lead the establishment of a broad regulatory framework for crypto assets, clarifying the regulatory scope among various U.S. regulatory agencies, allowing them to perform their respective duties, and potentially bringing all digital assets under regulation.

Recently, the SEC has begun to shift its regulatory focus toward DeFi, with the SEC chairman stating that any DeFi project providing services related to securities-type tokens falls under SEC jurisdiction, and any stock tokens or crypto tokens providing exposure to underlying securities are subject to securities laws, which has sparked significant controversy in the crypto market.

2. Japan

Perhaps influenced by the bankruptcy case of the Mt. Gox exchange, Japan is currently one of the leading countries in the world regarding the regulatory system for cryptocurrency exchanges.

In May 2016, the Japanese Diet passed a bill amending the Payment Services Act, which officially took effect in April 2017, adding a chapter on "virtual currency," clearly defining virtual currency as a means of settlement and payment with property value. At the same time, the law also introduced a regulatory mechanism for cryptocurrency exchanges, allowing only companies registered with the Financial Services Agency (FSA) to provide cryptocurrency exchange services in the country.

The registration requirements generally include: a minimum capital of over 10 million yen; providing customers with information on trading assets, contract details, etc.; separating user assets from operator assets; KYC confirmation, etc.

In 2017, the FSA issued licenses to 16 cryptocurrency exchanges, but due to the theft of nearly $500 million from Coincheck in early 2018, the FSA suspended the issuance of licenses that year and conducted inspections of registered exchanges in Japan for periods ranging from 2 to 6 weeks, covering everything from financial statements, anti-money laundering systems, employee background checks, to system versions, passwords of each computer, and employee attendance. Subsequently, several non-compliant exchanges received warnings, fines, and even shutdowns.

Afterward, the FSA reopened the issuance of licenses, and as of June 2021, 31 crypto companies have been registered, including bitFlyer, Coincheck, and Coinbase, which was newly approved in June this year. The FSA's official website also periodically publishes a list of companies engaged in cryptocurrency trading business in the country without registration, including Binance and Bybit, which have recently been warned.

In terms of cryptocurrency asset trading and management, margin trading, and STOs, the amendments to the Payment Services Act and the Financial Instruments and Exchange Act, which began implementation in May 2020, and recent government orders have proposed more specific regulations:

Regarding cryptocurrency asset trading and management, in response to the risk of cryptocurrency leakage, companies are required to retain an equivalent amount and type of cryptocurrency as repayment resources for user assets managed in hot wallets; in terms of trading risk assessment, exchanges must create and maintain trading records and report suspicious transactions to authorities; in terms of user rights protection, regulations require that in the event of an exchange's bankruptcy, the custodial cryptocurrency assets must be returned to users as a priority; regarding cryptocurrency asset custody, relevant service providers must also obtain regulatory approval for cryptocurrency trading.

For cryptocurrency derivatives trading, relevant operators need to be registered as both cryptocurrency exchanges and primary financial instrument operators. At the same time, Japan has limited the leverage ratio to one time.

Regarding securitized tokens, Japan has also clarified the relevant regulatory mechanisms in the Financial Instruments and Exchange Act. In March of this year, Sumitomo Mitsui Banking Corporation partnered with the securitized token platform Securitize to launch the first asset-backed security token, which is also the first securities-type token compliant with the Financial Instruments and Exchange Act.

Japan also places great importance on the role of industry associations in the crypto market. The Financial Instruments and Exchange Act certifies the Japan Virtual Currency Exchange Association and the Japan STO Association as self-regulatory organizations in the fields of cryptocurrency trading and STOs, to carry out specific operations related to the law and to establish specific rules and guidelines for the industry.

Additionally, Japan has established a taxation mechanism for cryptocurrency trading, requiring individuals with annual salary income exceeding 20 million yen or non-salary income exceeding 200,000 yen to declare their profits from cryptocurrency trading, with tax rates ranging from 15% to 55%.

3. Singapore

Singapore is one of the more crypto-friendly countries globally, having introduced detailed regulatory policies, thus attracting many crypto companies. Additionally, the country's sovereign wealth fund GIC and state-owned investment company Temasek have invested hundreds of millions of dollars in the crypto field.

The Monetary Authority of Singapore (MAS) is the main agency responsible for regulating the crypto market in Singapore. In 2018, MAS officials stated that they categorize tokens into application tokens, payment tokens, and securities tokens. MAS does not intend to regulate application tokens, but a draft payment regulation applicable to payment tokens will be formulated by the end of that year, while securities tokens are subject to existing Singaporean securities and futures laws.

According to documents on the official website, MAS defines digital payment tokens as any digital representation of value that is not denominated in any currency, not pegged to any currency, can be electronically transferred, stored, or traded, and is intended to be accepted by the public or part of the public as a medium of exchange for goods or services or for the settlement of debts, such as Bitcoin and Ethereum.

As early as 2017, MAS issued the "Guidelines on the Issuance of Digital Tokens," providing guidance and regulation for digital token issuance in the country. This was subsequently revised multiple times, with the latest version released in 2019, which included 11 specific cases.

According to these guidelines, when issuing tokens that are securities, the issuer must obtain a capital markets services license; when trading tokens that are securities, the trading platform must obtain a Recognized Market Operator (RMO) license; when providing financial consulting services related to tokens, the company must obtain a financial advisor license. At the same time, all relevant business operators must comply with anti-money laundering and anti-terrorism financing laws.

In 2019, MAS launched the Payment Services Act, which took effect the following year. This act requires businesses engaging in specific payment services to obtain licenses to operate, including digital payment token services, specifically referring to "buying or selling digital payment tokens (DPT) (commonly known as cryptocurrencies) or providing platforms that allow people to exchange DPT." This is widely regarded as a license aimed at cryptocurrency exchanges.

However, to date, Singapore has not issued licenses to crypto companies, but some crypto companies have received temporary exemptions for crypto payment services during specific periods, including Paxos, Coinbase, Genesis, and at least 20 others. At the same time, MAS requires crypto payment service providers to implement strong control measures, such as fulfilling customer due diligence and transaction monitoring obligations, and submitting suspicious transaction reports to the Commercial Affairs Department (CAD) to detect and prevent illegal funds from flowing through Singapore's financial system.

Additionally, MAS launched a regulatory sandbox mechanism in 2019, allowing financial institutions and fintech participants to test innovative financial products or services in a real environment but within clearly defined spaces and durations. At least two crypto companies, BondEvalue and the securitized token platform ISTOX, have been included.

In February 2020, MAS officially approved ISTOX for public listing operations, providing services such as issuance, settlement, custody, and secondary trading of securitized tokens. In October 2020, MAS officially approved BondEvalue as a market operator (RMO) to provide blockchain-based bond trading services for institutional investors.

4. United Kingdom

The main agency responsible for regulating the crypto market in the UK is the Financial Conduct Authority (FCA), whose regulatory purpose is solely for anti-money laundering and anti-terrorism financing. In January 2020, the FCA gained regulatory authority to oversee how crypto asset businesses manage money laundering and counter-terrorism financing risks. Since then, UK crypto asset businesses must comply with the Money Laundering Regulations (MLR) and register with the FCA.

Currently, registered crypto companies include Ziglu, Gemini, Archax, Fibermode, and Digivault. Additionally, over 80 crypto companies are on a temporary registration list, allowing them to operate temporarily until March 31, 2022, including Wintermute, Revolut, Galaxy Digital, Fidelity Digital, eToro, and Huobi.

If a crypto company is not on the temporary registration list, it is not allowed to engage in any crypto business activities. The FCA has also published a list of hundreds of unregistered crypto companies on its official website, including Binance, which has recently been warned.

On its official website, the FCA has issued a serious warning to users investing in crypto assets, stating that if users purchase crypto assets and encounter problems, they are unlikely to receive services from the Financial Ombudsman Service or the Financial Services Compensation Scheme. "Crypto assets are considered very high-risk speculative purchases. If you purchase crypto assets, you should be prepared to lose all your money."

The FCA does not regulate specific crypto assets and related businesses but will still oversee crypto asset derivatives (such as futures contracts, contracts for difference, and options) and those considered securities (securities tokens). Due to concerns about the volatility and valuation of crypto assets, the FCA has banned the sale of crypto asset derivatives to retail customers.

In the FCA's view, securities tokens are tokens that provide certain rights, including ownership status, repayment of specific amounts, and rights to share future profits, and all rules applicable to traditional securities apply to securities tokens.

Currently, the UK government is consulting on the use of stablecoins as a means of payment. If the government's proposals are adopted, the FCA will consult on the rules for implementing these proposals. This means that stablecoins used for payments and services will be regulated in the future, providing consumer protection according to the rules.

Additionally, the FCA has issued electronic money institution (AEMI) licenses to several crypto companies, including Circle, Coinbase, Wirex, and CEX.io. This license allows these companies to issue on behalf of clients, create electronic wallets, conduct mobile payments, global remittances, and open separate accounts to store clients' funds.

5. Hong Kong

The Securities and Futures Commission (SFC) is the main regulatory agency for crypto assets in Hong Kong, primarily regulating securities tokens for many years, with no clear regulatory policies for other types of crypto assets and trading platforms. Currently, it is also the actual headquarters for well-known cryptocurrency exchanges such as FTX, BitMEX, and Bitfinex.

In 2017 and 2019, the SFC issued statements regarding initial coin offerings (ICOs) and securities tokens (STOs), clearly stating that cryptocurrencies representing rights such as shares, debt securities, and collective investment schemes are considered "securities." Transactions, consulting, fund management, and distribution activities related to securities tokens will be regulated under the Securities and Futures Ordinance in Hong Kong. Relevant institutions must obtain licenses from the SFC or register with the SFC. For crypto assets that do not fall under the legal definitions of "securities" or "futures contracts," according to the regulatory framework statement issued by the SFC in November 2018, their markets are not regulated.

The statement on securities token issuance in March 2019 also clarified that securities tokens can only be offered to professional investors (in Hong Kong, individual professional investors are defined as those with 8 million HKD in liquid assets and a rich investment record over the past year).

Regarding trading platform regulation, Hong Kong began exploring a regulatory framework in 2018, and there has been a tightening trend recently. Historically, Hong Kong has not specifically legislated or amended laws targeting crypto assets and their related businesses, and regulatory agencies can only introduce regulatory policies within the existing legal framework, with relatively limited regulatory power and space.

In November 2019, the SFC issued a "Position Statement on Regulating Virtual Asset Trading Platforms," establishing a licensing system for trading platforms and announcing specific licensing terms and conditions. This system only applies to platforms that "provide at least one type of securities-type virtual asset trading service."

The licensing conditions mainly include: the platform can only provide services to professional investors, establish strict criteria for asset inclusion, and only provide services to clients who fully understand virtual assets, operate external market surveillance systems, and ensure that insurance for risks related to the custody of crypto assets is always in effect.

Under this mechanism, on December 15, 2020, the SFC issued a license to the first crypto asset trading platform, OSL. The digital asset trading platform OSL, under the listed company BC Technology Group, obtained Class 1 and Class 7 licenses under the SFC regulatory framework, allowing it to operate securities trading (brokerage services) and provide automated trading services.

Thus, under the current regulatory laws, non-securities crypto assets and their financial activities have remained unregulated. Until the end of 2020, the Hong Kong SAR government’s Financial Services and Treasury Bureau released a legislative consultation document proposing to implement a similar "mandatory licensing system" for all crypto asset trading platforms under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance.

On May 21, 2021, the Hong Kong Financial Bureau released a summary of legislative consultations. The document indicated that most respondents supported the establishment of this licensing system. The aforementioned amendments to the anti-money laundering ordinance are seen as a means to close regulatory loopholes in non-securities token trading. This ordinance is still in the revision stage, and the draft will be submitted to the Hong Kong Legislative Council for review in the 2021-2022 legislative year.

6. South Korea

South Korea is one of the more active countries in the cryptocurrency trading market. Due to the high enthusiasm of crypto investors in the country, the Bitcoin price in South Korean exchanges is higher than in other global exchanges, a phenomenon known as the "Kimchi Premium." In recent years, South Korean regulatory authorities have gradually strengthened their regulatory efforts on the crypto market, and it has now become one of the countries with the clearest regulatory mechanisms for the crypto market.

In September 2017, the Financial Services Commission (FSC), responsible for managing and supervising digital assets in South Korea, announced a ban on all forms of ICOs but did not establish regulatory policies for cryptocurrency exchanges. Instead, the Korea Blockchain Association promoted self-regulation, leading to the rapid development of South Korean exchanges such as Bithumb and Upbit.

In March 2020, the South Korean government approved the amended "Act on Reporting and Using Specific Financial Transaction Information," which took effect in March of this year. According to this law, all virtual asset service providers (including custodians, exchanges, and brokers) must register with the Financial Intelligence Unit (FIU) by September 25 and report transaction data regularly; otherwise, they will face severe penalties.

At the same time, virtual asset service providers must obtain an Information Security Management System (ISMS) certificate and open real-name accounts under bank guidance to prevent money laundering. Currently, only exchanges such as Korbit, Bithumb, Coinone, and Upbit comply with real-name trading regulations.

Due to the stringent regulatory rules mentioned above, several exchanges, including OKEx Korea, have decided to exit the South Korean market before the new regulations take effect. At the same time, more than ten operating exchanges have begun to delist high-risk coins.

Currently, the South Korean government has not classified cryptocurrencies as financial assets but announced in December 2020 that it would tax investor profits. If investors earn more than 2.5 million KRW (approximately $2,200) annually from cryptocurrencies like Bitcoin, they must pay a 20% tax rate.

In June of this year, the South Korean parliament began discussing legislation regarding crypto assets to promote the development of the crypto asset industry and protect investors.

7. Thailand

Thailand is also one of the countries with a relatively complete regulatory system for crypto assets. Since 2018, it has introduced several clear licensing mechanisms to regulate the development of the domestic crypto industry.

In May 2018, the Thai SEC officially issued the "Digital Asset Act," aimed at encouraging technological innovation, providing various fundraising tools to capable enterprises, while ensuring that the purchase, sale, or exchange of digital assets is fair, transparent, and responsible, and establishing mechanisms to maintain the stability of the national financial system and macroeconomic stability.

According to this law, digital assets are divided into cryptocurrencies and digital tokens. The first category of digital assets is used like ordinary currency for exchanging goods and services or as a medium of exchange, while the second category is used for investment in projects/businesses and for exchanging goods/services/other rights according to the regulations of the Securities and Exchange Commission.

At the same time, the law classifies digital asset business operators in Thailand into digital asset exchanges, digital asset brokers, and digital asset dealers, with each type of business operator required to apply for the corresponding license to operate. Additionally, the Thai SEC has established a licensing mechanism for ICO portals that publish ICO information.

To date, the Thai SEC has issued digital asset exchange licenses to eight companies, including Upbit, Huobi, and BITKUB, digital asset dealer licenses to six companies, including Upbit, and ICO portal licenses to four companies, including Longroot.

The Thai SEC has also established a corresponding tax mechanism for digital asset trading, requiring individual investors to pay a 7% value-added tax and a 15% capital gains tax on their digital asset trading profits.

However, despite these relatively complete regulatory mechanisms for crypto assets, the Thai SEC has maintained a strict regulatory attitude toward the development of the domestic crypto industry. For example, in the DeFi sector, in May of this year, the licensed exchange Bitkub issued tokens for its DeFi platform Tuktuk Finance, but the SEC quickly issued a warning, stating that activities related to DeFi may require permission from financial regulatory authorities in the future.

In June of this year, the Thai SEC announced a ban on exchanges providing trading services for the following types of crypto assets: (1) Meme tokens: lacking a clear purpose or substance, with prices driven by social media trends; (2) Fan tokens: tokenized based on the popularity of influencers; (3) Non-fungible tokens (NFTs): a type of digital creation used to declare ownership or rights or specific rights; (4) Digital tokens issued by digital asset exchanges or related personnel for blockchain trading.

Subsequently, the Thai SEC has successively required Huobi Thailand to cease operations, filed lawsuits against Binance, and issued announcements urging listed companies to exercise caution when purchasing digital assets, advising listed companies with related plans to proactively communicate with the SEC.

8. Other Countries

In January 2020, Germany implemented the government draft of the "Amendment to the EU Fourth Anti-Money Laundering Directive," which states that crypto assets do not have the legal status of currency or money but can be accepted by individuals or legal entities as a means of payment or for investment purposes, and are regarded as financial instruments under the German Banking Act. At the same time, all crypto custody companies managing digital keys for investors must be regulated by the Federal Financial Supervisory Authority of Germany, with Coinbase being the first company to obtain this license.

Starting August 2 of this year, Germany's newly effective "Fund Location Act" will allow certain institutional-level funds to invest in cryptocurrency assets on a large scale, with a maximum portfolio share of no more than 20%.

In June 2020, amendments to Canada's "Proceeds of Crime (Money Laundering) and Terrorist Financing Act" took effect, one of which confirmed the asset properties of cryptocurrencies like Bitcoin, legally recognizing cryptocurrency exchanges, payment processors, and other crypto companies as money services businesses (MSBs) and thus bringing them under regulation.

In January 2021, Russia's "Digital Financial Assets Law" officially took effect, requiring Russian officials or individuals holding public office to disclose their digital assets, as well as those of their spouses and children. At the same time, this law prohibits certain Russian officials from holding any cryptocurrencies, such as members of the board of the Central Bank of Russia and employees of state-owned listed companies.

In June 2021, the Australian Securities and Investments Commission (ASIC) indicated it would seek market opinions on a series of regulatory proposals for the crypto market, planning to establish a code of conduct regarding the pricing, holding, risk management, and information disclosure of these crypto assets to protect retail investors and maintain fair market behavior. Previously, Australia only required cryptocurrency exchanges to be regulated by the Australian Financial Intelligence Agency and to comply with anti-money laundering and anti-terrorism financing compliance and reporting obligations.

9. Conclusion

According to data released by the Financial Action Task Force (FATF) in July this year, among 128 jurisdictions, 58 have indicated that they have implemented the revised FATF standards, with 52 jurisdictions regulating virtual asset service providers and 6 jurisdictions prohibiting the operation of virtual asset service providers.

Recently, several governments have issued warnings to certain cryptocurrency exchanges, primarily for providing derivative trading and not being registered in their countries, reflecting that more and more countries are no longer maintaining a laissez-faire attitude toward cryptocurrency trading and are beginning to take proactive measures.

Currently, cryptocurrency assets play an increasingly important role in the global financial market, and more countries are formulating corresponding regulatory mechanisms. However, most countries are primarily conducting regulation based on defensive purposes related to anti-money laundering and counter-terrorism financing risks, rather than for the main purpose of promoting industry progress.

In countries with clear regulatory mechanisms, cryptocurrencies are typically categorized into different types of tokens, such as utility tokens, payment tokens, and securities tokens, requiring securities tokens to be managed according to relevant securities laws, while other types of tokens face less regulation.

Additionally, regions such as Japan, Singapore, South Korea, the UK, Germany, and New York in the U.S. have introduced licensing systems for crypto companies, with regions like Singapore, Hong Kong, and Japan being the most friendly, attracting many crypto companies to establish businesses locally or even relocate their headquarters, becoming current centers of the crypto market.

With the rapid development of new phenomena such as DeFi and NFTs, the regulatory issues faced by countries and regions around the world regarding the crypto market are becoming increasingly complex. How to balance market innovation inclusiveness with financial stability risks will particularly test the governance capabilities and strategic vision of various governments.