Famous Financial Analyst: Four Misconceptions of Traditional Investors Transitioning to Crypto Investment

Original Title: "A Little Bit About…"

Original Source: SAM ANDREW, substack

Compiled by: Kate, Marsbit

Former hedge fund analyst Sam Andrew has made it to the Artemis Monthly Analyst list. Sam has over 8 years of financial analysis experience at Credit Suisse and hedge fund BlueMountain Capital. In this article, Sam shares four misconceptions traditional investors have when transitioning to crypto investments, three key points on crypto fundamentals, his views on crypto investment themes, and advice for newcomers looking to enter crypto investing. His heartfelt insights are worth a read; here is the full translation:

I made it to this month's analyst list at Artemis. My conversation with Artemis founder Jon Ma covered personal, investment, and cryptocurrency topics. Our discussion provided more insights into my background, which some readers of Crypto Clarity have inquired about.

I will explain my crypto journey and share the framework I apply from my hedge fund experience to cryptocurrency. I outline the misunderstandings most tradefi investors have about cryptocurrency. I share more thoughts on the importance of crypto fundamentals. We conclude with interesting themes and general advice.

Here is my interview with Jon Ma, excerpted from "Artemis Monthly Analyst."

What is your story? How did you get into investing and the crypto space?

I grew up in Toronto, Canada. In my teens, my grandfather introduced me to financial markets and investing. He was a World War II veteran who worked in a factory for most of his life and later taught himself to invest. I was captivated! The idea that I could bet based on my own experience and make money was thrilling. At the same time, I realized I wouldn’t become a professional hockey player, so I thought it was best to find something else!

My interest in investing and financial markets led me to investment banking. I worked at Credit Suisse in London, UK. The banking industry served as a stepping stone to the buy side. After completing a two-year analyst program at the bank, I joined the hedge fund BlueMountain Capital. I spent over 8 years at BlueMountain, working for three years in London primarily focused on credit investments. I was then transferred to the company’s headquarters in New York, where I spent over five years involved in the firm’s long/short equity strategy. I was fortunate to join a great company in its early days. The capital managed by the firm grew from $3 billion to $22 billion.

I first got into crypto in 2017. The potential for seamless peer-to-peer currency exchange with Bitcoin and the programmability of Ethereum resonated with me. From my perspective, there were many potential use cases in financial markets. I bought my first BTC and ETH. I rode the bull market and the subsequent crash. For several years, I maintained an interest in cryptocurrency to satisfy my curiosity. But it took a few more years before I fully committed to the crypto space.

My belief in dedicating all my time to cryptocurrency was driven by personal and professional motivations. Personally, being part of a fast-growing disruptive industry where I could take a leadership role in helping to develop a potentially revolutionary technology was too compelling to ignore. Professionally, cryptocurrency is the most fertile ground for investment. It is the only market that is both inefficient and illiquid. It reminds me of the stock market decades ago when investment legends were just starting to emerge.

You worked as a hedge fund analyst at BlueMountain for over 8 years. What frameworks and experiences did you learn from the buy side when evaluating crypto assets?

I summarized four key takeaways from my hedge fund experience that apply to cryptocurrency investing:

1. Time Management: The most important skill for an investor is effective time management. There is an endless amount of research to be done. Timely returns and capital returns are equally important. The ability to quickly judge what is interesting and why it is interesting is crucial. Focus your research on the factors driving asset prices.

2. Sources of Returns: Alpha, or excess returns, is a product of your expectations aligning with the market's. Most investors are wrong. Investors need to believe in one outcome while the market believes in another. If the market starts to believe in your outcome, it will drive asset prices and generate excess returns.

3. Thesis-Driven Investing: An investment thesis is rooted in deep independent research that contains 3 to 5 principles unknown to the market that will change the market's perception of the asset. The result of thesis-driven investing is a differentiated viewpoint.

4. Risk Management: A very good investor's correct probabilities are only slightly higher than their incorrect probabilities. The true driver of portfolio returns is position size. For those you get right, your positions are larger. Manage position sizes accordingly. Investors need to find a balance between the courage of conviction and the humility to be wrong.

Where do you think most traditional financial investors studying cryptocurrency go wrong?

When studying cryptocurrency, traditional investors often misunderstand four things:

1. Business Models: Crypto protocols and applications sell products for fees and incur costs for doing so. This fundamental principle is no different from any other business. Non-crypto investors are interested in i) the term "cryptocurrency," ii) non-fiat currency units, and iii) value appreciation. Most tokens are not currencies. Confusing tokens with currencies is an unnecessary muddle. Introducing a new unit of account is a paradigm shift. It is hard for people to grasp this. It undermines their existing view that fiat currency is the only barometer of value. The appreciation of cryptocurrency is not as straightforward as owning stocks. This difference is primarily due to regulation. I expect the appreciation of cryptocurrencies to become standardized.

2. Operating Leverage: Crypto protocols have been and have the potential to be highly profitable. They possess what tradefi investors refer to as operating leverage. Their costs do not increase proportionally with revenue. Tradefi investors misunderstand the profit potential when revenue grows.

3. Durability: A company's durability, also known as competitive advantage or moat, comes from its intellectual property, brand, network effects, or regulatory capture. However, in cryptocurrency, there is no ownership of intellectual property. Crypto is open-source. Code is copied and used to create new versions of existing protocols. Therefore, the durability that businesses enjoy does not apply to cryptocurrencies. Tradefi investors avoid them due to the lack of a moat. They misunderstand that a moat can still exist without owning intellectual property. The moat lies in the network effects of the protocol.

4. Valuation: Valuing crypto assets is challenging. There is no universally accepted way to assess the value of tokens. Therefore, tradefi investors mistakenly believe that cryptocurrencies are primarily speculative. There are many ways to triangulate valuations. I believe most protocols will be viewed as productive assets with token-equivalent cash flows. A small portion of tokens will also have attributes of value storage assets.

We really appreciate your research on Crypto Clarity. We enjoy hosting "Crypto Fundamental Investing" on Twitter and your article "Crypto Fundamentals Don't Matter… Do They?" So, are fundamentals important for cryptocurrencies? When do you think fundamentals will matter more?

The importance of fundamentals reflects the adoption curve. In the early days of cryptocurrency, fundamentals did not matter. They are more important now. They will become even more important in the future.

Fundamentals are playing an increasingly important role because:

1. Metrics Exist: The DeFi summer birthed many applications and generated metrics that need to be tracked, including developer activity, network usage, fees, and costs. These metrics did not exist before. Without metrics, there is no fundamental analysis.

2. Capital Formation: Cryptocurrency is becoming increasingly important globally. The development and adoption of the industry require funding. When investors can realistically assess the projects they are investing in and predict their value, they are more willing to allocate capital.

3. Historical Analogies: The crypto market is similar to the stock market decades ago. In recent decades, fundamental analysis of stocks has become increasingly popular. As markets mature and become more complex, understanding and regulating fundamentals become more important. The same patterns apply to the stock, credit, and commodity markets. Cryptocurrency will follow suit.

I believe regulation could be a watershed moment for crypto fundamentals. Enhancing confidence and integrity in the crypto market will pave the way for more investors to enter. They will apply what they do best: fundamental analysis.

What crypto topics are you currently researching or interested in?

In the low trading volume market post-FTX, catalysts are crucial. Fundamental theses underwrite investments and catalyst-driven position sizes. I believe the two biggest catalysts next year, outside of macroeconomic factors, are EIP-4844 and the Bitcoin halving. I have spent a lot of time on both.

What advice do you have for new investors looking to enter the crypto fundamental investing space in 2023?

It is useful. This goes far beyond the fundamentals of investing in 2023. Cryptocurrency is not an expert-driven industry. In fact, it doesn’t matter that you haven’t been in the crypto space for the past decade because no one has. Things change so quickly that insights from two years ago are less applicable today. So you are not that far behind those who are already in the industry.

When I started writing Crypto Clarity, I had three goals: i) to enhance my knowledge, ii) to share that knowledge with others, and iii) to leverage my knowledge and value to provide crypto investment insights to others. If you provide value to others, you will also be rewarded.

How do you use Artemis in your fundamental research?

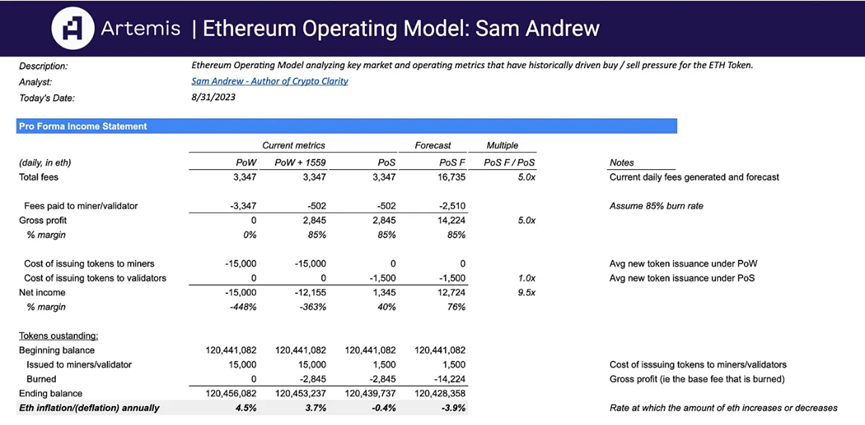

Artemis is my most commonly used tool. Check out the 50+ articles I published last year. The sources from Artemis are the most extensive. Artemis is the tool I use to extract chain data and easily compare protocol metrics. I also use it to create dashboards and models in Excel and Google Sheets that can be updated with the click of a button. Take a look at the Ethereum template I built on the Artemis example template.

Stay curious.