Will the SEC approve the Bitcoin spot ETF application? What will be the impact?

Original Title: "Will the SEC Approve Bitcoin Spot ETF Applications, and What Impact Will ETFs Have on the Crypto Market?"

Written by: Daniel Li, CoinVoice

After a prolonged bear market, the market's thirst for positive news is growing stronger. Relying solely on the emergence of innovative projects is no longer sufficient to boost overall market sentiment. The market urgently needs a new breakout point, much like how Grayscale's Bitcoin Trust (GBTC) gained approval from the U.S. Securities and Exchange Commission (SEC) in 2020, sparking a market frenzy. The most likely candidate to play this role now is the highly anticipated Bitcoin spot ETF.

Despite the SEC's cautious stance on Bitcoin spot ETFs and its recent delays in approvals, the market remains optimistic about their eventual approval. Current market predictions suggest a 75% probability of Bitcoin spot ETFs being approved within this year, with the likelihood rising to 95% by the end of 2024. The bear market has long suppressed the market, and the approval of Bitcoin spot ETFs could become a significant positive catalyst, potentially driving the next crypto bull market.

What is a Bitcoin Spot ETF and Why is it So Attractive to Capital?

To understand Bitcoin spot ETFs, we first need to grasp the concepts of ETFs and Bitcoin futures ETFs. An ETF (Exchange-Traded Fund) is an investment tool designed to track the price and performance of specific assets. They can be traded on stock exchanges, allowing investors to buy and sell ETFs like stocks.

A Bitcoin futures ETF is a fund that holds futures contracts linked to the price of Bitcoin. In reality, Bitcoin futures ETFs do not directly hold any Bitcoin. Their investment strategy is to track Bitcoin's price movements by holding futures contracts. Through Bitcoin futures ETFs, investors can buy, sell, and trade, thus participating in the price fluctuations of Bitcoin.

In contrast, a Bitcoin spot ETF is a fund that allows investors to buy and sell actual Bitcoin at current market prices. This fund directly purchases, sells, and holds real Bitcoin. This enables investors to hold Bitcoin without managing their own Bitcoin wallets. Through Bitcoin spot ETFs, investors can conveniently participate in the Bitcoin market and profit from the price changes of Bitcoin.

Advantages of Bitcoin Spot ETFs:

Bitcoin spot ETFs possess the advantages of futures ETFs, such as not needing to invest in Bitcoin directly through exchanges, lower trading fees, and simplified processes. Compared to futures ETFs, spot ETFs carry lower risks. Spot ETFs invest at the actual Bitcoin price, meaning investors hold real Bitcoin during the contract period. This characteristic of holding Bitcoin is also considered a more legitimate investment approach.

Moreover, as an exchange-traded fund, Bitcoin spot ETFs can be traded on stock exchanges. This means investors can buy or sell Bitcoin spot ETFs like stocks, providing more flexible investment and trading strategies. Investors can buy or sell shares of Bitcoin spot ETFs at any time based on market changes, enjoying the advantages of flexibility. This has made Bitcoin spot ETFs a popular investment tool, attracting more investors to participate in the cryptocurrency market.

Additionally, Bitcoin spot ETFs offer traditional financial institutions and capital markets more investment opportunities related to cryptocurrencies. As the Bitcoin market continues to develop and mature, more institutional investors are eager to participate. The introduction of Bitcoin spot ETFs provides these institutions with a compliant investment tool, allowing them to engage in the Bitcoin market and earn returns within an appropriate regulatory framework. This further drives the development of the Bitcoin market and brings cryptocurrencies into the purview of traditional finance.

Reasons Capital Favors Bitcoin Spot ETFs:

The capital's favor for Bitcoin spot ETFs stems from optimism about their broad future prospects. Here are some advantages explaining why Bitcoin spot ETFs are highly sought after by capital:

1. Expanding Market Size and Participation: As one of the main categories of exchange-traded products, ETFs have a massive market size, with a total value reaching $7 trillion. The launch of Bitcoin spot ETFs will further expand participation in the cryptocurrency industry, attracting more investors into the market and thereby enlarging the overall market size. For capital, a larger market size means more opportunities and potential profits.

2. Providing Direct Participation in the Bitcoin Market: Compared to Bitcoin futures, Bitcoin spot ETFs are closer to the actual Bitcoin market. Spot Bitcoin involves directly trading the actual digital currency. This opportunity for direct participation in the Bitcoin market allows capital to manage and allocate Bitcoin assets more flexibly, further enhancing investment efficiency.

3. Meeting Market Demand and Expanding Investment Channels: As the cryptocurrency market becomes more mainstream, more traditional financial institutions wish to enter this field. However, due to regulatory restrictions and channel limitations, these funds cannot directly enter the crypto market. Bitcoin spot ETFs provide a more convenient and manageable investment method, offering traditional financial institutions and large capital a pathway into the crypto market.

4. Providing Higher Transparency and Regulatory Compliance: Bitcoin spot ETFs are listed on stock exchanges and are directly subject to regulatory scrutiny and oversight, offering higher transparency and regulatory compliance compared to some unregulated or loosely regulated cryptocurrency exchanges. This provides capital with a safer and more reliable investment environment.

The Bitcoin Spot ETF Curse May Be Broken

For years, the idea of a Bitcoin spot ETF has been brewing. Although numerous proposals have been submitted to regulators, no Bitcoin spot ETF has yet been approved for listing on major U.S. stock exchanges, which seems to have become a curse for the U.S. crypto market. However, outside the U.S., Bitcoin spot ETFs have already been successfully approved. On February 18, 2021, Canada's Purpose Investment Company launched the world's first Bitcoin spot ETF—Purpose Bitcoin ETF—trading on the Toronto Stock Exchange, with nearly $400 million in trading volume on its first day.

As the center of the global crypto market, the U.S. investment institutions clearly will not give up on this market. Since the Winklevoss brothers first applied for a Bitcoin spot ETF in 2013, institutions in the U.S. have applied for Bitcoin spot ETFs every year, but all have been rejected without exception. Due to the high number of failures, previous applications for Bitcoin spot ETFs did not attract much market attention, and people seemed to have lost hope regarding the approval of Bitcoin spot ETFs in the U.S. until June of this year, when the world's largest asset management company, BlackRock, submitted an application for a Bitcoin spot ETF, reigniting hopes for approval.

It is reported that BlackRock manages assets exceeding $9 trillion, and in this application, BlackRock proposed Coinbase as the cryptocurrency custodian and spot market data provider, with Bank of New York Mellon as the cash custodian, clearly indicating that BlackRock is well-prepared for the Bitcoin spot ETF application. Notably, BlackRock has only had one rejection in its past 576 ETF applications.

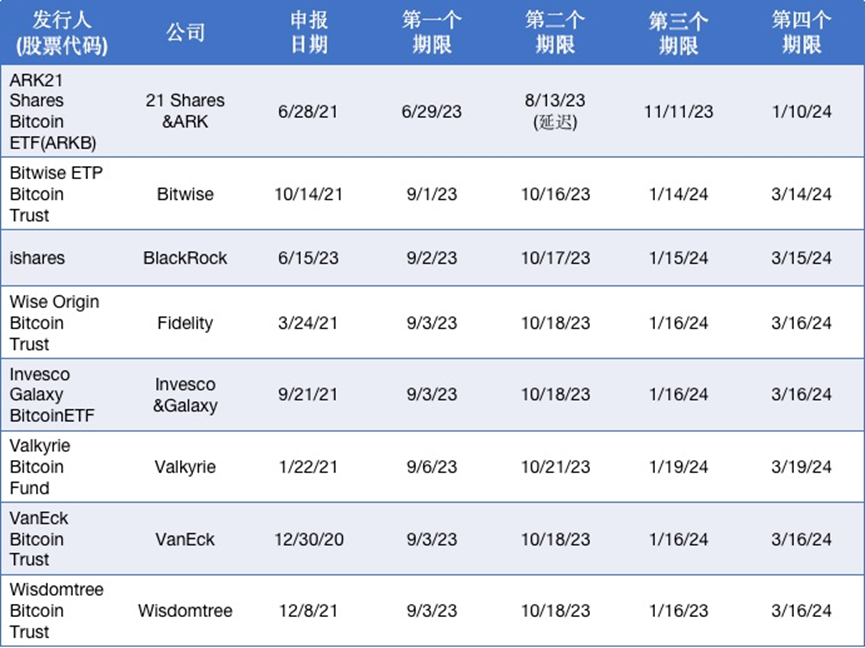

Due to the market's optimistic outlook on BlackRock's Bitcoin spot ETF application, some institutions that previously failed in their applications have rejoined the race for Bitcoin spot ETFs, believing that if BlackRock is approved, similar applications may also be approved. According to data, by August, eight well-known institutions had applied for Bitcoin spot ETFs. The density of capital applying for Bitcoin spot ETFs clearly indicates that the curse of not being able to apply for Bitcoin spot ETFs in the U.S. may soon be broken after a long battle of ten years.

What Impact Will Bitcoin Spot ETFs Have on the Crypto Industry?

Bitcoin spot ETFs have already been approved in some countries, but for the global crypto market, the approval of Bitcoin spot ETFs by the U.S. SEC remains significant, as the U.S. is the global crypto center. According to Bloomberg ETF analyst Eric Balchunas, if Bitcoin spot ETFs are approved, the U.S. could account for 99.5% of global crypto ETF trading volume. Therefore, the importance of the U.S. market is self-evident. What impact will the approval of Bitcoin spot ETFs by the U.S. have on the global crypto market?

1. Coinbase May Become the Biggest Winner Behind the Bitcoin Spot ETF Race

Once the ETF application is approved, the biggest beneficiary in the market will not be the ETF applicants, although they will also gain significant benefits; rather, Coinbase will be the biggest winner behind the scenes.

The SEC previously rejected Bitcoin spot ETFs due to a lack of regulatory transparency, so the institutions applying for ETFs this time included surveillance-sharing agreements to meet regulatory requirements. In these agreements, asset management companies must choose a partner as the custodian of the Bitcoin fund, responsible for providing regulatory sharing services and allowing both parties to share information about transactions, clearing activities, and clients to reduce market manipulation risks. In this regard, Coinbase, as the largest and compliant crypto exchange in the U.S., is undoubtedly the best choice.

Currently, in the Bitcoin spot ETF application race, besides BlackRock and Coinbase establishing a partnership for the Bitcoin spot ETF, other firms like Fidelity, VanEck, Ark Invest's 21Shares, Valkyrie, and Invesco have also submitted revised applications, designating Coinbase as their partner. If the SEC approves these asset management companies' applications in the future, the vast assets under these firms will be custodied on Coinbase. According to data from CoinGecko, an analysis included in BlackRock's ETF filing estimates that 56% of the $129 billion Bitcoin trading in the U.S. occurs on Coinbase. In the future, as Bitcoin spot ETFs develop, this proportion is expected to further increase. Coinbase will also reap significant benefits and become the biggest winner in this race.

2. Bitcoin Spot ETFs May Become the "Engine" for the Crypto Market's Transition from Bear to Bull

If Bitcoin spot ETFs are approved, it will provide a safe and effective "pipeline" for massive traditional financial capital to flow into the crypto world, which will have a far-reaching impact on the crypto market. Especially given the current market's prolonged bearish sentiment, from 2022 to now, we have witnessed various crypto institutions facing crises and regulatory crackdowns. Even industry leaders like Binance and Coinbase have encountered multiple regulatory pressures, with Bitcoin's price dropping from a peak of $45,000 in early 2022 to $25,000 now, leading market investors to lose confidence in the crypto market. At this moment, a significant positive catalyst is urgently needed to stimulate the market's transition from bear to bull and kickstart a new bull market.

Bitcoin spot ETFs precisely possess this capability. It is worth noting that the asset management companies applying for Bitcoin spot ETFs, with BlackRock alone managing nearly $9 trillion in assets, are not the only ones in this field. As more asset management companies enter this space, the amount of traditional capital entering the crypto market will be astronomical. The SEC's approval of Bitcoin spot ETFs will signal the start of the crypto market's bull run.

3. Accelerating the Mainstreaming of Crypto Assets

The launch of Bitcoin spot ETFs provides institutional investors with a more convenient and standardized way to participate in the crypto market. Since ETFs are a more traditional investment tool, their introduction will enable more investors to participate in the crypto market in a more convenient manner, thereby increasing the recognition and popularity of cryptocurrencies. This will help further expand the scale and liquidity of the crypto market, attracting more institutional investors.

Additionally, the surveillance-sharing agreements implemented by Bitcoin spot ETFs will further enhance the transparency of crypto market regulation, thereby increasing market credibility and investor confidence. These agreements will also help align the regulatory approaches of the crypto market with those of the U.S. market, leading to the implementation of more suitable regulatory policies and standards for the crypto market, which will contribute to the maturation and stability of the crypto market. Furthermore, these agreements will allow regulators to gain a more comprehensive understanding of the operations and risks of the crypto market, thereby better protecting investors' legitimate rights and interests.

Conclusion

Despite many reasons supporting the approval of Bitcoin spot ETFs, the outcome remains unpredictable until the SEC makes a final decision. However, logically speaking, since the SEC has allowed high-risk Bitcoin futures ETFs to be listed, there is no reason to reject Bitcoin spot ETFs.

The SEC's previous rejection of Bitcoin spot ETF applications due to a lack of regulatory transparency is no longer valid, as new applications have included surveillance-sharing agreements. The SEC's recent delay in approval differs from past reasons for postponement. Reports indicate that Nasdaq is preparing a regulatory cooperation agreement with a U.S. Bitcoin trading platform. The SEC may be waiting for traditional financial institutions to complete infrastructure development. Therefore, the listing of Bitcoin spot ETFs in the U.S. seems to be only a matter of time.