New lows in trading volume and declining volatility: Data interpreting the harsh reality of the crypto market

Written by: Tyler Pearson & Adam Morgan McCarthy, DL News

Compiled by: Felix, PANews

After the boom in 2022, the sentiment in the crypto market has plunged, characterized by declining trading volumes and a lack of liquidity.

How severe is it?

To help understand all of this, this article provides three charts to explain the current state of the industry.

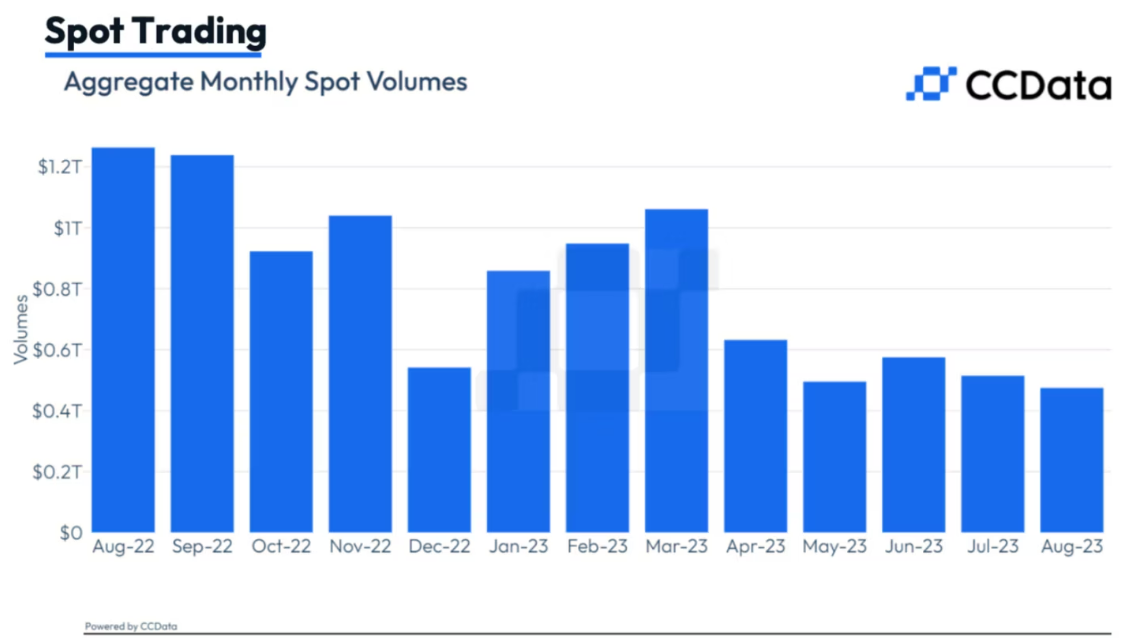

Spot Trading Volume Hits 2019 Low

In 2023, the spot trading volume of cryptocurrencies has continued to decline. The volume hit a multi-year low in May and then again in August.

According to data from crypto research and analytics firm CCData, the trading volume on centralized exchanges last month was only $475 billion, down nearly 8%. The firm stated that this was the lowest month for spot trading volume since March 2019.

CCData analysts noted that on August 26, the daily trading volume on centralized exchanges was nearly $6 billion, the lowest level since February 2019.

Monthly Spot Trading Volume (CCData/CCData)

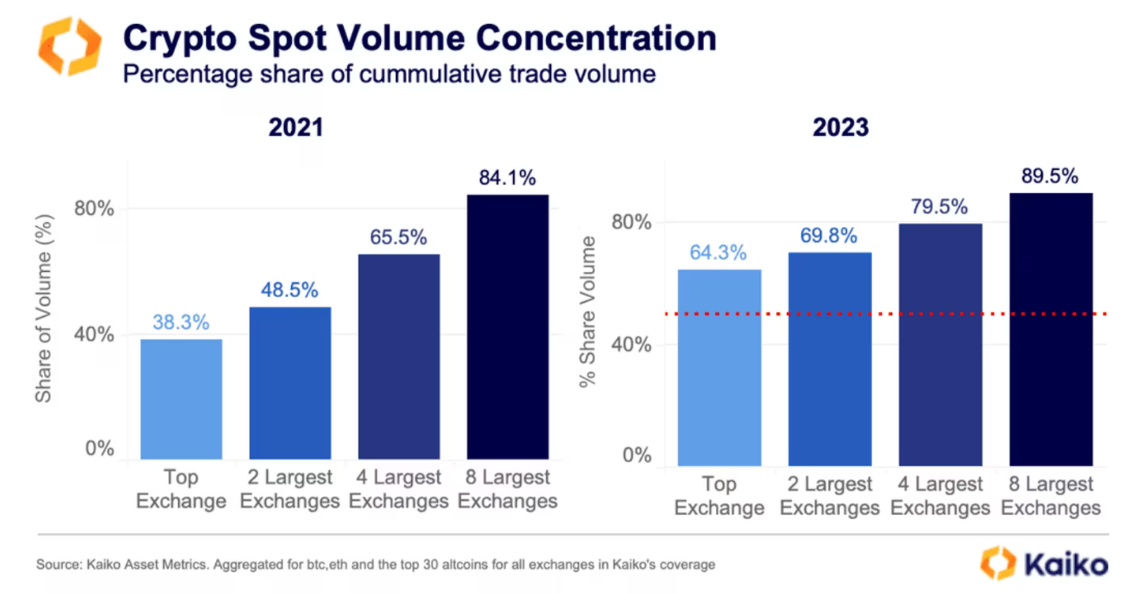

Crypto Market Too Concentrated

As noted by research firm Kaiko, the market is overly concentrated in a few exchanges.

The firm stated that currently, eight centralized exchanges control nearly 90% of the trading volume in the cryptocurrency market, up from 84% in 2021.

One of the most notable advancements in recent years is Binance's absolute dominance—its share of global trading volume has nearly doubled to 64%.

Cryptocurrency Spot Trading Volume Concentrated on CEX (Kaiko)

Kaiko commentators emphasized the potential dangers of liquidity concentration, which could lead to single points of failure, resulting in a significant loss of liquidity, as seen during the FTX collapse in 2022.

CCData analysts stated that Binance remains the largest cryptocurrency spot trading venue, with a trading volume of $183 billion. However, they added that the exchange's market share has declined for the sixth consecutive month, falling to 38% in August, the lowest market share since August 2022.

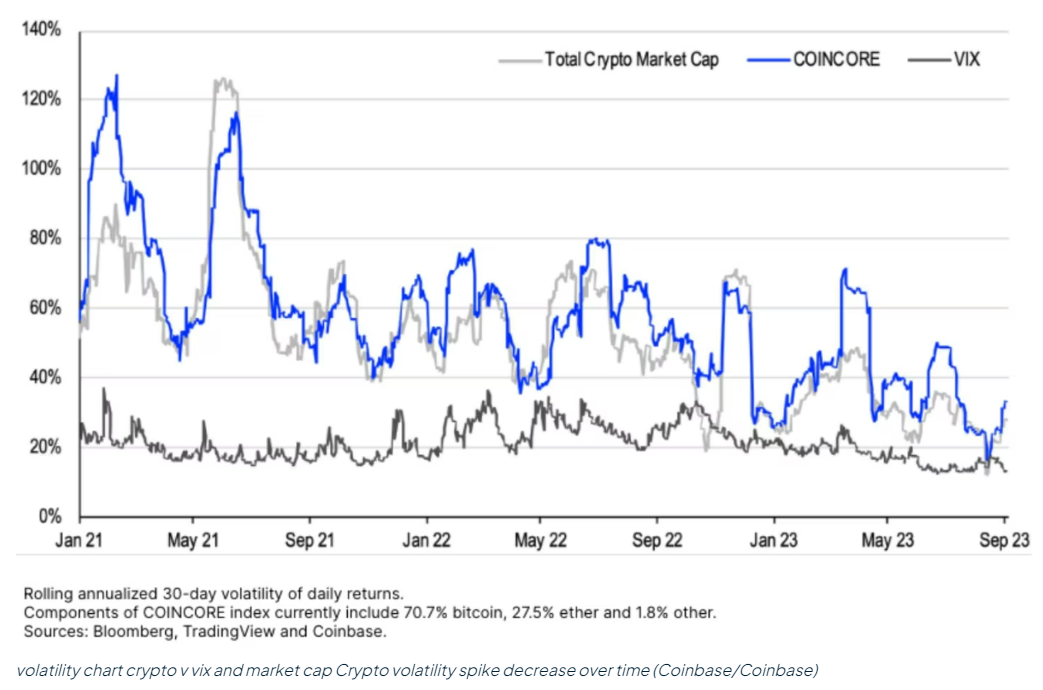

Volatility Steadily Declining Since 2021

Although the cryptocurrency market is known for its high volatility, it has been steadily declining over the past three years, resulting in fewer volatility peaks.

The volatility in the crypto market is represented in the chart by a line marked Coincore (the blue line in the chart below), which is Coinbase's measure of crypto volatility. Coinbase's head of institutional research, David Duong, pointed out, that this trend has been downward.

David Duong stated that recently, cryptocurrency volatility has even been "close" to the Cboe Volatility Index (also known as VIX).

VIX is sometimes referred to as the "fear gauge," and it measures expected volatility and investor sentiment. It tracks the S&P 500 index and rises during periods of uncertainty or panic in the financial markets.

Volatility Chart

Last month, Bitcoin's volatility hit an all-time low, and just days later, the price plummeted, with investors suffering over $1 billion in liquidations on August 17.

A report released by K33 Research (formerly Arcane) on Tuesday indicated that volatility is expected to increase in the future. The firm stated that volatility is expanding compared to previous weeks.

While a volatile market can be dangerous and may lead to higher losses, it can also provide greater returns for traders willing to take risks. Professional traders favor volatility because it offers better opportunities to exploit pricing gaps.

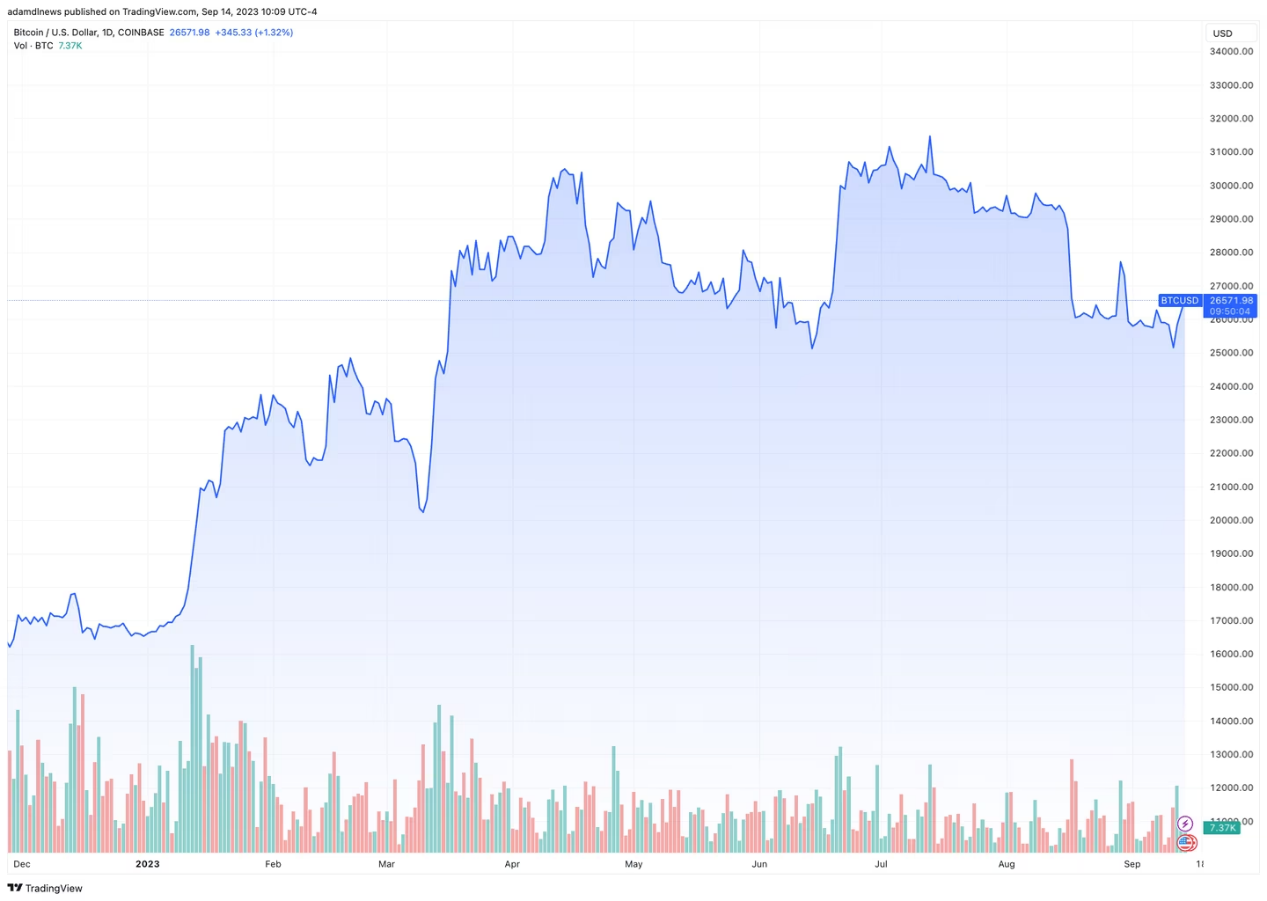

Bitcoin Rebounds

Bitcoin stands out in the cryptocurrency market. It has risen over 50% year-to-date. The total market capitalization of all cryptocurrencies has increased by nearly $200 billion, reaching $1.1 trillion.

Bitcoin Price Trend Year-to-Date

CoinShares' head of research James Butterfill stated, that while it has failed to reverse the trend of declining trading volume, the sharp drop in volume "reminds one of the pre-bull markets of 2019 and 2020," but this is already a very high threshold.

In 2021 and 2022, daily trading volumes surged to approximately $14 billion and $11 billion, respectively. This year, the daily trading volume of the leading cryptocurrency by market capitalization averages around $7 billion.

The decline in trading volume followed Binance's decision in March to end zero-fee trading activities for traders.

Binance has been waiving fees on 13 Bitcoin spot trading pairs, including Bitcoin and Tether trading pairs.