Friend.tech economic model expansion: What kind of price curve does SocialFi need?

Author: Loki, ABCDE

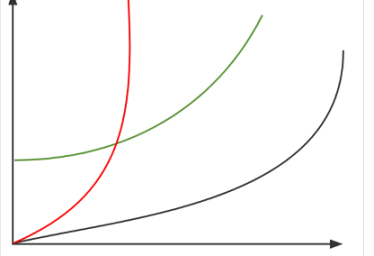

I. Pricing Curve Comparison & The Cost of Changing Slope

Since October, the competitive landscape of Socialfi has gradually become clearer, with some competing products slowly fading from the market. Looking back at the development process of Friend.tech, the economic model (especially the pricing curve) has played a crucial role. Specifically, the pricing curve of FT has the following characteristics:

- The differential positivity ensures that as the number of users increases, the price continues to rise, and the rate of increase accelerates, ensuring that earlier participants make profits;

- 16,000 achieves a relatively reasonable community scale capacity;

- As the number of users increases (especially after 100-200), the curve becomes steeper, price fluctuations become more pronounced, and capacity gradually weakens;

- The leftmost part of the curve is the most profitable buying range, but this part is monopolized by Bots, forming a revenue model similar to "MEV."

For more detailed explanations, please refer to: In-depth Analysis of Friend.tech's Economic Model: Game Theory, Expected Value, and the Illusion of Demand Curves

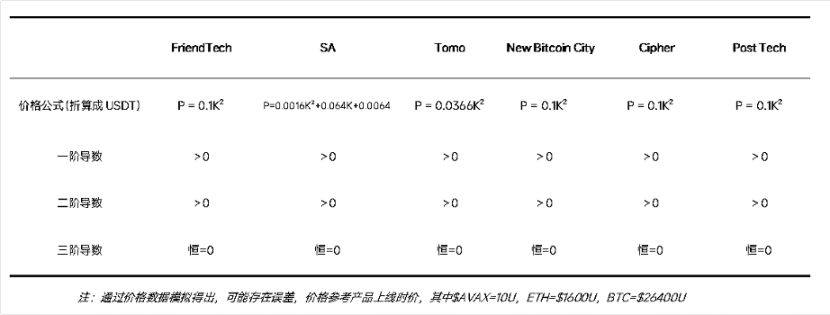

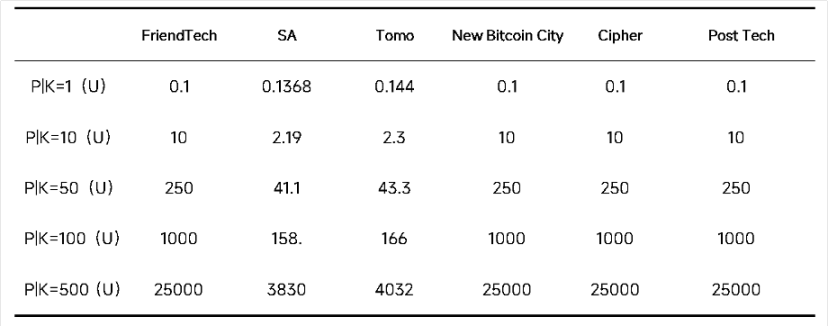

In terms of competing products, Cipher, PostTech, and NewBitcoinCity have completely retained FT's formula, with all protocols still constructed in the form of quadratic functions, maintaining the characteristics of first derivative > 0; second derivative > 0; third derivative = 0, which will ensure that FT's FOMO/profit-making effect continues to exist.

The curve changes in New Bitcoin City mainly stem from changes in the pricing benchmark currency and BTC price fluctuations, while SA and TOMO have made some adjustments to the curve's form. Among them, SA has added a linear term and a constant term based on the quadratic term (K²) and reduced the coefficient of the linear term. This change theoretically leads to a flatter overall curve (rising more slowly) and an initial price increase, but since the constant term of SA is very small, this change is not easily noticeable. Tomo's change is simpler, merely reducing the coefficient of the quadratic term by about 73%.

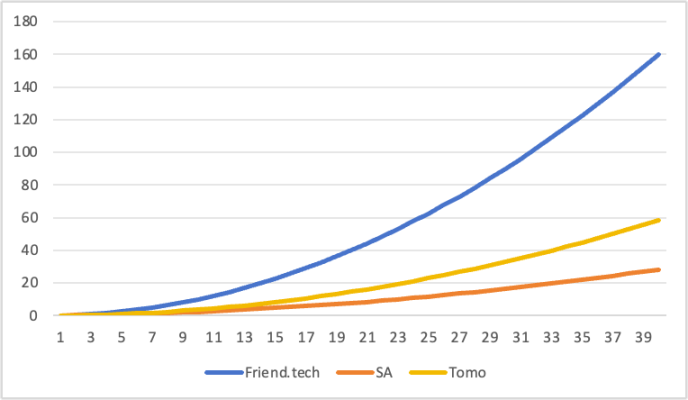

It can be seen that both SA and TOMO essentially change the growth rate of the curve. Based on this change, under the same Key supply quantity, the prices of SA and TOMO will be lower, with SA's price level roughly maintaining between 15%-20% of FT, and TOMO's price at 37% of FT.

Overall, this change is not particularly innovative; a flatter price curve is a double-edged sword for clones. On one hand, FT provides a value anchor; it is reasonable for the price of the same player's Key on clones to be lower than that of FT itself, as a lower price will bring better acceptance and greater user capacity. On the other hand, a flatter curve means a poorer wealth effect, which is one of the key factors that attracted hundreds of thousands of users to FT.

Of course, a steep price curve does not come without a cost; the other side of a spiraling rise is a spiraling decline. In the past week, Friend.tech's TVL dropped from 27,000 ETH to 21,000 ETH, a reduction of less than 20%, but the resulting price collapse and 33 betrayals are far from over.

II. FT's Gray Rhino: Net Capital Outflow

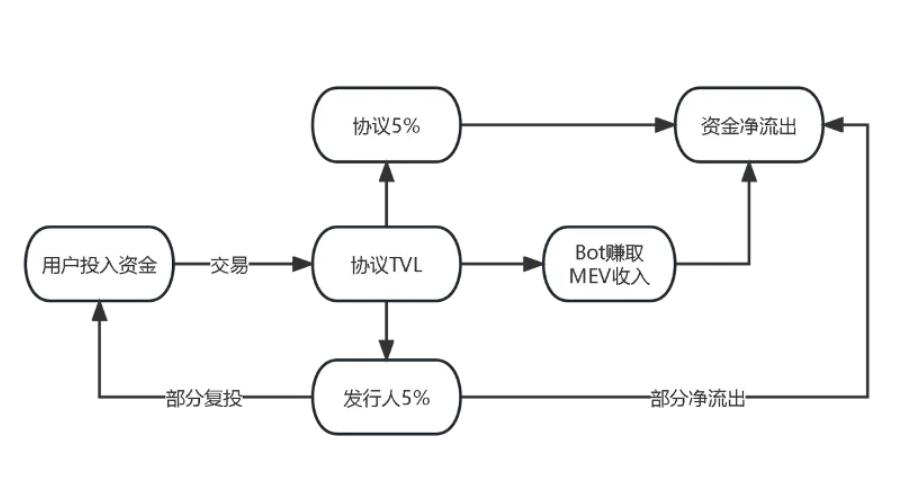

FT's Bots and high transaction fees are visible problems for everyone, and the net capital outflow they cause is killing Friend.tech. As shown in the figure below, all of Friend.tech's TVL comes from user deposits. If the PnL generated from user transactions and the royalties earned by issuers are not withdrawn but reinvested, this money will still remain within the protocol. However, the "MEV income" earned by Bots and the fees earned by the protocol will directly contribute to net capital outflow.

The "MEV income" earned by Bots is difficult to quantify, but the entry of DWF founder AG into FT in September is a typical case. The first buy price displayed on FT's front end was 0.4 ETH, meaning the Bot directly purchased 80+ Keys at an average price of 0.135 ETH. These Keys were subsequently sold over the next 48 hours at transaction prices of 1.1 ETH to 1.5 ETH. Based on this estimate, the Bot earned approximately 100 ETH in AG's Room, all of which came from user losses.

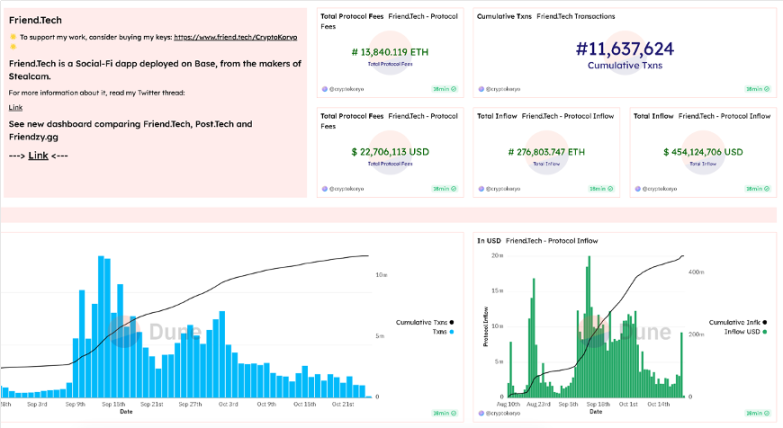

The fee portion is easier to quantify; DUNE data shows that as of October 25, the cumulative fees belonging to the project team amounted to 13,840 ETH. Based on the peak TVL of 27,000 ETH, users' cumulative deposits of ETH were at least 40,000 ETH. Even without considering Bot MEV income, net withdrawals of KOL royalties, or net outflows caused by fake accounts, FT has already taken over 30% of users' principal, and this is just the result of three months.

When TVL rises, users' feelings are not as intense. But once TVL enters a downward trend or even just stagnates, the impact becomes exceptionally strong. The protocol's siphoning, Bot MEV income + net withdrawals of KOL royalties + net outflows caused by fake accounts are all brought about by non-trading. If we estimate the latter three items at 5,000 ETH (this figure is already very conservative), then users' cumulative total deposits would be 45,000 ETH.

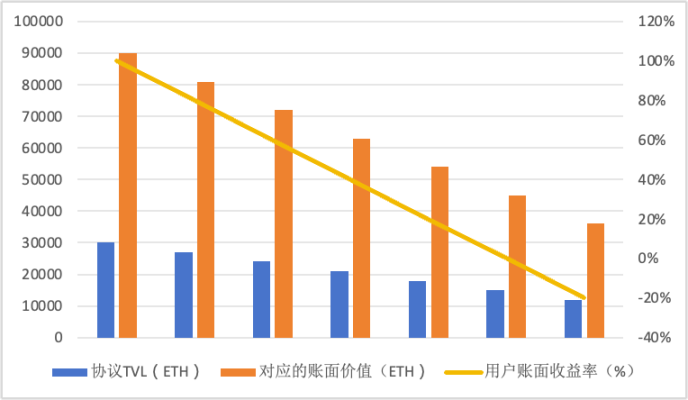

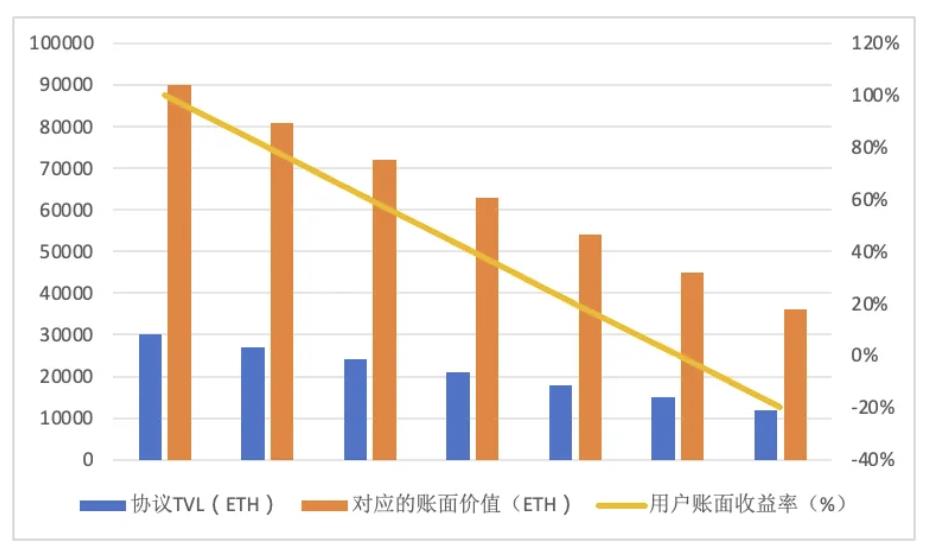

Previous articles have mentioned that the book value of Keys is approximately three times the actual TVL. Therefore, when TVL is 27,000 ETH, the book value of Keys is about 81,000 ETH. Compared to the 45,000 ETH principal, users received an average of 80% positive returns. However, when TVL drops to 21,000 ETH, the book value of all Keys falls to 63,000 ETH, and users' average returns drop to 40%. It can be seen that the book return rate of Keys is inherently leveraged. If TVL continues to decline to 15,000 ETH, users' total book value will equal their total principal, and considering transaction fees and price spreads, users will enter an overall loss state.

Currently, the disintegration of FT's consensus has already shown a trend of transmission to Tomo. If the high siphoning by the protocol + Bots continues, it will only be a matter of time before FT and other SocialFi collapse, and with the decline in book return rates, the disintegration trend will accelerate. We had hoped that Friend.tech would solve the issues of protocol siphoning and Bots, but so far, no changes have occurred. Moreover, recent changes to the scoring rules have objectively led to trading by score-farming users, further increasing trading friction; meanwhile, founder 0xRacer has also withdrawn high fees earned from his Keys.

III. How Can the Curve Be Improved?

Further consideration reveals that if we still maintain the form P = K²/C + D (where C and D are constants), the pricing formula needs to consider the following factors:

- Curve Growth Rate & Price

The faster the growth rate, the more FOMO it generates, mainly achieved by increasing the constant C. Competing products generally reduce the growth rate, making the curve smoother. However, the primary purpose of this approach is to maintain the low price of Keys. The TVL of clones will have a huge gap compared to FT, so having a lower price under the same holders is more reasonable.

- Community Capacity

The growth rate of the curve will also determine the upper limit of community capacity. If a higher capacity is needed, the curve must be made flatter:

(1) Increase the constant C

(2) Set piecewise functions, making the later segments flatter

(3) Calculate the corresponding ratio relationship between P and FT-Key's P under the same X conditions

The MEV value at the leftmost end of the curve

- Addressing the "MEV Problem" Caused by Bots

(1) Increase the positive intercept D, making the initial price > 0 (Tomo has set D, but the value is very low and can be ignored). This approach also has drawbacks: it leads to a decrease in the multiplier of the wealth effect.

(2) Add a flatter or horizontal curve at the leftmost end.

(3) Fixed price IDO (pre-sale system, differing from 2 in that one is first-come-first-served, while the other is a fair sale).

(4) Allow room owners to pre-purchase.

From the shape of the curve, there are two types of improvement ideas: one is to directly change the parameters C and D. This is also the most common improvement method currently, and by changing the constant D, it can also somewhat address the MEV issue.

The second form is to set piecewise functions. This approach allows for different parameters to be set within different price range intervals to achieve different purposes. For example, setting a relatively flat curve or even a horizontal curve in the first half of the curve to combat MEV or to initiate a type of IDO. The IDO model has positive significance for addressing Bot MEV and issuance failures (which is particularly prominent on Tomo).

This also comes at a cost. If a flat curve is adopted at the left end, the wealth effect at the opening will be significantly weakened, and further consideration must be given to the quantity of supply at the left end; excessive supply may consume potential buying power or wealth effect.

IV. Beyond KOLs, What Else Can Keys Carry?

An objective fact is that the "services" or "information" provided by most Room Owners are insufficient to support the value of Keys, or in other words, the price of Keys is generally overestimated. The reason for this issue is that the speculative demand and score-farming demand of Friend.tech have confused the true utility demand, and both FT and clones have made pricing curve choices based on business purposes.

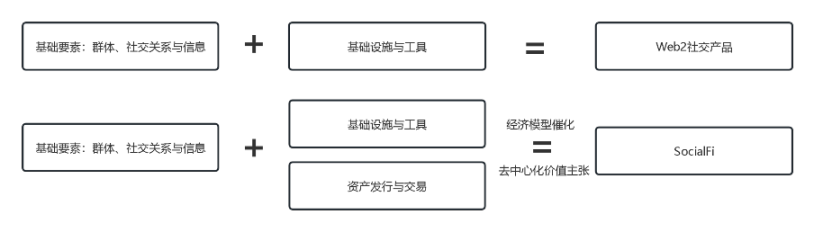

Most people merely view Keys as social tokens, but in fact, Keys can represent any asset. Friend.tech has given us an idea: to introduce the issuance and trading of assets as "Fi" into "Social," completing the ultimate loop of SocialFi. For FT and most clones, Keys represent the personal brand or reputation of KOLs, but this does not mean that SocialFi is limited to this. Even based on FT, any asset can be packed into Keys, such as equity or tokens of Web3 projects (some have already done this), in which case Keys represent Tokens or shares; or using FT to complete IDOs, where Keys represent investment shares or future claims (perhaps some projects will do this soon).

Currently, it seems that the functions of FT and clones are too simplistic and do not adequately meet some derivative demands. Another idea is to introduce asset issuance into existing Web3 social/content products (such as DeBox, CrossSpace, etc.). For example, DeBox, positioned as the most native DAO governance platform, has already built a social platform covering chat, dynamics, and community functions based on DID, providing components for voting, proposals, Token authorization detection, trading, etc. With a sufficient number of users, strong social connections, information, management tools, and trading tools, DeBox currently has 1.5 million registered users and over 100 million daily messages, with high scalability in terms of functionality, making it naturally suitable for introducing an effective asset issuance solution and an economic model and pricing curve that fits the business type.

DeBox Interface

The assets here include but are not limited to specific content, decentralized groups, or even memes that have no substantial meaning but possess a collective will; a series of social tools and infrastructure will provide services for these assets, and the value of Keys will truly complete the loop.

Finally, the biggest difference between Fi and Ponzi lies in whether the assets exist and have value; we must never overlook this point.