Public testing of the testnet is underway: Filecoin miners are riding the wave of ranking manipulation

01

Shell companies occupy positions, riding the hot trend

"Looking at the brand and model is useless; the main points to consider are the configuration, server, and data center, as well as whether there is a license issued by the Ministry of Industry and Information Technology of the People's Republic of China. For example, our company holds the national IDC/CDN dual license issued by the Ministry of Industry and Information Technology of the People's Republic of China, and all our machines are custom Dell servers, with technology sourced from the IPFS protocol laboratory at Stanford University in the United States. Currently, this technology is receiving a lot of global attention." This is how a salesperson named Xiao Xi introduced a series of talking points on how to choose Filecoin mining machines to Chain Catcher.

However, when asked whether the mining machines participated in the second phase of the public test, the other party confidently said, "We have to wait until the mainnet vulnerabilities are fixed before we can participate in the test."

Subsequently, Xiao Xi began to introduce the advantages of their mining machines, such as the company's strategic cooperation with top global server manufacturers, being a platinum council member of (DELL China), which guarantees five years of after-sales service; DELL servers are hosted in national IDC data centers, covering dozens of central cities across the country; the technical team is composed of professionals from global Fortune 500 companies like Cisco, Oracle, Huawei, Dell, and Xianhe; the cooperation plans are diverse, and the tax and legal matters have been optimized by professional institutions to ensure rigor, standardization, and completeness; servers participate in IPFS network testing; strategic planning is rapidly advancing, and cooperation and services in industries such as catering, automotive, and insurance have already begun, etc.

However, this statement seems absurd to veteran miner Tian Shu, who has been paying attention to Filecoin mining machines for a long time. "Testing is about finding bugs. Why can't their mining machines run? Either the technology is lacking, or they are just a shell company that doesn't produce machines but wants to ride the hot trend."

He analyzed that the advantages mentioned by salesperson Xiao Xi have little to do with the mining machines themselves. The so-called custom Dell servers hide the fact that they purchase DELL servers and add components from other obscure manufacturers, such as CPUs and GPUs, during assembly, which is akin to sleight of hand. Even if the mining machine has the DELL logo, it does not prove that the configuration inside is from Dell.

Additionally, DALL's custom servers are generally only available to international giants like Huawei, Google, and Amazon. Unknown small companies cannot obtain custom services at all, so it is very likely that the manufacturer is just doing marketing hype to deceive consumers.

As for the aforementioned Ministry of Industry and Information Technology license, IDC data center, professional legal team, and strategic planning in catering and automotive industries, they are completely unrelated to the performance of mining machines. To some extent, they are a maze specifically targeting novice investors, and it is very likely that this company itself does not understand what the IPFS network protocol and the Filecoin incentive layer actually are; it may just be a pyramid scheme.

However, in this public test of Filecoin, there are quite a few such companies, just with varying degrees of false information.

According to insider Fu Yun, many intermediary sales companies without machines or technology choose to rent IDC data centers or even supercomputing centers for testing. After boosting their rankings, they will immediately stop, with the goal of obtaining a miner ID that proves they have mining machines and participated in the public test, so they can later promote that their machines have high performance to attract customers.

02

Strong teams compete for rankings, burning money to PK

In fact, for shell companies, it is just riding the hot trend, but for real technical miners participating in the test, they can not only receive rewards of over 1 million tokens prepared by the protocol laboratory (although the reward details have not yet been released), but also receive additional subsidies from the official for large miners. Most importantly, the test results serve as the best advertisement for mining machine manufacturers.

Although the original intention is good, it overlooks human nature. This public test not only attracted the aforementioned shell companies but also indirectly provided a stage for mining machine manufacturers to take the opportunity to boost their rankings. Even relatively leading companies in the industry cannot escape this trend, as besides official rewards, they can also obtain data on the leaderboard that makes novice investors more convinced.

Fu Yun told Chain Catcher that currently, the number of mining machines participating in the second phase of the public test exceeds 12,000, with 233 testing nodes, including 156 in China (including Hong Kong) and 67 overseas, which is very active. However, it is astonishing that during the second test, miners completed in just five days what took five months in the first test, an incredible speed, which is the result of competition among various manufacturers.

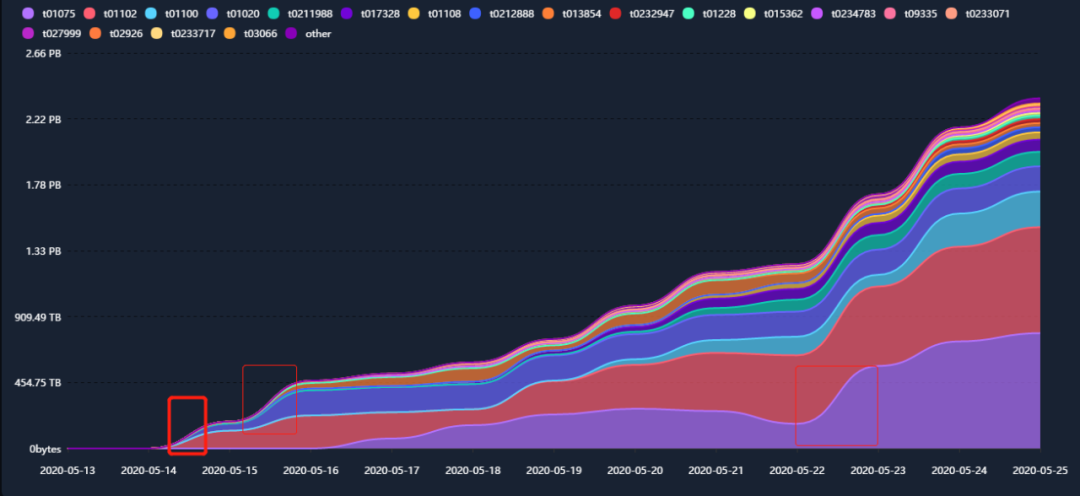

Miner computing power trend chart, data from Filscan---Filecoin block explorer

In addition, from the leaderboard of the testing network shown in the above image, it can be seen that there was a situation where the computing power of a certain node surged sharply during the testing period, which indicates that some miners are increasing the number of machines participating in the test to seek a higher ranking.

Fu Yun revealed that some manufacturers even stack 100-200 or even 1000-3000 machines, keeping them powered on continuously to dominate the leaderboard. Once surpassed, they will not hesitate to continue burning money to increase machines to maintain their ranking.

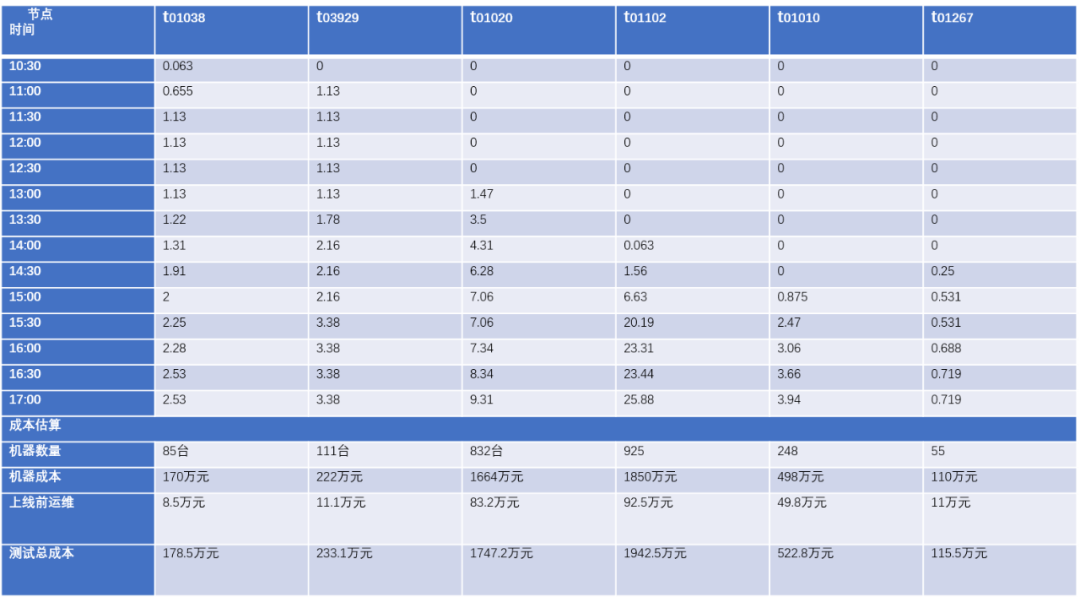

However, while boosting rankings is enjoyable, it requires real money to support it. In the current situation where the official promised rewards have not yet materialized, companies without sufficient funds cannot afford to play this game, which also raises the cost threshold for participating in the test. Below is the effective storage growth and testing costs on the day of the first node launched on May 15, where miner number t1102 incurred a total testing cost of nearly 20 million yuan.

Note: 1. Calculation method: Number of machines = Number of Messages - Number of PreCommit Sectors (this method is only valid under certain conditions);

2. Based on the cost of AMD 3900X being about 20,000 yuan, the cost of 200 machines is 4 million;

3. Assuming the second test runs for 45 days until the mainnet goes live, with a single machine hosting and operation cost of 1,000 yuan calculated.

Although the manufacturers participating in the test prove their technical strength by ranking and ensuring stable growth in computing power, investors need to recognize that this is the result of the combined effect of a large number of machines and does not represent the performance of a single machine.

According to Tian Shu, generally, manufacturers now sell mining machines based on single high-quality data such as effective storage first, block explosion quantity first, single T efficiency first, and do not clearly inform users how much computing power a single machine has in terms of comprehensive performance.

In this regard, Chain Catcher specifically contacted the sales of the 1475 mining machine for consultation. The other party immediately informed about their mining machine's achievements in the second phase of the public test: "Our mining machine's block explosion quantity and effective computing power public test ranking are both first. Now everyone is scrambling for the first miners; early layout means early benefits." They also sent the contract to Chain Catcher, hoping for further understanding.

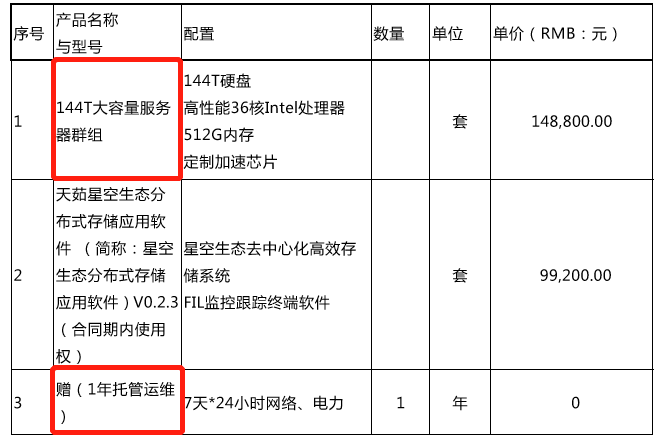

Contract screenshot

However, the contract has suspicious aspects. For example, in the product name and model section, investors cannot determine how the corresponding configuration is specifically combined, nor can they confirm the newness of the hardware; for instance, in the section on free hosting and operation, it should be noted that customers cannot take away the physical machines and must wait until the one-year hosting period ends to retrieve them, which is equivalent to indirectly buying computing power. Even if investors can get back the physical mining machines later, they still cannot confirm whether the most critical custom chips have been replaced.

In this regard, Tian Shu believes that 1475 is relatively reliable in the industry, only those companies that promise consumers a payback period, accurately predict prices, or recruit people as distribution agents may be the real scam companies.

However, he still suggests that novice miners should learn more about this circle, "they can learn from institutional investors how to conduct due diligence on projects, which mainly includes communicating with on-site and technical personnel, checking technical backgrounds, understanding the founding team's resumes, etc. Do not shy away from trouble; after all, buying mining machines is essentially an investment behavior."

Although boosting rankings is for rewards and advertising needs, it also makes it difficult for consumers to navigate to some extent, but manufacturers also face significant risks.

Some manufacturers blindly purchase hardware targeting the current algorithm (uncertain whether the official will change the existing algorithm) to maintain their rankings, but once the official changes or optimizes the algorithm, a series of troubles will arise.

"The current SDR algorithm is very friendly to AMD CPUs, but if the algorithm changes in the future, it may be more friendly to Intel CPUs. Therefore, burning money to buy hardware to boost rankings is largely a gamble. Once the existing mining machine configuration does not match the actual operational requirements, all mining machines will become scrap metal," Fu Yun lamented. Although it is a losing game, such bloody competition is inevitable in the early stages of any market.

Indeed, looking back at history, the birth of new technologies always stems from a good vision and inevitably brings new opportunities. However, almost every technological innovation also faces considerable resistance. Just like this public test of Filecoin, its purpose was to mobilize the community to test together, find bugs, and improve them, so that the public chain mainnet could run more safely and quickly after going live. Yet, it has been taken advantage of by many mining machine manufacturers to show off, competing for the so-called first place on the leaderboard without regard for costs, even though these reckless behaviors may come with painful consequences.

Note: Xiao Xi, Tian Shu, and Fu Yun are all pseudonyms.