When the wall falls, everyone pushes? The crypto industry is abandoning Silvergate

Source: André Beganski, Decrypt

Compiled by: Moni, Odaily Planet Daily

On March 2, crypto-friendly bank Silvergate Bank's parent company, Silvergate Capital Corporation, announced a delay in submitting its annual 10-K report to the U.S. Securities and Exchange Commission (SEC), claiming it may face capital inadequacy issues and is reassessing its business. Silvergate stated that accounting firms and independent auditors have requested more information to address potential inquiries from the U.S. Congress, as well as subsequent investigations by the Department of Justice and banking regulators.

Following the news, the entire digital asset industry expressed a desire to distance itself from Silvergate, and Silvergate's stock plummeted, closing at $5.72 on Thursday, down 57.69%, a decline of over 93% compared to its historical high of $222 during the last crypto bull market in November 2021.

The Crypto Industry is Abandoning Silvergate

Silvergate has confirmed that a recent series of events may affect its "going concern" ability, a situation that the crypto industry clearly does not want to see. Following this news, several crypto companies and exchanges have stated their intention to sever ties with Silvergate.

1. Coinbase

Coinbase was one of the first exchanges to announce it would no longer work with Silvergate. On the evening of March 2, Coinbase announced on social media that, in light of recent developments and out of caution, it would no longer accept or initiate payments with Silvergate, nor would it use Silvergate as a dollar banking partner for Prime customers. Coinbase also stated that its exposure to Silvergate's corporate risk is minimal and that it has switched its dollar banking operations to Signature Bank, a change that does not affect payment instructions in GBP or EUR.

2. Crypto.com

Singapore-based cryptocurrency exchange Crypto.com also announced that it would refuse to transfer funds to and from the platform via Silvergate. A spokesperson for the exchange confirmed that "deposits and withdrawals through Silvergate have been suspended."

3. Bitstamp

On March 3, Bitstamp issued a statement on its official blog stating that the Luxembourg-based cryptocurrency exchange has temporarily canceled the Silvergate Exchange Network (SEN) service for all users, as well as all dollar wire transfer support provided through Silvergate Bank. For instant dollar payments, users will now need to use Signature Bank's SigNet service. Additionally, Bitstamp clarified that its platform's customer funds are safe, and it has no significant risk related to Silvergate Bank. The exchange collaborates with 17 global banking partners and has implemented alternative banking services to minimize disruption to customers.

4. Gemini

Cryptocurrency exchange Gemini stated on its official Twitter account that it is actively monitoring the situation with Silvergate Bank but has no GUSD or customer funds stored with the bank. Furthermore, the exchange has halted customer deposits/withdrawals via ACH, and the funds exchange services initiated by Silvergate Bank to Gemini have also been suspended.

5. Circle

USD stablecoin issuer Circle posted on social media that it is in contact with multiple banking partners and is closely monitoring market concerns regarding Silvergate. Circle is also unwinding some services with Silvergate. The company stated that it would keep customers informed of relevant developments, and all Circle services, including USDC, are currently operating normally. Circle has multiple reserve and settlement banking partners responsible for managing USDC's cash reserves and providing robust liquidity management.

6. Paxos

On the evening of March 2, USD stablecoin issuer Paxos released a statement on social media regarding Silvergate Bank, stating that the company has had no substantive contact with Silvergate. Paxos's top priority has always been to protect its customers' funds and assets while leveraging a diversified network of banking partners.

7. Tether

Tether's Chief Technology Officer (CTO) Paolo Ardoino stated on social media that the company has no exposure to Silvergate and has not had any contact with Silvergate.

8. Galaxy Digital

Mike Novogratz's crypto investment firm Galaxy Digital announced on its official Twitter account that, in light of recent developments, Galaxy has stopped accepting or initiating fund transfer transactions to Silvergate. As a company, Galaxy has had no substantive contact with Silvergate, and this action is taken as a very cautious decision and part of its risk management process to ensure the safety of customer and company assets.

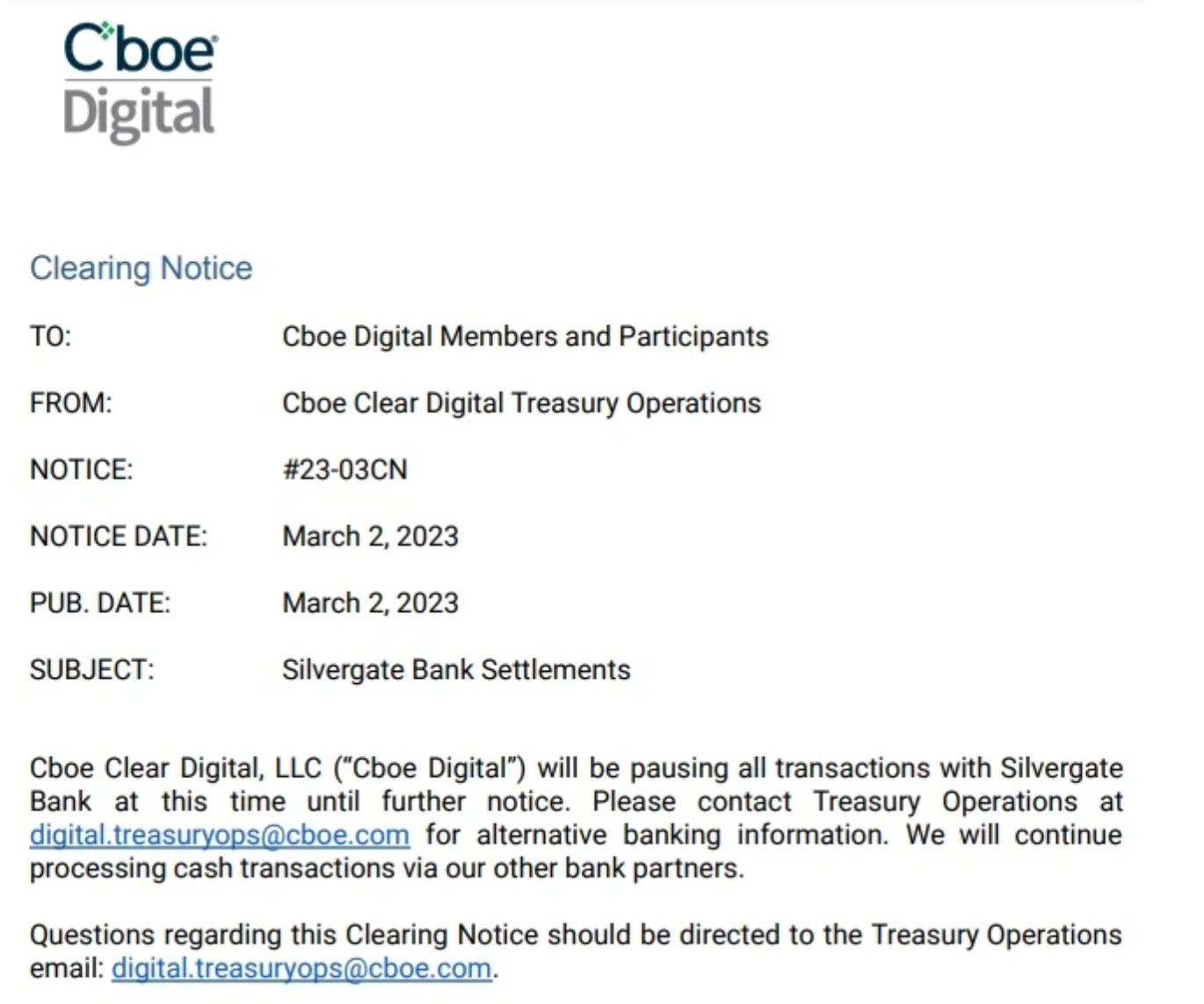

9. Cboe Digital

Cboe Digital also promptly issued a clarification notice to its members and participants, stating that it would suspend all trading with Silvergate and use other banking partners to handle cash transactions.

10. MicroStrategy

As the publicly traded company holding the most Bitcoin, MicroStrategy confirmed that it has a loan from Silvergate, which is not due until the first quarter of 2025. The company stated that this loan will not accelerate Silvergate's bankruptcy process and confirmed that the Bitcoin collateral is not held by Silvergate, with no other financial relationship beyond this loan.

Another "Victim" of the FTX Collapse?

Silvergate is actually another "victim" of the FTX collapse. Due to FTX's bankruptcy, Silvergate Bank experienced a significant decline in deposits. Previous reports indicated that it handled a large volume of withdrawal transactions in the last fiscal quarter of 2022, with $81 billion being withdrawn in January alone, accounting for 68% of its deposit balance. To meet the massive withdrawal demands from the crypto market, Silvergate had to obtain a $4.3 billion loan from the Federal Home Loan Bank and sell approximately $5.2 billion in debt securities.

Silvergate Bank's poor performance even drew the ire of U.S. lawmakers. Senator Elizabeth Warren led a letter to Silvergate CEO Alan Lane, demanding stricter scrutiny of Silvergate's transactions with FTX and Alameda, expressing concerns that Silvergate's dealings with the FTX exchange could "further introduce risks from the crypto market into the traditional banking system."

In January of this year, the U.S. Department of Justice launched an investigation into Silvergate's handling of account funds for FTX, particularly regarding the potential criminal behavior of allowing FTX to deposit funds, including user funds, into Alameda Research accounts.

In fact, the market had sensed potential risks early on, with Wall Street investors, including billionaire George Soros, recently shorting Silvergate. According to MarketWatch data, by the end of February, Silvergate had become the most shorted stock on Wall Street, with 73.5% of all available Silvergate shares being shorted, ranking first.

Frankly, Silvergate was one of the few banks in the U.S. handling cryptocurrency-related funds, with Circle, Coinbase, Binance US, and several domestic crypto institutions having partnerships with it. However, as the saying goes, "when the wall falls, everyone pushes," and when Silvergate found itself in trouble and unable to extricate itself, crypto companies began to leave it in search of other banking solutions.

Although Silvergate has stated it will submit the 10-K report as soon as possible, the crypto market's confidence in it seems to have been eroded. Whether Silvergate can rise from the ashes or remain down for the count may only be answered by time.