MEXC DEX+: Layout on-chain assets, breaking the boundaries between CEX and DEX

Author: Yoyo

1. Trend Insights ------ The Blurring Lines Between CEX and DEX

If we rewind five years, DeFi was merely an experimental playground for a few geeks, and meme coins were a fringe narrative far from mainstream attention. But today, on-chain wealth opportunities have become a new consensus in the crypto space. Against this backdrop, CEXs are beginning to move on-chain, attempting to borrow from DEX models to provide more flexible trading methods.

Recently, MEXC DEX+ and Binance Alpha 2.0 were launched simultaneously, both aiming to break the boundaries between CEX and DEX, allowing users to trade on-chain assets more quickly and conveniently.

Binance Alpha 2.0 allows users to directly purchase on-chain assets in the Alpha sector using their spot accounts on the Binance platform, without the need to create an additional Web3 wallet or perform on-chain transfer operations, simplifying the on-chain trading threshold and integrating CEX and DEX trading methods. However, there are still two major limitations:

- Limited number of cryptocurrencies ------ Currently, the coverage of Alpha assets is limited, failing to meet users' demands for trading more early-stage on-chain assets.

- Delayed asset inclusion in the Alpha sector ------ Updates are irregular, making it difficult to respond to market trends in real-time, causing users to miss out on the earliest investment opportunities.

In contrast, MEXC DEX+ adopts a more thorough strategy, allowing users to trade on-chain assets freely through the CEX interface and more direct on-chain trading methods without needing a Web3 wallet. This means:

- Broader asset coverage ------ DEX+ directly connects to on-chain liquidity pools, supporting more popular assets that are not yet listed on CEX.

- Faster trading timeliness ------ Users can capture the benefits of new on-chain projects immediately without waiting for any listing notifications.

- The current version already supports pump.fun and Raydium on Solana, and will support BSC on March 26.

The simultaneous launch of MEXC DEX+ and Binance Alpha 2.0 may signify that CEXs are trying to find a new answer ------ how to allow users to enjoy the convenience of CEX while also accessing on-chain wealth opportunities in real-time?

The DEX+ product launched by MEXC is a typical representative of this trend. It not only inherits the convenient trading experience of CEX but also lowers the usage threshold of DEX through technological innovation, providing users with a more efficient and user-friendly on-chain trading method. So, what exactly are the advantages of MEXC DEX+ in the overall market landscape? Will the boundaries between CEX and DEX truly disappear? In this competition regarding on-chain trading experiences, how will MEXC DEX+ break through? This article will conduct an in-depth analysis from multiple dimensions.

2. What Does "DEX+" Add? Deconstructing MEXC's Potential Strategies

The core of the "+" in MEXC DEX+ is integration, not merely embedding DEX functions into CEX, but perfectly blending the advantages of CEX and DEX to ultimately upgrade the trading experience. The DEX+ product mainly features the following core highlights:

First, a smooth CEX-level on-chain trading experience. MEXC DEX+ aims to significantly reduce the complexity of on-chain interactions, even directly shielding users from it. Users simply need to open the MEXC App, activate their DEX+ account, and then transfer funds from their centralized wallet to their DEX+ account with one click, allowing for quick completion of on-chain trades within the platform. Users no longer need to deal with complex smart contract signatures and wallet address entries; all interactions are completed "between the spot and DEX+ accounts." This design eliminates the cumbersome intermediary steps of traditional DEXs, directly transplanting the convenience familiar to CEX users into DEX trading.

Secondly, what else has DEX+ done? Efficient asset liquidity is crucial. In traditional on-chain trading, users face numerous DEXs and the barriers of asset transfer between different chain ecosystems. Currently, MEXC DEX+ supports the increasingly popular Solana network, providing direct access to over 10,000 on-chain assets, aggregating multiple leading Solana DEX pools like Raydium and Pumpfun, allowing users to enjoy asset selection and trading experiences similar to CEX depth on DEX+. In the future, DEX+ will gradually expand to more chain ecosystems, truly achieving a one-stop solution for multi-chain trading needs; it is understood that BSC support is coming on March 26. Currently, DEX+ can support both of the two booming ecosystems of on-chain assets.

At the same time, DEX+ also attempts to address users' concerns about the security of on-chain assets. One of the biggest risks faced by traditional DEX users is complete self-custody of assets; a slight mistake can lead to private key leakage and total asset loss. DEX+ centralizes the custody of private keys with MEXC and introduces a third-party authority testing agency, GoPlus, to ensure the security of each trading pair, significantly reducing the likelihood of assets being hacked. New users need not worry about the risk of losing private keys, further alleviating security concerns.

So why is MEXC making such a bold move to lay out DEX+, even going all in? The answer lies in MEXC's own development strategy.

Since 2024, MEXC has made a remarkable comeback in the meme coin sector, launching over 240 quality meme coins in Q4. Its sharp coin selection strategy has created a number of star projects with astonishing price increases: among the top five best-performing meme coins launched in 2024, the average maximum increase has directly exceeded 8700%, with the tokens KEKIUS and FWOG seeing increases far beyond this level. This phenomenon reflects MEXC's precise capture of trends in the meme sector and its keen sense of on-chain traffic hotspots. The effects of this strategy not only enhance MEXC's market competitiveness but also create considerable profit opportunities for platform users.

To some extent, MEXC's strategy of quickly capturing and launching trending meme coins has become an important means of differentiating itself from other exchanges. The emergence of DEX+ provides users with a smoother and safer on-chain trading experience in the broader trend of CEX and DEX integration ------ users no longer need to wait for MEXC's official announcements; they can jump into projects immediately and easily secure early "hundredfold coin" tickets.

Ultimately, the layout strategy of MEXC DEX+ is not merely a simple addition of functions, but an exploration of deep integration between CEX and DEX.

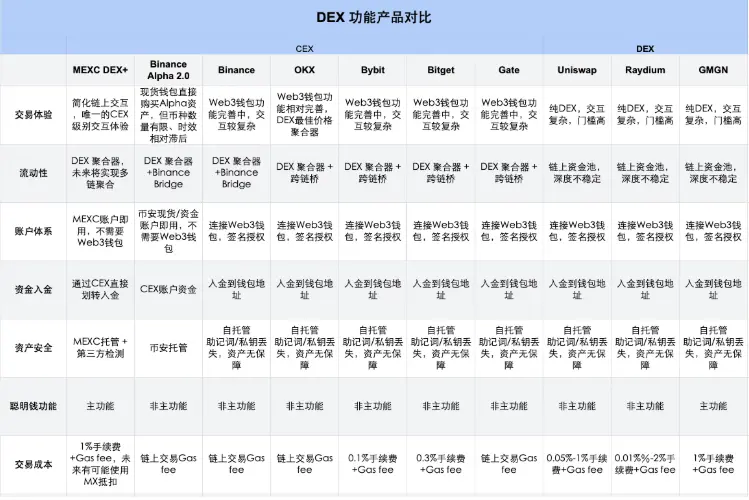

3. Comparison of DEX Functional Products: Competitors Have Already Acted, What Are MEXC's Chances?

With the explosion of on-chain assets, various CEXs have already stepped into the on-chain trading field, attempting to carve out territory with DEX as a new growth point; meanwhile, DEXs continue to optimize experiences to attract more users. What are MEXC's chances with the launch of DEX+? How does DEX+ differ from existing exchanges? Where does its competitiveness lie? We can analyze this from several key dimensions.

1. Trading Experience: The Core Competitiveness of DEX+

The trading experience is a key factor determining user loyalty. Traditional DEX platforms like Uniswap, Raydium, and GMGN, while offering high asset freedom, involve complex on-chain operations and high barriers, often deterring novice users.

In contrast, traditional CEXs, apart from Binance Alpha allowing direct trading with CEX accounts, still require Web3 wallet connections for the Web functions of Binance, OKX, Bybit, Bitget, and Gate. Although this represents a step towards "decentralization," it essentially remains a "external wallet + exchange" splicing model, where users need to perform additional actions like connecting Web3 wallets and signing authorizations, leading to a sense of disconnection in the experience.

However, MEXC DEX+ completely breaks out of this circle; it is the only DEX product that offers a CEX-level trading experience, with the entire interaction experience approaching that of CEX, while the essence of trading remains on-chain. Users only need to transfer assets within their MEXC account to directly start trading on-chain assets. For novice users who want to quickly dive into meme coins but are unfamiliar with on-chain operations, this is a significant advantage.

2. Liquidity: How to Break Through the Bottleneck of DEX Models?

Liquidity determines the depth and stability of trading, and while the liquidity pool model used by traditional DEXs like Uniswap, Raydium, and GMGN has decentralization advantages, it still has significant limitations. When the market fluctuates sharply, liquidity may dry up instantly, leading to skyrocketing slippage, making it difficult for users to execute trades at suitable prices.

In the CEX camp, MEXC DEX+, Binance Web3, OKX Web3, Bybit Web3, and others adopt a DEX aggregator model to improve liquidity by integrating multiple on-chain trading pools. In contrast, MEXC DEX+'s liquidity strategy is more differentiated; it not only relies on DEX aggregators but also leverages its influence in the meme sector to form a unique liquidity ecosystem. This is due to MEXC's previous rapid listing strategy in the meme sector, which has accumulated a large number of traders focused on early on-chain assets. These users are not only a source of traffic for MEXC CEX but also potential traders for DEX+, allowing MEXC to quickly bring early liquidity to DEX+ through its existing trading ecosystem. Additionally, unlike other exchanges, MEXC DEX+ directly targets the most active and explosive meme trading market, making the user group match more conducive to liquidity growth.

Of course, DEX+ will also integrate more DEXs and public chains in the future, forming broader liquidity and enabling seamless multi-chain asset trading, greatly enhancing user experience.

3. Account System & Deposit Methods: No Need for Web3 Wallets, Direct Asset Transfers

Traditional DEXs like Uniswap, Raydium, and GMGN require users to connect their self-managed Web3 wallets, placing the responsibility for wallet security on users, which raises the learning curve and risk management difficulties.

The Web3 wallet functions of Binance, OKX, Bybit, Bitget, and Gate also generally adopt on-chain wallet connection methods, where users face wallet management issues and the risk of losing private keys.

MEXC DEX+ completely changes this model; users can participate in on-chain trading directly through an independent DEX+ account without needing to connect a Web3 wallet or worry about private key management. At the same time, the DEX+ account is completely independent from the MEXC CEX account, ensuring that on-chain trading does not affect CEX account assets, providing users with clear account isolation and security guarantees while enjoying a convenient experience. This way, users can achieve both asset security and account convenience, making MEXC truly user-friendly.

This also brings about differences in funding deposit methods; MEXC allows users to directly transfer funds from their CEX accounts to their DEX+ accounts, while other exchanges require users to first deposit into their own Web3 wallets before trading, making the process more complex.

5. Security: Centralized Custody Combined with Third-Party Testing

Security is one of the core competitive advantages of all exchanges. Although traditional DEXs claim to be secure and free, the risk is high due to users managing their own private keys; once the mnemonic phrase or private key is lost, assets cannot be recovered.

MEXC DEX+ adopts a centralized custody security model, storing users' private keys on the MEXC platform to avoid the risk of key loss. At the same time, it introduces a third-party security agency, GoPlus, for real-time asset risk monitoring, providing more comprehensive and timely security guarantees, making users feel more at ease regarding asset safety.

Conclusion: The Unique Competitiveness of MEXC DEX+

In summary, the greatest advantage of MEXC DEX+ lies in lowering the barriers to on-chain trading, allowing users to complete DEX trading as easily as using CEX. Compared to the exploratory solutions of CEXs like Binance and OKX, MEXC DEX+ offers a smoother experience, reducing complex on-chain interactions. In contrast to DEXs like Uniswap, MEXC DEX+ also features a more user-friendly account system and trading fluidity, making it easier for ordinary users to enter the on-chain market.

As on-chain trading gradually becomes the mainstream of the market, MEXC's approach may become a breakthrough path.

4. From the User's Perspective: How Does DEX+ Help New Users Easily Enter the On-Chain Wealth Track?

4.1 DEX is Attractive, But Why Is It Still Hard for You to Get Started?

In early 2021, Dogecoin skyrocketed overnight, making countless outsiders envious. By 2025, the wealth codes on-chain have become even more direct and crazy, with various hundredfold projects emerging, and stories of sudden wealth continue to circulate. But a very realistic problem is: the various complex on-chain interaction processes have kept novice users wanting to dive into meme coins at bay.

In this environment, how to easily and smoothly take the first step into on-chain trading has become the core demand of ordinary retail investors. MEXC DEX+ has precisely identified this point, with a highly targeted product that directly addresses the pain points of user experience, providing novice users in the crypto space with a "smooth entry into meme coins" one-stop solution.

4.2 One-Stop On-Chain, Lowering the Barriers to On-Chain Trading to the Minimum

MEXC's DEX+ has made unprecedented innovations and integrations in this regard. As mentioned repeatedly earlier, users only need to simply register a MEXC account, without needing to download a Web3 wallet, remember mnemonic phrases, or deal with private key storage and risk, to directly experience on-chain asset trading. They only need to easily complete account activation to immediately enter the world of on-chain trading:

The specific operations are also extremely simple and clear:

- Step 1: Switch to "DEX+" on the webpage (on mobile, open the MEXC App, find "Wallet" in the bottom right corner, click to enter, and select "DEX+"). Upon first entering the system, it will automatically prompt "Activate my DEX+ account," and users only need to click agree to activate the DEX+ wallet with one click, eliminating the cumbersome steps of creating a wallet and saving mnemonic phrases and private keys.

- Step 2: After activation, directly click "Receive," then select the type and amount of cryptocurrency to recharge, and click confirm to transfer funds from the spot account; the entire process takes less than 30 seconds. No more complex on-chain recharges, no need to memorize wallet addresses, and no worries about transfer address errors leading to fund losses.

The mobile version operation is as follows:

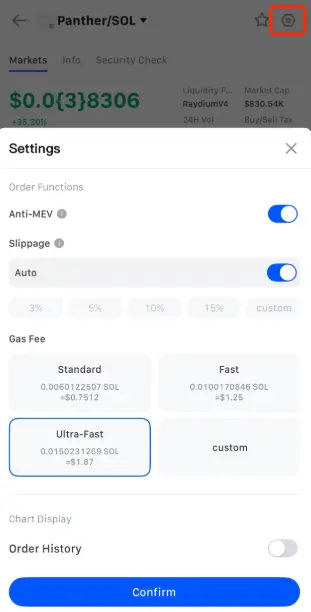

- Step 3: Once the funds arrive, enter the DEX+ trading page, where users can directly select their favorite tokens for buying and selling, without needing on-chain approval, signing, or other cumbersome interactions; simply click to trade. MEXC DEX+ includes quick buy/sell orders and limit order functions. For novice users wanting to quickly buy and sell meme projects, the user experience is very smooth.

In terms of trading fees, traditional DEX trading, such as Uniswap and Raydium, requires users to sign smart contracts for every operation, and a slight mistake can lead to wasted gas fees. In contrast, the assets transferred into the DEX+ account already include the necessary gas fees; the system will automatically deduct a 1% service fee for each transaction or exchange. It is understood that in the future, it may also support using MX for fee discounts, further reducing user costs. This charging model is clear and simple, avoiding the hassle of calculating gas fees, making trading easier to start. Users can also view the estimated gas fees in real-time on the settings page, and gas fees will be automatically deducted during the transfer process.

In addition to lowering the threshold, MEXC DEX+ also impresses new users with an important feature ------ "Smart Money Tracking."

On the DEX+ trading interface, addresses of "smart money" are directly marked; these addresses are typically large holders on-chain, seasoned DeFi players, or OGs with a high historical trading success rate. MEXC presents these smart money addresses to users through algorithms, allowing them to track smart money operations in real-time, observe the buying and selling directions of smart money, and directly copy the trading strategies of on-chain experts, giving novices the opportunity to start on the same starting line as smart money. Currently, this feature has not yet appeared in other CEX's Web3 wallets, and in DEXs, only GMGN provides similar support.

Moreover, in the on-chain world where hundredfold coins and meme projects frequently emerge, there are not only many opportunities but also significant risks. MEXC DEX+ understands that users' biggest concern is actually security. The DEX+ product directly introduces third-party authority institutions (GoPlus) for security audits and risk warnings on on-chain trading pairs. Whether the project code is secure and whether the contract has high-risk vulnerabilities are complex and professional matters that ordinary users cannot identify one by one, but DEX+ automatically provides security warnings and risk alerts, allowing novice users to feel more secure when chasing hundredfold coins.

From registration, activation, and fund transfers to smart money tracking and hundredfold project screening, MEXC DEX+ has considered every aspect of on-chain trading to the extreme, striving to allow novice users to seamlessly transition from zero to the wealth code on-chain.

As the boundaries between CEX and DEX become increasingly blurred, MEXC DEX+ offers ordinary people the opportunity to easily obtain "primary market entry tickets" on-chain through the seamless integration of CEX-level experiences and rich asset choices of DEX. In this regard, MEXC DEX+ has achieved: "You just charge ahead, leave the rest to me!"

5. Conclusion: The Future of Exchanges Is No Longer a Binary Opposition

The future of exchanges should perhaps not be defined as a single choice between CEX or DEX. Integration is just the beginning.

Whether it is MEXC's newly launched DEX+ or Binance Alpha 2.0, they are noteworthy because they keenly capture user pain points and industry development directions, proposing a new solution of "CEX experience + on-chain assets." This represents a new starting point and trend: not only breaking down the barriers between centralization and decentralization but more importantly, creating a new possibility for a low-threshold and complete on-chain experience.